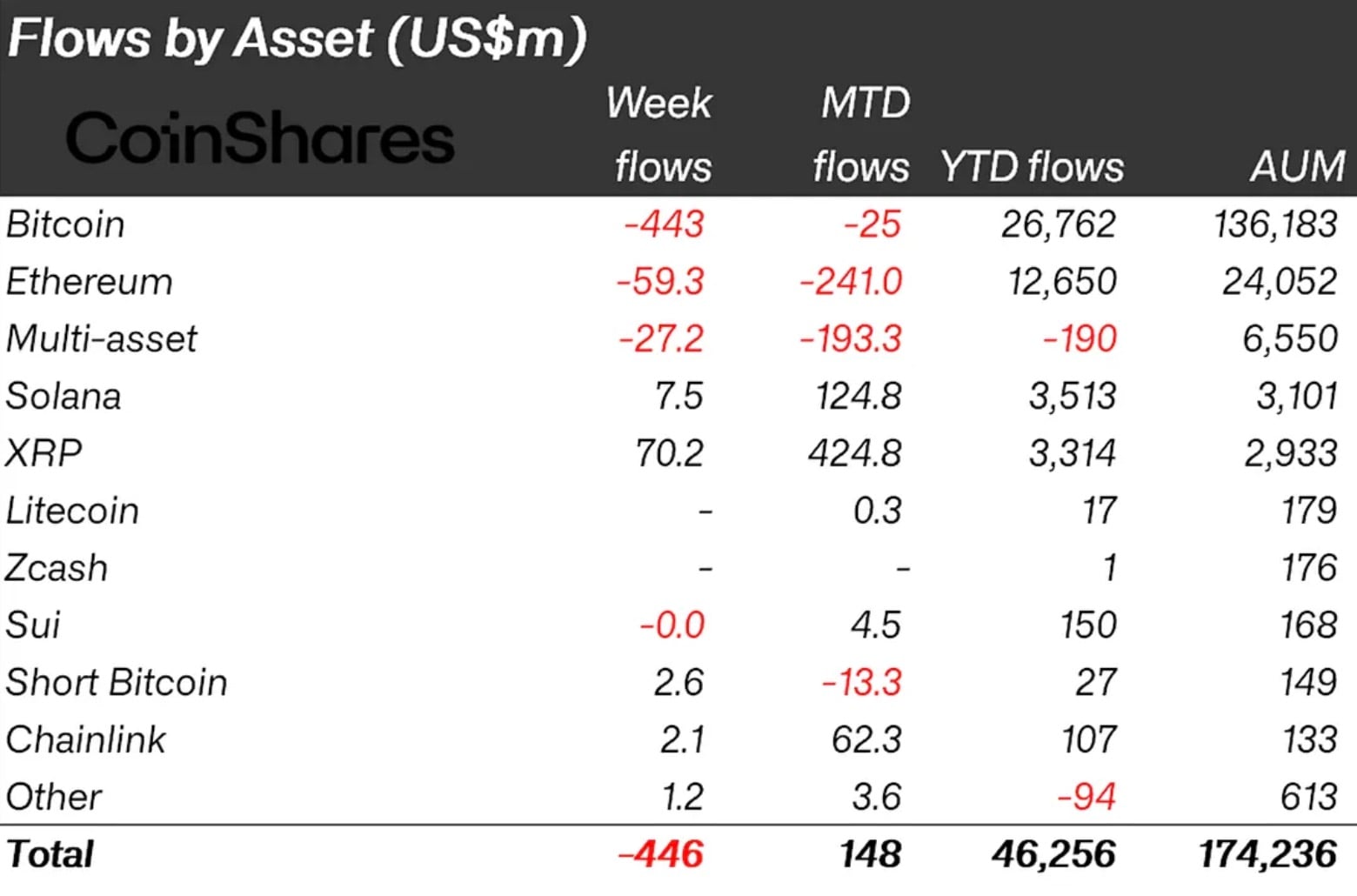

Bitcoin’s $90K Tango: A Farce in Red Candles and Bullish Tears 😂

According to the annals of Bitstamp, our crypt king embarked on a valiant ascent during the Asian session’s dawn, cresting just above $90,200 at the stroke of 05:00 UTC. A triumph, one might think, but oh, the fragility of such glory! By 09:30 UTC, the sell-side specters emerged, their howls crescendoing into a high-volume cascade that washed away the day’s gains like so much sand in a tempest. 🌊🔻