Ethereum’s Resurgence Ignites Meme Coin Frenzy: PENGU and PUMP Plummet

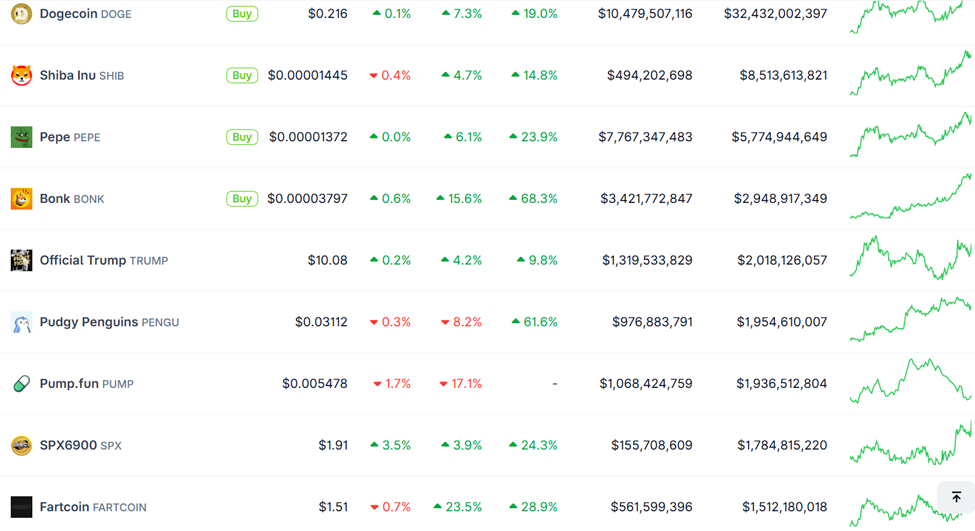

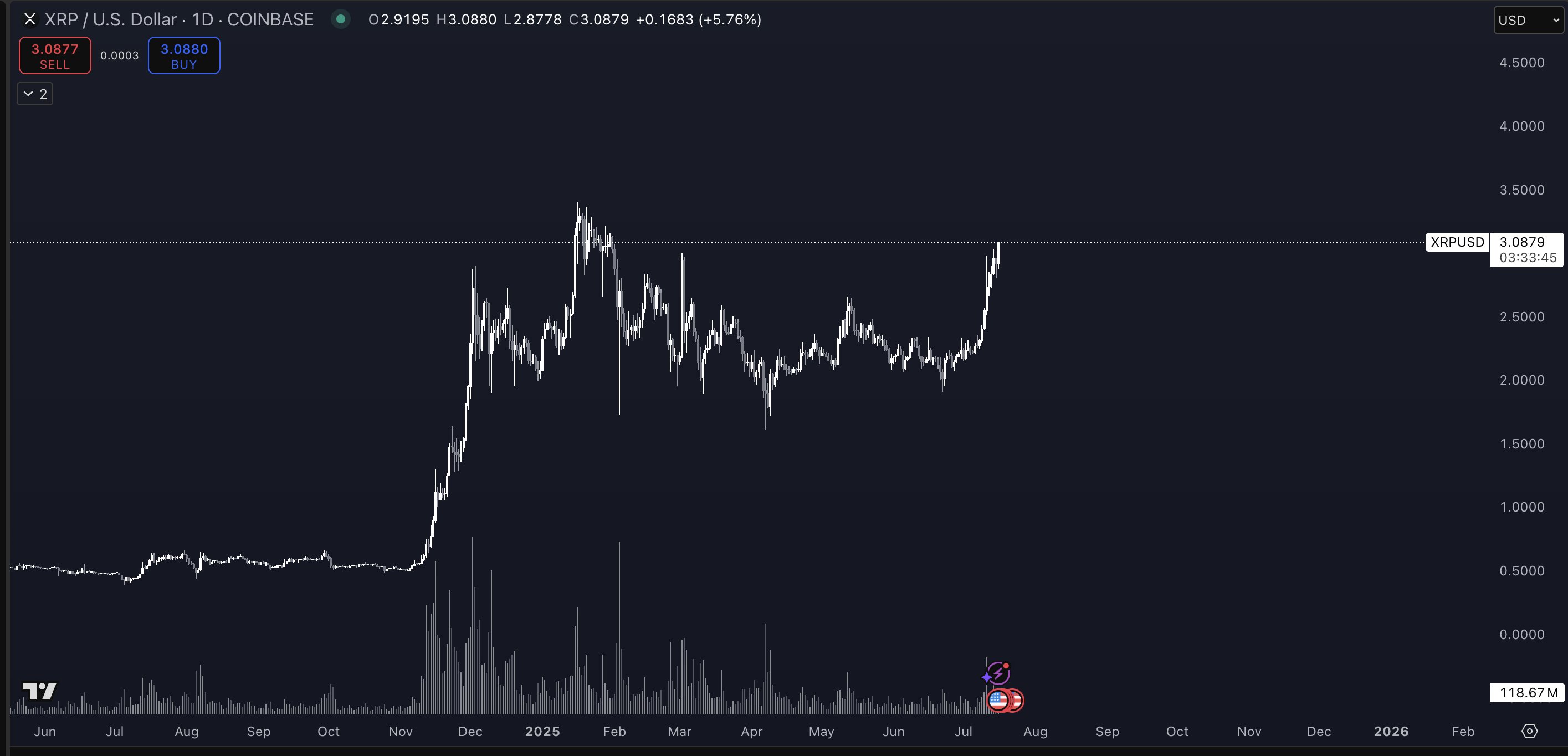

Traders are shifting their capital away from weaker narratives like PENGU (Pudgy Penguins) and PUMP (Pump.fun), and into tokens with stronger momentum and perceived fundamentals.

Traders are shifting their capital away from weaker narratives like PENGU (Pudgy Penguins) and PUMP (Pump.fun), and into tokens with stronger momentum and perceived fundamentals.

