Crypto Crash! BTC Tanking at $117K & ETH Liquidation Frenzy-What a Day! 🚀💥

It’s a cocktail of regulatory spaghetti, leverage lunacy, and altcoins throwing tantrums. Just your average Tuesday, folks.

It’s a cocktail of regulatory spaghetti, leverage lunacy, and altcoins throwing tantrums. Just your average Tuesday, folks.

The whispers of on-chain metrics and the murmurs of macroeconomic signals warn that BTC’s grand rally may be sputtering, like a dying fire. What are these omens? The tale is told below. 😒

Ah, a tragic comedy! Metaplanet plunged like a suicidal kamikaze (36%), KindlyMD collapsed faster than a soufflé in a hurricane (87%), and Semler Scientific whimpered away (-12%). 🎭

Imagine, if you will, two titans of the pixelated universe – Tilted and Majyo Treasure – huddled over their alchemical apparatus, brewing a potion that blends artificial intelligence with the blockchain, that grand ledger of human folly. Together they promise a grand spectacle, a carnival of fantasy and techno-wizardry, where fun frolics with innovation like drunks at a tavern. Players and creators alike might find themselves pulled into an experience so rich, so cunningly woven, that even the most jaded souls would crack a smile… or at least smirk. 😂

Meanwhile, the wise MindX advises patience, as Worldcoin doth trade in a narrow $1.48-$1.52 range, with a steady $223.5 million volume. Holding above $1.45-$1.50, sayeth MindX, could herald a rally to $2.40, or higher if the volume gods smile upon us. Together, these insights reveal a consolidation phase, where sustained closes above key levels might signal a bullish breakout-or just another Tuesday in crypto. 🌪️

Beyond technicals, Dogecoin’s latest news has been shaped by growing institutional interest. Grayscale, that paragon of digital asset management, has filed an amended S-1 with the SEC, seeking to transform its Dogecoin Trust into a spot ETF. If granted, this would see the fund listed on the NYSE Arca, a symbol of institutional acceptance-or perhaps a fleeting illusion. 🧛♂️💸

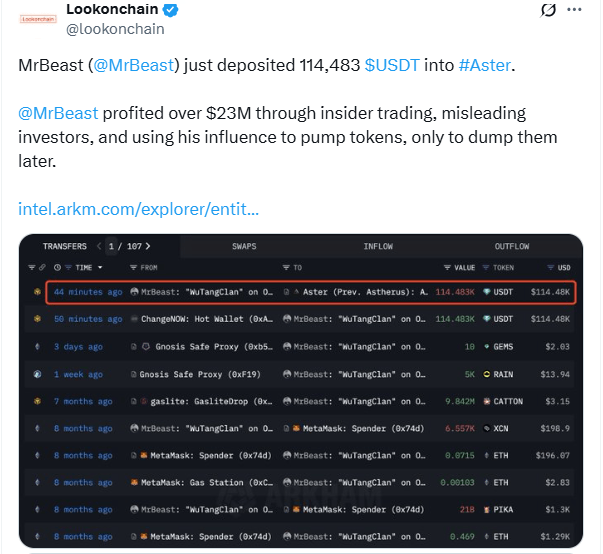

Ah, Aster, the so-called decentralized exchange (DEX) that promises the moon but delivers a circus. Since its token generation event (TGE) on Sept. 17, ASTER has been less of a rocket and more of a fireworks display-brief, dazzling, and suspiciously controlled. From a humble $0.02, it shot to $2 by Sept. 21, a 7,000% leap that briefly crowned it with a $3.3 billion market cap. 🌠 But, as Gorky would say, “The higher the flight, the harder the fall.” At the time of scribbling, it’s back to $1.60, shedding $660 million like a snake shedding its skin. 🐍

Data from Blockworks reveals that, for a brief, glorious moment in late 2024, meme coins monopolized over 60% of Solana DEX activity. Speculators, drunk on FOMO and Red Bull, bought everything that glittered-including tokens named after cats, politicians, and questionable life choices. Trading volumes soared to stratospheric heights, briefly eclipsing Ethereum like a toddler declaring himself king of the playground 🌕🚀.

Scott Lucas of J.P. Morgan and Sandy Kaul from Franklin Templeton are now co-chairs of the Subcommittee. Because nothing says “innovation” like letting Wall Street’s finest reinvent the wheel. 🚀💼

Binance’s Long/Short ratio stands at 2.55, a bold declaration that 71.82% of traders are long, even as the downtrend bites. Are they fools or visionaries? Only time will tell. 🎭📈