AVAX crypto’s tale is igniting once more, and this time, it’s not merely retail fervor fueling the blaze. A colossal institutional march and a cascade of bullish technical omens have reignited hope across the market, like a poet’s quill scratching at the edges of despair. 🌌

Institutional Demand Boosts Avalanche’s Market Outlook

A $675M SPAC deal has been committed to purchasing $1B worth of AVAX tokens, marking what could become one of the largest institutional treasury allocations of 2025. As reported by Andres Meneses, this move represents a defining moment for Avalanche’s credibility among institutional investors. Sarcasm alert: Because nothing says “trust me” like a billion dollars in crypto. 💸

Such large-scale accumulation tends to have a profound impact on liquidity and sentiment. It reinforces the notion that AVAX remains a key player in the Layer-1 race, and the injection of fresh capital could significantly stabilize prices and fuel higher valuations as the year progresses. Or it could be a mirage. 🧠

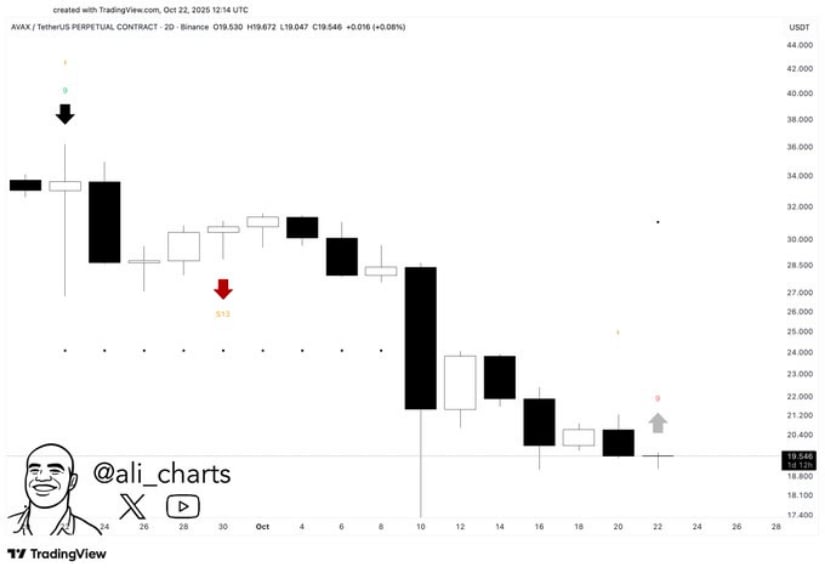

AVAX TD Sequential Flashes a Bullish Signal

Ali Martinez’s latest analysis shows that the TD Sequential indicator, which accurately signaled the last market top, is now flashing a buy setup on the Avalanche chart. This reversal cue aligns with multiple compression candles near $19-$20, suggesting that downside momentum may be exhausted. The TD Sequential, that old trickster, has whispered a bullish secret… or is it a riddle? 🧙♂️

A breakout above $20.8 to $21.5 would likely confirm bullish continuation, with short-term resistance visible near $23.0. Holding current lows and printing higher closes on the next few sessions could validate this reversal, positioning Avalanche for a potential mid-term rally phase. Or a mid-term nap. 😴

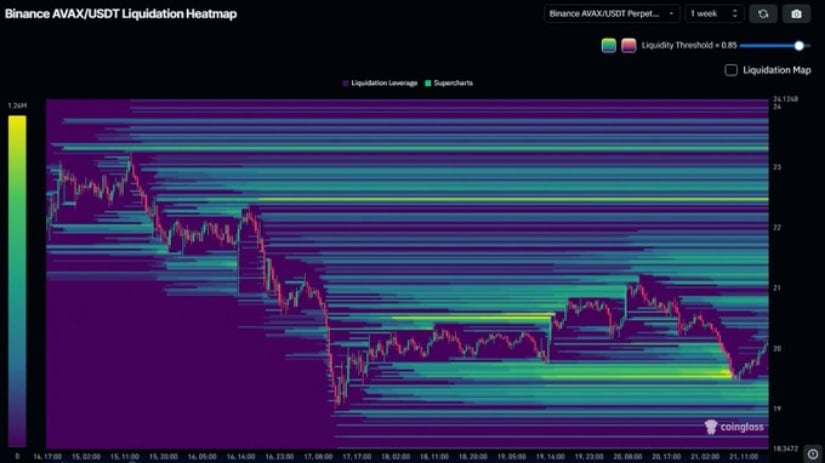

Liquidity Flow Suggests Accumulation

Recent data shared by RebornAli3N reveals that Avalanche successfully absorbed liquidity at $19.5, an area where demand has historically returned. The next major liquidity wall stands around $22.5, indicating that the market might be preparing for a rotation into higher zones. Like a dancer twirling toward the spotlight. 💃

