Hype Me or You’ll Cry: HYPE Token’s Dance with $60 💸

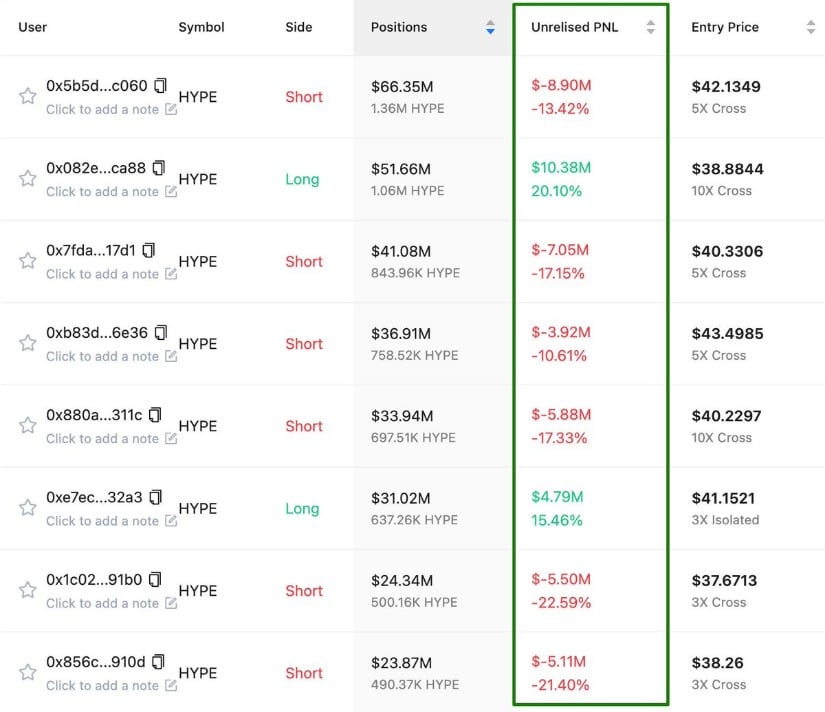

Recent whispers from the ledger of Hyperliquid Daily paint a frantic scene: those daring short sellers are clinging to a precipice, their positions squeezed with a ferocity that inspired a wry chuckle. The largest short, worth a whopping $66.35 million, now stands exposed with a 13.4% unrealized loss, while other large shorts echo their misery. This delightful spectacle suggests bears have been valiantly clashing against the bullish tide since the uptrend began, and we might soon witness a breathtaking cascade of liquidations if the price dares to climb further.