🐧 PENGU’s Plunge: Will Whales Save the Day or Is It Iceberg Time? 🤑

🧊 Top wallets are holding 97% of their icy treasures-a potential frosty rebound if PENGU can slide back to $0.0177 support. Brrr, it’s chilly out there! ❄️

🧊 Top wallets are holding 97% of their icy treasures-a potential frosty rebound if PENGU can slide back to $0.0177 support. Brrr, it’s chilly out there! ❄️

Oh, definitely. November’s like that one relative who always shows up to parties at the last minute and somehow steals the show. Historically, when sentiment is low, things turn around. So, yeah, it could happen.

Instead of mere governance doodads, the plan is to let network usage and enterprise licensing pump value straight into the token’s veins-think of it as a crypto blood transfusion, minus the needles, hopefully.

It followed Ethereum’s move to turn negative for 2025, amidst the altcoin’s steepest daily drop in months. One might say the crypto world is as stable as a house of cards in a hurricane. 🌪️

ZKsync, ever the tormented artist, persists in its rally, adorned with an upgrade that dares to prove its long-term utility and tokenomics. On a Tuesday, a day as mundane as any other, Alex Gluchowski, the CEO and co-founder of Matter Labs, unveiled a proposal so grand it could only be described as a “major ZKsync.” Rewards, they say, shall flow to its holders. But at what cost, dear reader? At what cost? 🤔

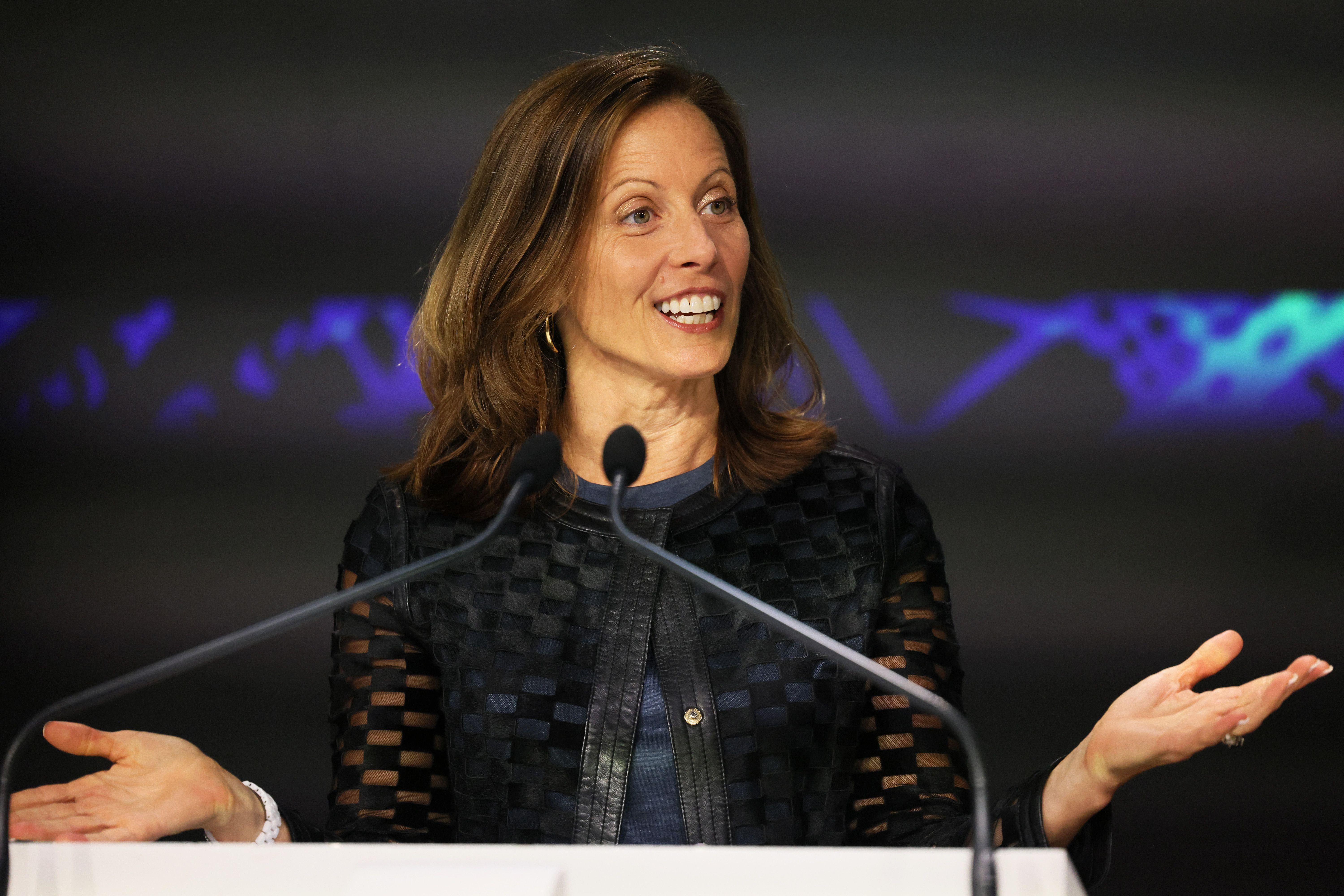

Alright, folks. Nasdaq CEO Adena Friedman, in her infinite wisdom, is telling us that blockchain is the future of finance-no big surprise there, right? But she’s really onto something here, making some bold claims about how blockchain could shake up the way finance has been working for decades. Who knew? Maybe it’s time we stop pretending the current system doesn’t feel like it was built with a typewriter and a fax machine.

In what might be the beginning of the end, or merely a bizarre interlude of chaotic unpredictability in the crypto theater, Paris-based Sequans (SQNS) is the first bitcoin treasury darling to dump its shiny, digital gold. The company’s decision, laid bare during their third-quarter earnings report on Tuesday, revealed that 970 bitcoin were parted with to clear half of its July 2025 convertible debt, trimming the total from $189 million to a more “breathable” $94.5 million.

On the 3rd of October, Ripple made yet another bold move, acquiring Palisade, a crypto wallet and custody provider. The deal was hailed as a grand expansion of Ripple’s ability to “serve the core needs of fintechs, crypto-native firms, and corporates.” Monica Long, Ripple’s President, had this to say:

Hidden bullish divergence on the XRP charts could finally give the bulls a little breather. 💪

By offering STRE in euros, Strategy is building a bridge between traditional finance and Bitcoin’s wild west. Institutions can now “invest” in Bitcoin without actually touching crypto-because nothing says “trust” like a middleman with a stock ticker. 🏛️➡️🚀 Michael Saylor, the man who once said “Bitcoin is the future!” and still says it, declared this a “milestone” for Europe. Let’s hope the next step is a Bitcoin-themed Eurovision entry. 🎤