jpyxx

jpyxx

Blockchain’s $7M Vanish Act: A Tale of Crypto and Folly

On a fateful day in January 2026, the guardians of Saga Blockchain, with furrowed brows and trembling fingers, halted their SagaEVM chain at the solemn block height of 6593800. Suspicion, that silent sentinel, had whispered of foul play, and lo, it was not in vain. The Medium, that digital herald, proclaimed the attackers’ scheme: a synchronized cascade of contract deployments, followed by cross-chain antics, and the final act-the withdrawal of liquidity, a thief’s grand finale.

Ripple’s XRP Price Flirts with $2: Banking on Blockchain and a Dash of Sarcasm!

This ascent comes as Ripple embarks on an ambitious crusade to expand its digital asset realm, a quest punctuated by a strategic alliance with none other than DXC Technology (DXC), because why not?

Binance Prunes Its Garden: 19 Pairs Clipped, BTC and ETH Left in the Shade

Come January 23, at the ungodly hour of 3:00 a.m. UTC, a host of pairings will vanish like dew under the morning sun. AI/BTC, FIL/ETH, DYDX/FDUSD-these and others shall join the ranks of the forgotten, though their tokens may yet cling to life, paired with the more prosaic USDT, BNB, or FDUSD. Binance, ever the gardener, seeks to consolidate its plots, lest they become overgrown with the weeds of fragmentation.

XRP: The Crypto That Refuses to Die (Again)

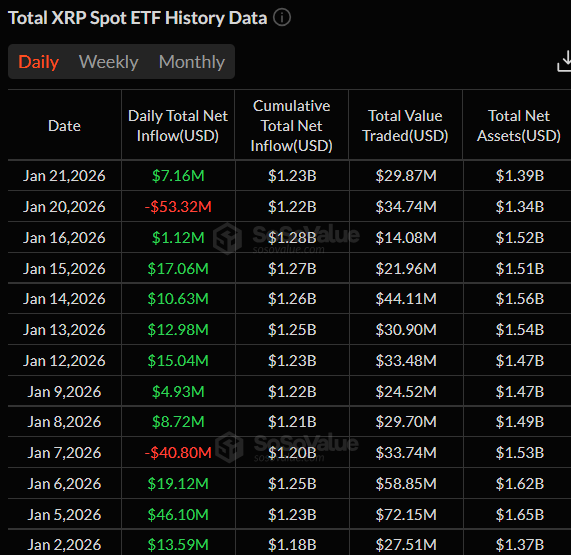

Santiment’s on-chain data is basically the crypto version of a tabloid, screaming about market fear and negative sentiment. But here’s the twist: everyone’s so busy doom-scrolling that they’re actually accumulating. Classic. It’s like when you hate-watch a show but end up binging the whole season. Meanwhile, ETFs are acting like the cool kids at the party, holding $1.39 billion in assets and pretending they’re not impressed. Sure, Jan.

Crypto Carnival 2025: Bitcoin’s Reign & Litecoin’s Brief Seduction

According to the latest gossip from the venue of digital assets, CoinGate, which saw a staggering 1.42 million crypto transactions in 2025-an impressive feat when you consider most people can’t even decide what to watch on Netflix-I.e., over 7 million transactions in its lifetime, Bitcoin pulled itself from the shadows of obscurity to dominate the payments scene with unassailable flair.

The Great Bitcoin Whale Coup: New Money Masters the Market

Beyond the price tantrum, a deeper upheaval stirs within the Bitcoin cosmos. According to analyst MorenoDV, the “new whales” have usurped the throne from the long-suffering “OG” whales, a development as shocking as a well-dressed man in a clown car. Realized Cap, that arcane metric of financial alchemy, now reflects a world where recent buyers, fresh from the crypto baptismal font, hold more sway than those who’ve weathered the cycles like grizzled sailors. It’s a shift as profound as a tea party in a tornado.

Wall Street’s New Trick: Tokenizing T-Bills Without Losing Your Mind

Major firms are racing to bring their shiny, traditional assets onto this new thing called a blockchain-because if everyone’s doing it, it must be good. BlackRock’s liquidity fund is already speeding along Ethereum like it’s a rollercoaster, and JPMorgan? They’ve jumped in with a tokenized money-market fund for the big guys. Basically, it’s Wall Street’s version of-and I can’t believe I’m saying this-digital monopoly money, but regulated.

2026 Crypto Boom: Pantera’s Magic Tricks Revealed!

Pantera begins by acknowledging that last year was not fundamentally driven when it came to returns within the crypto markets. It cites macroeconomic factors, market positioning, and structural influences as the main drivers that shaped performance, particularly for assets beyond Bitcoin (BTC). Ah yes, the usual suspects: inflation, market crashes, and the existential dread of holding a cryptocurrency that’s more volatile than a kangaroo in a teahouse.

Solana’s Staking Triumph: A Comedy of Errors?

Let me piece it all together, keeping each section’s content but infusing Molière’s humor and satire. Watch the character count for the title, and ensure all elements are present.