Bitcoin’s Bold Bid: Will It Test $75K This February?

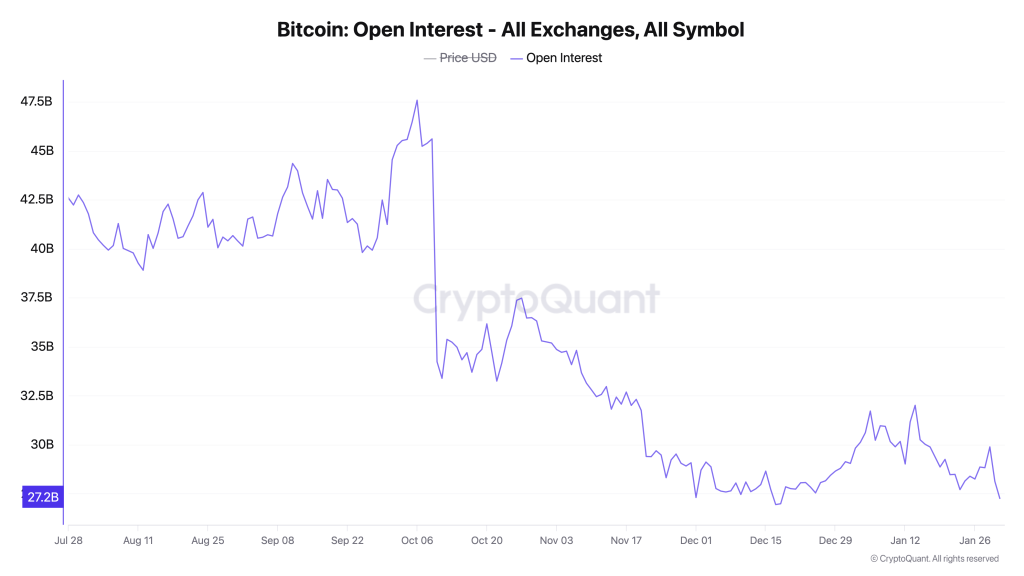

Open interest across exchanges has declined as if the market suddenly remembered it left the stove on-broad deleveraging rather than heroic dip-buying. In plain terms: traders are closing positions instead of marching in with fresh longs to defend the current perch. And crucially, open interest has struggled to recover alongside price, which suggests conviction is thinner than a goblin’s disguise.