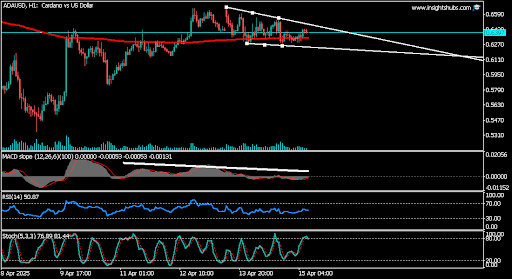

The Great Cardano Escape: Bullish Breakout or Just Another Illusion?

After weathering the tempestuous market volatility that has so kindly rocked our fragile hearts, ADA has—almost heroically, if I may add—carved out a base of support. It’s beginning to show signs of life, with rising lows and increased buying interest. Of course, nothing is certain in this cruel game, but it certainly gives one the faintest glimmer of hope. Perhaps the bulls have finally come to their senses? Or maybe they’ve just had too much of the endless doom and gloom? Only time will tell… ⏳