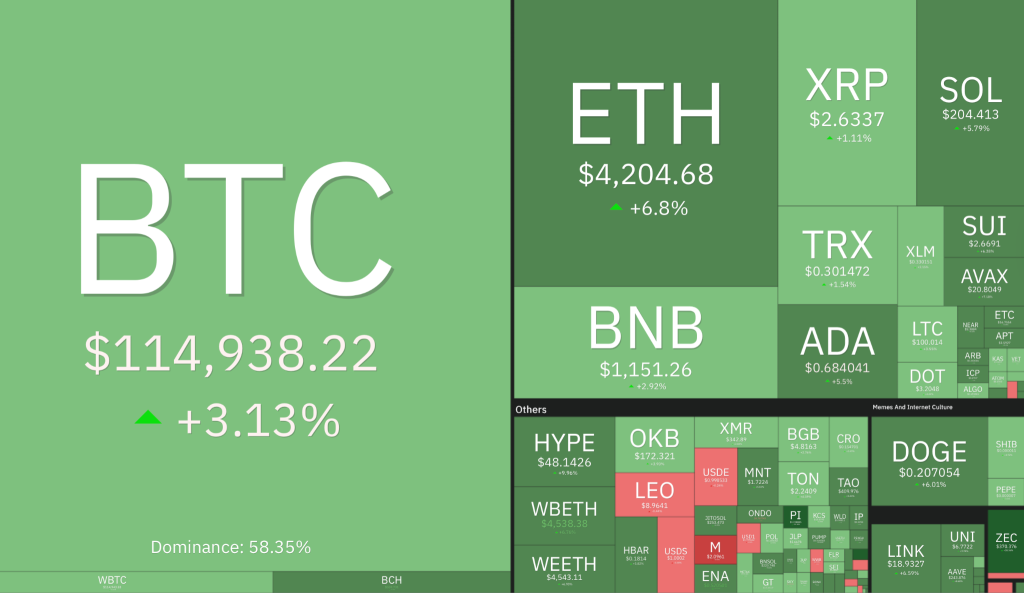

Ah, but what’s the fuss? It’s merely a license, you say, but a license that grants the tiny titan the power to scale up its bitcoin services-yes, the very same digital gold-keeping users’ self-custody like a mother holding her child. Now, they can boast about improved payment features-think 24/7 instant SEPA, because who needs sleep?-and higher euro trading limits, making the world of crypto just a tad more chaotic and exciting. They talk about having over ninety thousand users and a billion dollars in total volume, which, I suppose, would make even the most hardened banker raise an eyebrow. Julian Liniger, their co-founder and CEO, sounds proud-proud enough to call themselves “one of the first bitcoin companies to get the MiCA license,” as if it’s some noble achievement, and not just another step in the endless dance of regulation. He advises users to update their auto-invest orders to the shiny new SEPA IBAN, perhaps thinking we’re all just characters in a grand chess game.