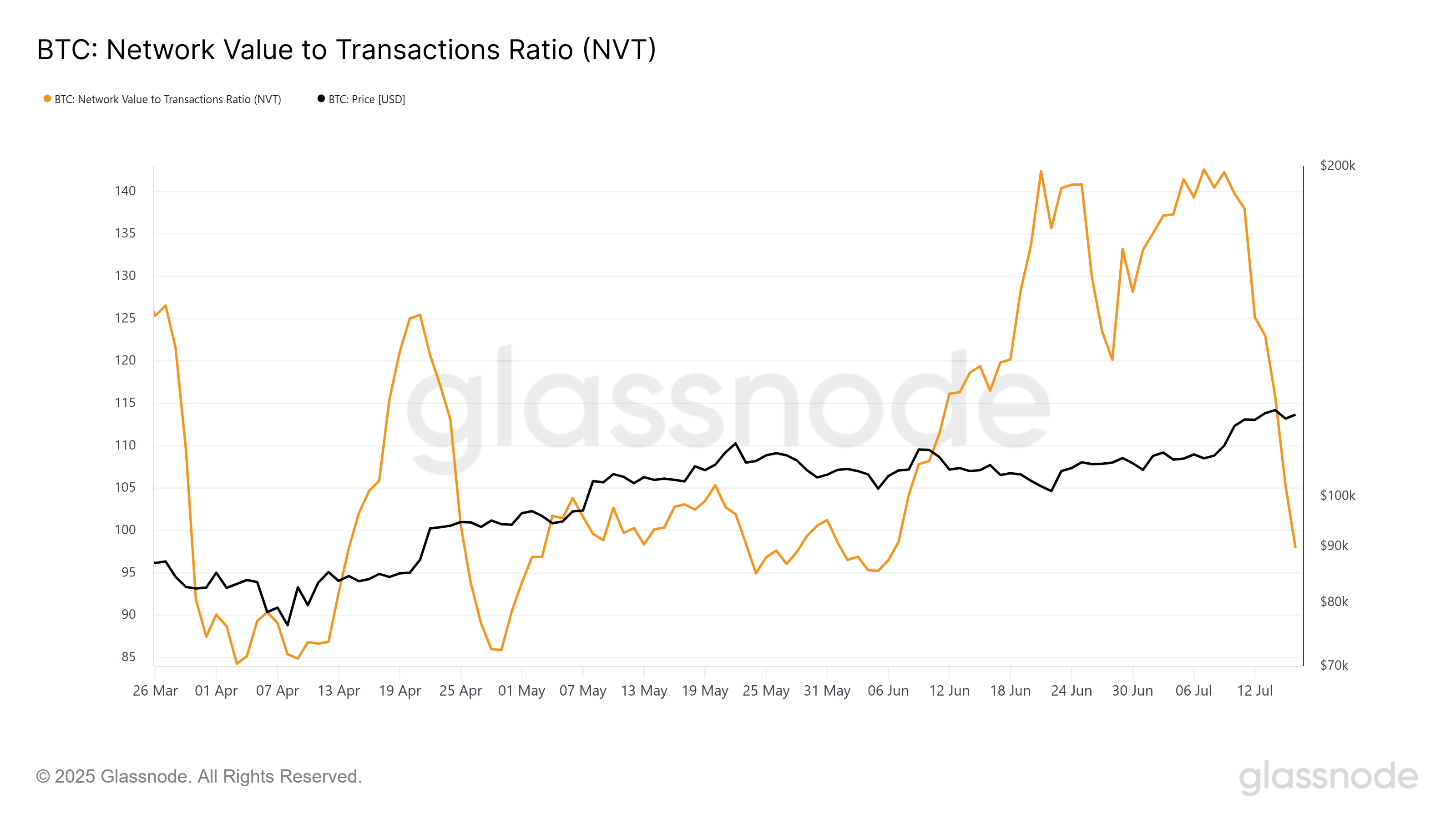

Could this mean that Bitcoin is still in the midst of a grand performance, with more acts to follow?

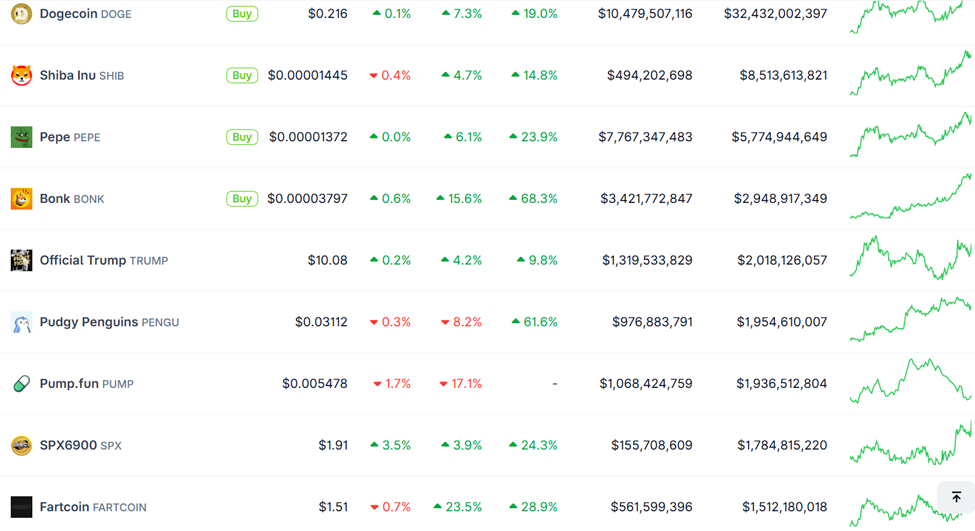

BNB Chain has plans for a wild ride in 2025, cranking up performance, and come 2026, they’re rolling out native privacy and high-performance architecture. The idea? To blend the speed of centralized exchanges (you know, the ones that make you cringe with all their fees) with the freedom of decentralized blockchain. As if balancing the two isn’t already a circus act. 🎪

So, CZ took to Twitter (because where else do these tech wizards go to vent?) to share his thoughts on Warren basically claiming that crypto is about to throw our economy into a black hole. 🌀 Because that’s what an economy needs—more drama! Her latest hill to die on? Companies like Amazon and Meta should totally stay under SEC’s watchful (and slightly grumpy) eye if they want to keep the “sacred” NYSE safe. Because obviously, companies controlling trillions of dollars can’t handle freedom, right?

Shiba Inu (SHIB) has bounced up about 15% this week, currently hanging out around $0.00001445 (or as we like to call it, the equivalent of pocket lint). Sounds great, but compared to other altcoins like Stellar (XLM) or Ripple (XRP), it’s like showing up to a potluck with just a bag of chips.

