Well, here we are. Bitcoin’s holding steady at $103,700, even after a brutal selloff over the last 24 hours. It’s like watching a weathered ship try to stay afloat in a storm, but somehow, it keeps chugging along. That’s right, folks, Bitcoin’s still above $100k, but it’s looking a little tired. The signs of exhaustion are starting to show—yep, we’re talking about the last 48 hours.

Now, don’t start planning your vacation to the moon just yet. While long-term indicators are whispering sweet nothings about Bitcoin’s future—bullish continuation and all that jazz—short-term models are giving us some serious side-eye. Especially as Bitcoin approaches that critical $100k support level, it’s like a drama series you can’t stop watching. What happens next?

Enter Willy Woo. The crypto analyst who’s here to deliver the good and bad news, straight from the land of charts and graphs.

Good News: The Bullish Long-Term Signal is Still Hanging On

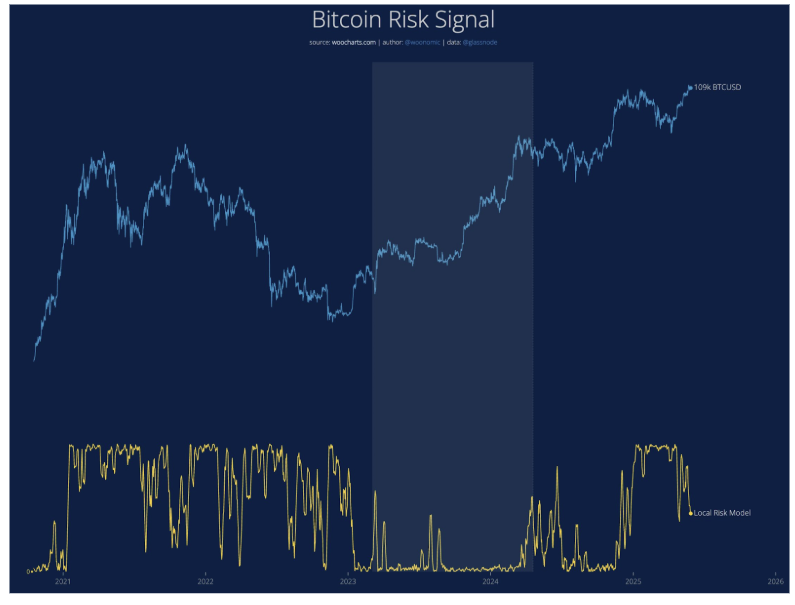

So here’s the good news, in case you weren’t feeling all doom and gloom: Woo’s got a signal that’s still hanging on like your grandma’s favorite chair—strong and steady. The Bitcoin Risk Signal, which tells us how risky it is to jump into Bitcoin, is currently trending downward. Translation: buyers are in control, and this could be setting the stage for Bitcoin to charge forward like a bull on a mission.

The lower the risk, the more it feels like a safe bet to hold or accumulate Bitcoin. So, if you’re one of those long-term investors just waiting for the next big jump, Woo’s telling you, “Chill out, it’s safe for now.” Bitcoin’s above the six-figure mark, and for the bulls, that’s still a win.

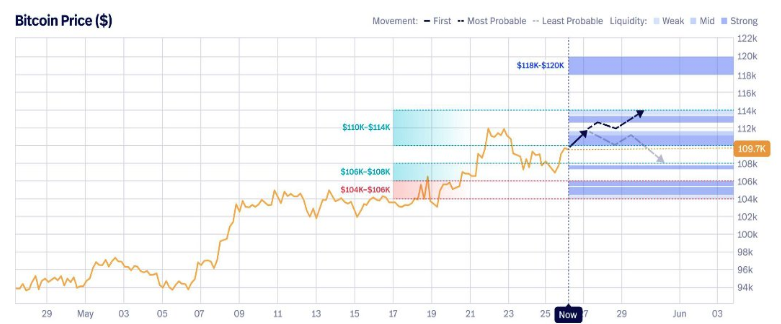

The risk model right now is sitting comfortably in the middle, down from the craziness of early 2025, and it’s expected to keep going down. Woo’s even got his eyes on a possible $114,000 move, which could cause short positions to panic and liquidate like their favorite show just got canceled.

Bad News For Bitcoin Price

Now, don’t get too cozy just yet. There’s always a catch. The short-term indicators, including the Speculation and SOPR (Spent Output Profit Ratio) metrics, are flashing red lights like a car alarm in a quiet neighborhood. Woo’s saying that the rally from $75,000 to $112,000 is starting to lose steam—basically, that rocket ship isn’t exactly leaving orbit right now.

Bitcoin’s price action this week is going to be crucial. “If we don’t see some strong follow-through,” Woo warns, “we’re looking at another consolidation period.” Translation: another boring phase where nothing much happens, and you stare at your screen wondering why you’re still here.

If spot buying doesn’t pick up soon—especially with the U.S. markets reopening after a long weekend—it could set the stage for a bearish pivot. And we all know what that means. Bearish trends are about as fun as waiting in line at the DMV.

In short: if the buying pressure picks up fast, Bitcoin could shoot past $114,000 and aim for a liquidity zone between $118,000 and $120,000. If not, we’re probably looking at a bit more of the same: consolidation, waiting, and refreshing your portfolio every five minutes to see if things have changed.

As of now, Bitcoin’s trading at $103,700, down 1.5% in the last 24 hours and 3.9% in the past week. So, what’s next? Hang tight, folks. It’s anyone’s guess.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD TRY PREDICTION

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- SEC & CFTC: 24/7 Markets? Because Who Needs Sleep? 😂

- FLR Token’s Wild Ride: Is It the Next Crypto Superstar? 🚀💰

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- Brent Oil Forecast

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

2025-06-01 04:18