- Behold, as AAVE withers by 20.69% in a single day—a silent testament to the ruthless march of fate.

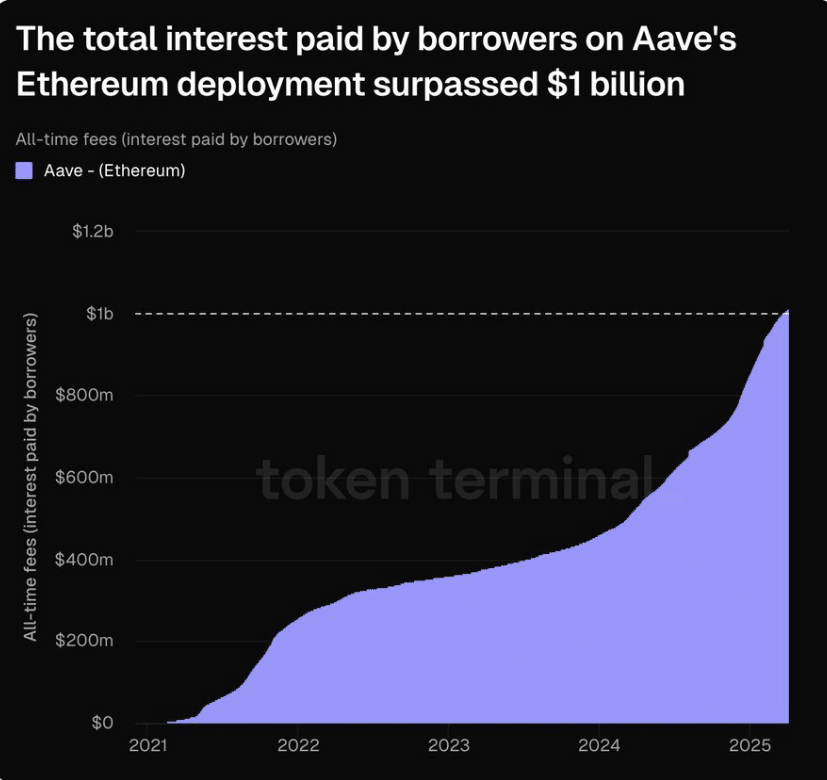

- The cursed ledger now reveals that borrowers have bled over $1 billion in interest from Ethereum’s vaults.

In the bleak corridors of modern finance, where hope and despair intertwine as bitter comrades, the AAVE network has reached an ominous milestone. It is as if the gods of DeFi, in their relentless irony, have charged every borrower with their own penance. One cannot help but smirk at the absurdity—like a tragic comedy played out on the digital stage. 😏

The records from Token Terminal, those indifferent chroniclers of our era, attest that AAVE borrowers have, in their relentless pursuit, paid over $1 billion in interest on Ethereum. This staggering figure, though draped in the garb of progress, is a grim reminder of the burdens shouldered by those who dare to challenge the system—a system as inscrutable and capricious as fate itself.

What does this mean for the network?

In the labyrinthine world of smart contracts and digital liquidity, the surge in interest cast a long shadow. It is an affirmation—not of triumph, but a curious display of confidence in the network’s silent machinery. With pools swirling with activity, the guardians of liquidity reap yields that glimmer like rare jewels in dark times, urging ever more souls to stake their fortunes.

Moreover, the rise in fees has become an unintentional benefactor to AAVE’s coffers. As the network collects its share, one might jest that even in suffering, there is profit—a paradox that would have amused even the most cynical of bureaucrats. This revenue, fueling sustained progress, lends an ironic buoyancy to the token’s value in our wretched economic theater.

Thus grows a fragile confidence among users and providers alike—a shared delusion of progress that, much like the bitter Russian winters, pushes them to endure and invest further. Perhaps a twisted invitation for more hopeful investors to join the grand, absurd carnival of risk.

Could this boost AAVE’s price performance?

Alas, while the AAVE network revels in demand and frenetic usage, the immutable charts of price tell another, more sorrowful tale. The altcoin, like a reluctant pilgrim, is trudging through a bitter downtrend—a struggle that mocks the hopes of many. 🤨

And so the narrative unfolds further. The altcoin stumbles not merely in spirit but in the practical theater of Futures and Spot markets. A decline in the count of Futures trades—falling to a modest 917.23k—reveals a somber truth: fewer traders are enticed to delve into the abyss of speculative positions.

This very drop shouts of waning trust and mounting uncertainty—a comedy of errors where investors recoil from the brink of further misfortune. One might almost laugh at the tragedy that unfolds with every hesitant step.

The telltale decline in AAVE’s Futures buy volume—plummeting to 116.65 million from its previous exuberance—paints a picture unmistakable in its gravity. It is a stage where sellers, emboldened and numerous, have overpowered the few remaining buyers, casting the altcoin into a relentless descent. As you read these lines, the price languishes at $117, a stark reminder of the near 20% erosion witnessed in a single day. 😬

Read More

- Silver Rate Forecast

- SPEC PREDICTION. SPEC cryptocurrency

- ETHFI PREDICTION. ETHFI cryptocurrency

- USD PHP PREDICTION

- INR RUB PREDICTION

- OM PREDICTION. OM cryptocurrency

- RUNE PREDICTION. RUNE cryptocurrency

- MNDE PREDICTION. MNDE cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- ILV PREDICTION. ILV cryptocurrency

2025-04-07 20:11