Banks vs. Bitcoin: Will They Be Friends or Foes?

Amid this shift, where do traditional financial institutions like banks fit? BeInCrypto consulted several experts to explore what the future holds for these institutions in the changing space. 🐉❓

Amid this shift, where do traditional financial institutions like banks fit? BeInCrypto consulted several experts to explore what the future holds for these institutions in the changing space. 🐉❓

Now, let’s get cozy with some tech jargon: NDAChain is a permissioned network. Basically, that means it’s the exclusive club no one can enter without a fancy invitation. Think of it as the VIP section of blockchains! 🎟️ It uses a hybrid model—part centralized snooping and part decentralized party. 🎉 Oh, and don’t get too relaxed; it’s run by 49 validator nodes operated by state institutions and big-name private sector players like SunGroup, Zalo, and Masan. So, great choices all around! 😏

Goldman Sachs and Bank of New York Mellon have recently dabbled in tokenizing shares of these funds. How quaint! But hey, there’s a method to this madness. By doing so, they can keep their funds hot and fresh, offering new uses, like collateral for margin trades, because who doesn’t like a good margin?

Burns commenced his treatise by leafing through the dry pages of tokenomics. Dogecoin, with its charmingly quaint issuance of 10,000 DOGE each minute—translating to about 5.2 billion DOGE yearly—boasts an inflation rate that dances about at a riveting 3.3%. Compared to the towering behemoth of 150 billion DOGE he guesstimably considers as its circulating supply, such inflation is deemed positively delightful. Should one bend an ear towards his reasoning, you’ll find he waxes lyrical about the absence of those nasty “supply shocks” that afflict dear old Bitcoin every four years, allowing miners to rest easy in their slumber.

Bitcoin (BTC) decided to take a 3% nap today. A nap…in the form of a price drop. Very relatable, honestly.😴

Markets are whispering sweet nothings, but darling, history has a wicked sense of humor and never truly plays nice forever.

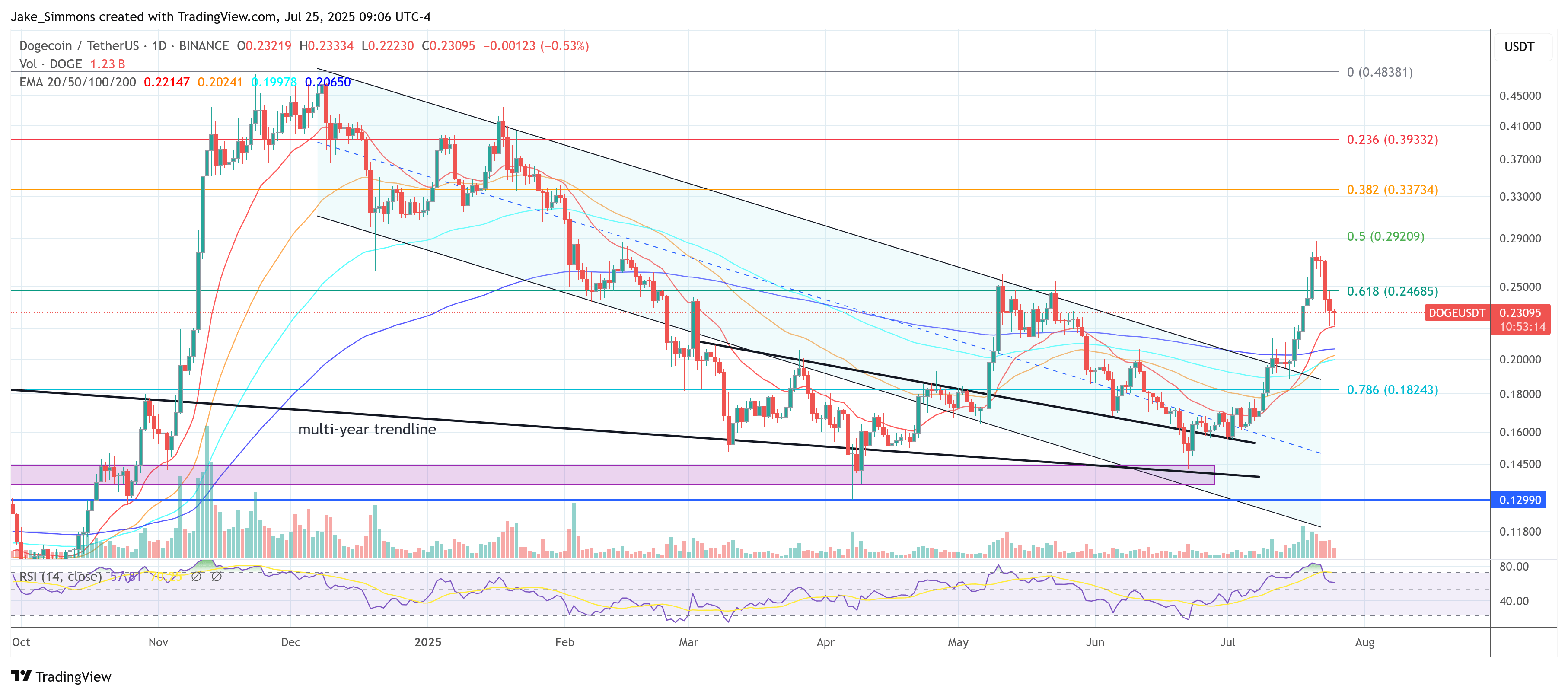

Now, if we peer curiously at the Dogecoin’s hourly chart, we’ll notice this golden cross might just form at a price of $0.2331. How thrilling! Essentially, this golden cross occurs when a short-term moving average hops over a long-term one, almost like a romantic dance at a wedding reception—awkward at first, but it could lead to a beautiful waltz if done right.

A Week of Revelations (or Regrets)

Now, according to the data—which, let’s face it, is about as reliable as Aunt Agatha’s gossip—Galaxy Digital has been up to no good. They’ve shifted a cool 30,000 BTC, valued at over $1.1 billion, to exchanges and OTC platforms. Dash it all, that’s enough to make even Bertie Wooster blush! And while they’ve still got 18,500 BTC tucked away, their aggressive liquidation has sent the market into a bit of a tizzy. One fellow reckons they’ve offloaded nearly $8 billion worth in the past week. Blimey! 💸

Davinci, with the patience of a man who has watched banks process a wire transfer, expounded upon the glacial pace of traditional finance. “Behold!” he declared (or rather, tweeted), “#Crypto moves money fast. Banks move a lot of excuses.” A statement so piercing in its simplicity that one could almost hear the collective sigh of a thousand bankers clutching their pearls. 💎