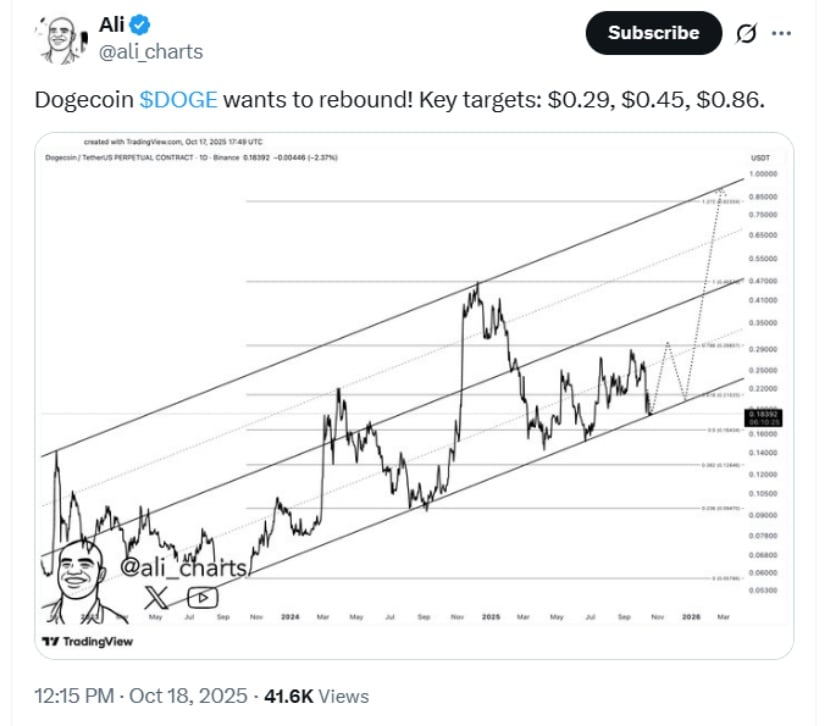

🚀 DOGE to the Moon? $1.50 or Bust! 🌕

Imagine, if you will, a noble hound, long confined to its kennel, now stretching its limbs and preparing for the hunt. Dogecoin, after months of sideways sauntering, shows signs of renewed vigor. Analysts, those modern-day soothsayers, predict a breakout from its multi-year triangle formation-a pattern so grand, it could only be devised by the gods of finance themselves! As of mid-October 2025, our dear DOGE hovers around $0.188, consolidating in the $0.18-$0.22 range, a modest 5% weekly gain, according to the wise sages at Yahoo Finance.