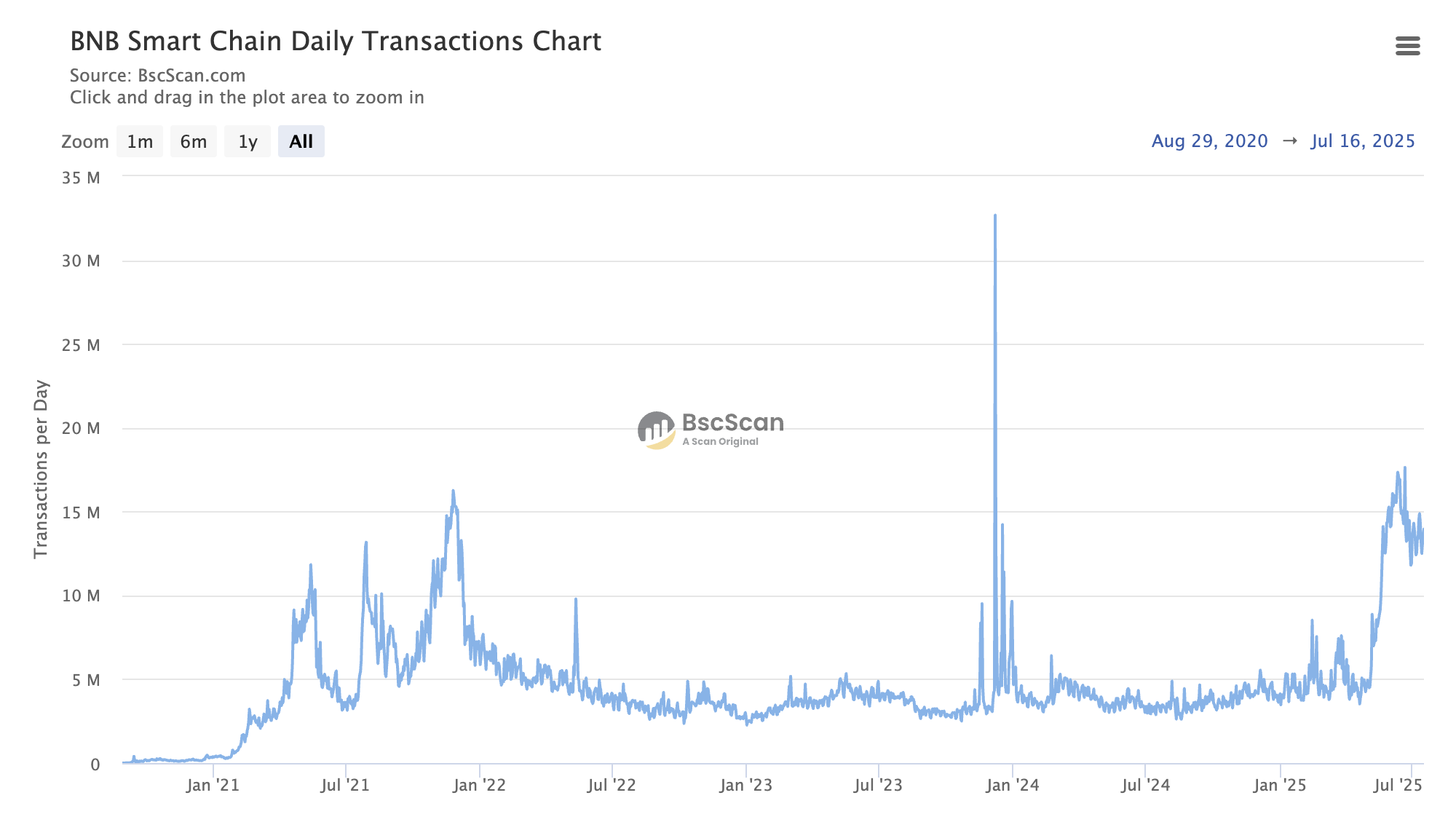

By Wednesday afternoon, XRP was trading at $3.08, up roughly 27% on the week and just below its highest close since the 2021 cycle high. Daily volumes have topped $8.5 billion, and momentum indicators on major venues show relative-strength indexes back in “buy” territory, supporting Pentoshi’s claim that overhead supply is thin.

Consider, if you will, the audacious Gen Z—a sprightly lot spending a dizzying 36% of their digital assets on that most noble of pursuits: gaming. Meanwhile, a respectable 35% manage to allocate their hard-earned crypto on quotidian expenses and jaunts to far-off lands.

Key takeaways (because who doesn’t love a good list?):

Yet, in the face of such volatility, the ETF market has shown a steadfast resilience, and Bitcoin has largely returned to its former glory. With a substantial influx of ETF funds, the price of Bitcoin may soon surpass its previous all-time high, or so the optimists whisper. 📈

According to DuckAI Agent’s post on X, he noted that the crypto space is buzzing with activity as Peter Thiel took a bold step in dropping a 9.1% stake in BitMine, which sent the company stock soaring as investor confidence surged. This is a strong signal from one of the tech influential players.