If you’d like to lose half your money in seconds without even the dignity of a Las Vegas buffet, do I have a crypto token for you. It’s called Bedrock (BR), and its main feature is a price graph that looks like one of those trapdoor slides villains fall through in cartoons. 🎢

BR, the darling token hand-picked by the so-called “thoroughly vetted” Binance Alpha program, went full Humpty Dumpty on June 19th. The price didn’t just topple off the wall; it swan-dived straight off with all the grace of a drunken tightrope walker.

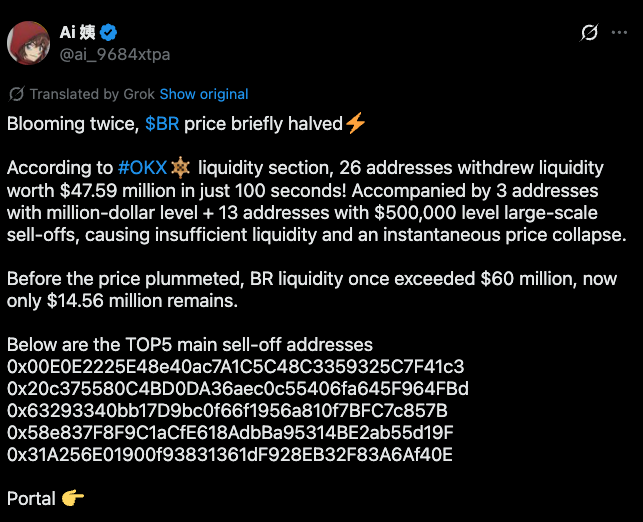

It all started when 26 mysterious addresses—let’s just call them “the Usual Suspects”—pulled nearly $50 million in liquidity quicker than you can say “why’s my portfolio melting?” According to the Twitter account @ai_9684xtpa (which I assume is run either by an AI or a cat walking over a keyboard), the whole operation took just 100 seconds. Three addresses were particularly ambitious, each holding more than $1 million in tokens, proving once again that every group needs an overachiever. Thirteen more got halfway there, presumably stopped only by existential dread or weak thumbs.

With this much money sprinting for the exit, surprise: the price collapsed. BR is now down 44% in just 24 hours, which is only impressive if you are speedrunning financial despair. The timing made everyone on social media immediately suspicious—did these whales plan their synchronized dump, or is this just what passes for serendipity in crypto?

the pump and dump, occasionally rebranded as a “rug pull.” It’s the time-honored crypto tradition where whales jack up the price, then ghost you faster than a bad Tinder date. The only guarantee is heartache.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- Brent Oil Forecast

- ETH Does What Now?! 😱

- Crypto Drama: When State Stablecoins Fight Federal Overlords 😲

- Crypto Dreams Shattered: PI’s $100M Fund Debuts, Token Sinks Below $1 Anyway 😬

- Pakistan’s Hilarious Bitcoin Mining Adventure: Can It Save the Day?

- Crypto Drama: A16Z’s $55M Bet on LayerZero – Will It Pay Off? 💰😱

2025-07-09 16:27