Bitcoin Hyper: The Blockchain’s New Valet or Villain? 😏

Bitcoin, that noble digitized gold, so shiny it makes a king’s crown weep with envy! 💎

Bitcoin, that noble digitized gold, so shiny it makes a king’s crown weep with envy! 💎

In a recent interview, reminiscent of the absurdity of a scene in “The Master and Margarita,” President Trump, with a waxen smile, proclaimed, “I don’t know who this fella is. But I granted him clemency because I heard he was caught in a Biden witch hunt.” This, of course, was delivered as if to a gathering of unconscious gypsy fortune-tellers predicting the latest novelties in White Nights.

The market’s recent antics-catastrophic volatility, the Oct. 10 flash crash (a modern-day financial tempest)-have left investors clutching their portfolios like a drunkard clutches a bottle. “Scared capital,” as it’s quaintly called, now flees the scene, urging others to join in their exodus. One might think it’s a Russian novel, but alas, it’s crypto.

The Altcoin Season Index, that once-glorious beacon, now languishes at 29-a number that makes even the bravest traders clutch their pearls. 🍑 Once, it danced at 78, a siren song of altcoin glory, but the market, ever the trickster, led it into a labyrinth of losses. 🧩 The 90-day period, a cruel judge, has declared that only 29 of the top 100 altcoins outperformed Bitcoin, leaving the rest to wallow in ignominy. 🙀

Our protagonist, Zhao, desiring perhaps a touch of candor, avowed that this venture was not part of any sordid corporate maneuver or sly market handshake. “I harbored some Aster tokens in Binance today,” he confessed, “using the alas limited sands of my own coffer.” And he laid out a blanket proclamation: “I’m no merchant of speculation, I acquired and shall possess them.”

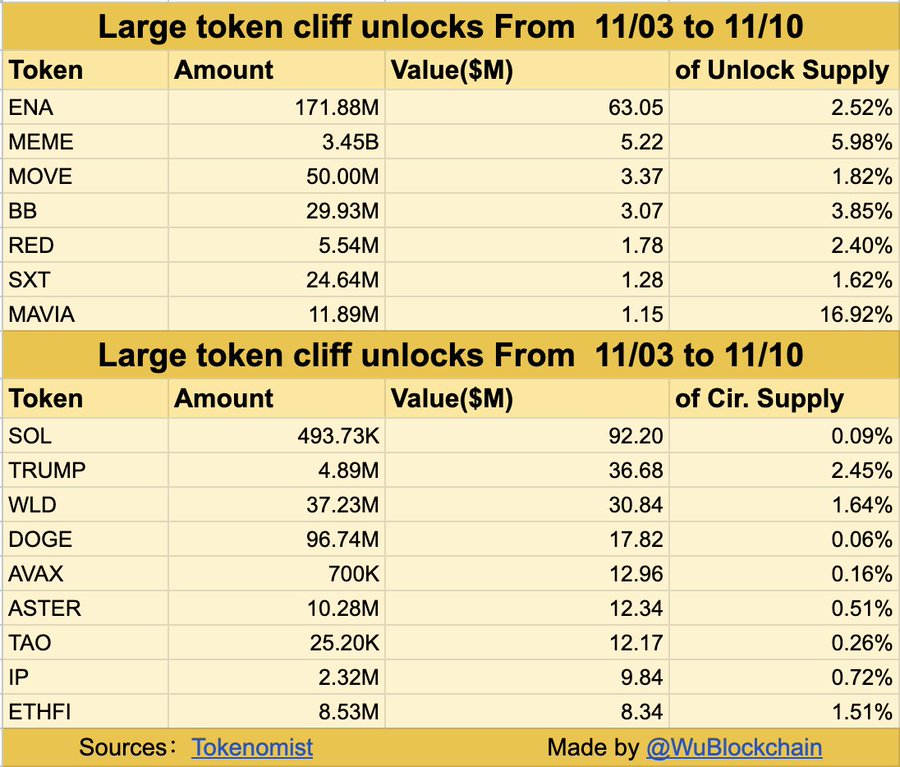

This week’s token unlocks are so big, they’ll make your wallet weep. Key suspects include:

The crypto realm, once a gilded goose laying golden eggs, now clucks feebly. Ethereum, that proud peacock, lost 2.55% of its plumage. Solana (SOL), once a comet, dimmed by 4.76%. The market’s indifference to joyous tidings speaks volumes of a soul parched by greed and thirsting for chaos.

Everyone knows the conference is a big deal-top brass from places that do not exist just to make money, flutter in and out. Brad Garlinghouse, Chris Larsen, and their merry band of Ripple grandees will prance on stage, perhaps to announce breakthroughs, partnerships, or merely to show off their shiny watches. Funnily enough, the crowd includes big shots from Franklin Templeton, Citigroup, Fidelity-the usual suspects in a game where every handshake could mean a new ripple of the tide or a sinking ship.

In Tehran’s industrial zones, you’d stumble upon these shady mining farms that’d make Willy Wonka’s chocolate factory look quaint. Egg fried in factories, potato crisps heating up food plants, and a maze of tunnels set underground like some sort of subterranean tech disco. And the cherry on top? Miners taking advantage of Iran’s hearty public power subsidies. Spoiler: Iran makes mining Bitcoin as cheap as a fast-food burger, folks!

Okay, so it’s not exactly breaking news that bitcoin is doing the financial equivalent of a toddler throwing a tantrum while the rest of the market celebrates. Other risk assets have been cruising at record highs, while BTC is just kind of…meh.