If this liquidity cluster holds firm, the shift in balance from sell-side pressure to accumulation could set up a clean breakout structure. Reclaiming the $22.5 to $23 area would put AVAX crypto back on track for a broader move, potentially targeting $27 to $30 in the near term. Or a near-term nap. 😴

AVAX Price Double Bottom Formation Near Key Support

AVAX crypto is currently carving out a double-bottom pattern near the $19 horizontal support, an area that previously acted as a strong reaction zone. This formation reflects strong buyer defense despite recent sell pressure. A double-bottom? More like a double ‘I told you so.’ 🤷♂️

A breakout above the descending trendline, which currently caps price around $21.8, would confirm structure strength. Until that happens, traders are watching how well price sustains above $19, as any close beneath this line could briefly invite another test near $17.8 before recovery. Or a test of patience. 🕒

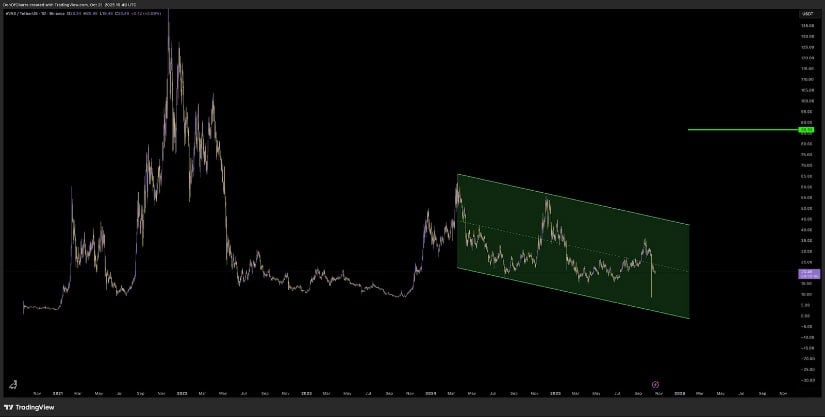

AVAX Price Prediction: Descending Channel Targets Point Towards $86

The broader view from Don’s chart displays AVAX price is trading within a long-term descending channel, with its upper boundary aligning near the $85 to $90 zone. The current setup implies that if this channel breaks to the upside, AVAX could experience one of its strongest cyclical expansions since 2021. A channel? More like a cage. 🐉

The structure remains intact as long as AVAX crypto holds above $18 to $19 levels, Each retest within this range continues to show strong rebound potential, making the next major breakout towards $40, $65, and ultimately $86 increasingly plausible if momentum builds into Q4 and beyond. Or a Q4 of quiet. 🌙

Final Thoughts: AVAX Price Rebound Momentum Building

Institutional demand, technical signals, and liquidity behavior all point towards a developing recovery phase for AVAX crypto. The confluence of the SPAC treasury purchase, TD Sequential buy setup, and strong on-chain liquidity zones reflects a well-supported base forming around $19 to $20. A base? More like a pedestal for a phoenix. 🔥

If AVAX price successfully clears $23 to $25 levels, it could trigger an extended move towards $40+ as broader sentiment improves. Avalanche appears to be entering an early accumulation stage, one that, if sustained, may define the foundation for its next major cycle expansion. Or a cycle of chaos. 🌀

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Why NEAR Protocol Might Just See $5: The Great Cryptocurrency Quest! 🚀

- Whale of a Time! BTC Bags Billions!

- Binance’s CZ Predicts Bitcoin Will Go So High Even Molière Would Write a Satire

- 🔥 Solana’s Meme Coin Mania Implodes – Stablecoins Rise from the Ashes! 💸

- Will Bitcoin’s “Uptober” Bewitch Us with Crypto Sorcery? 📈🔮

- MSCI’s Exclusion Plan Sparks Crypto Chaos! 🚨📉

2025-10-23 16:36