The Dark Side of Crypto

Hyperliquid lists on OKX as HYPE trades at $41.23 with 2% dip and TVL rises to $4.899B ahead of potential $50 target 🤔

Hyperliquid lists on OKX as HYPE trades at $41.23 with 2% dip and TVL rises to $4.899B ahead of potential $50 target 🤔

Die Bitcoin Branche steht vor einer radikalen Neuordnung. Nach der Halbierung der Mining-Belohnung im April 2024 schrumpfte die Rentabilität drastisch und zwang viele Unternehmen zum Umdenken. Firmen wie IREN, früher Iris Energy, stürzten zunächst ab und erlebten dann eine dramatische Wende. Seit der strategischen Neuausrichtung und dem Rebranding im November 2024 legte die Aktie über 580 % zu. Konkurrenten wie Riot Platforms, TeraWulf und Cipher Mining verzeichneten ebenfalls enorme Kursgewinne zwischen 100 % und 360 %, was zeigt, wie stark der Markt auf die neue Ausrichtung reagiert. 📈

Dogecoin could hit this price mark if bear conditions are extended for a longer period and bulls failed to defend accumulation zones before this zone. A scenario as likely as a penguin winning a race against a sloth. 🐧🐢

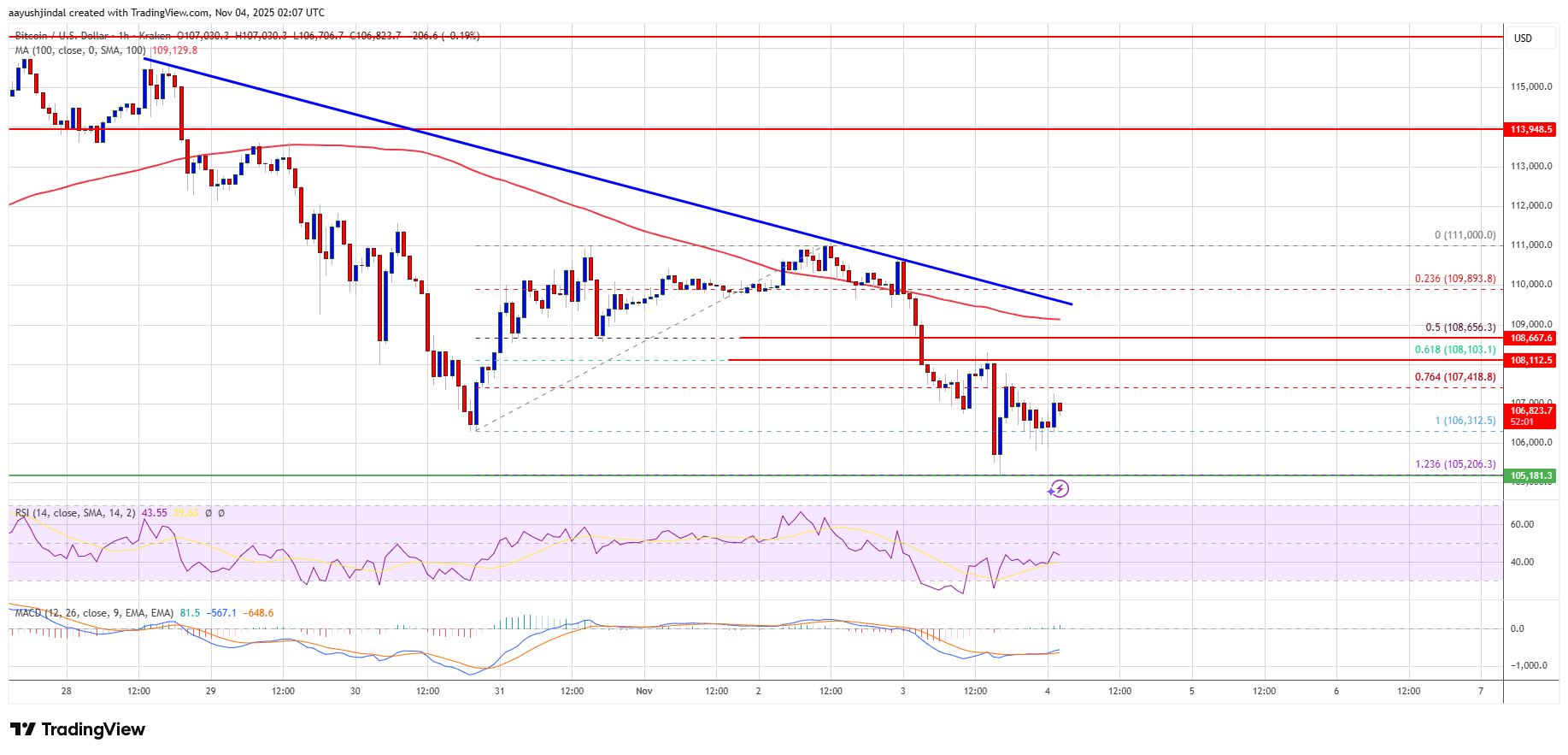

Well, bless its digital heart – Bitcoin couldn’t manage to stay above $110,000, which really is the cryptocurrency equivalent of failing to hold a teacup properly. A fresh descent commenced, and down it went – below $109,000, then $108,800 – into the dimly lit realm of bearish despair. Positively tragic.

Indeed, the asset has struggled to maintain its lofty uptrend, slipping below the $3,800 threshold and testing the critical $3,715 support zone, a battleground as contentious as a dinner party with rival suitors. Analysts, ever the dramatists, note that this level has been retested multiple times since October, a performance as tiresome as a repeat of a failed comedy. 🎭

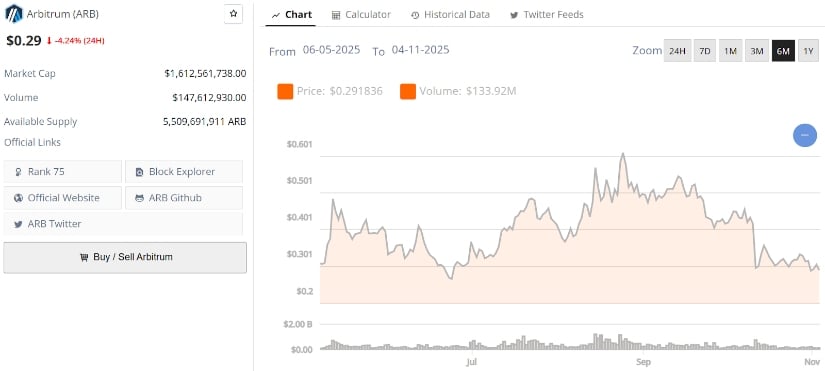

So, Arbitrum has wandered back to its familiar old haunt between $0.28 to $0.30. This spot’s been a loyal friend for rebounds in the past-kind of like that one reliable friend who always shows up to the party, even though they’re a bit rough around the edges. Looking at the last 6 months, ARB’s price action has been more like a slow squeeze, with lower highs that just won’t quit. Yet, every time ARB tests this support, it’s like a chorus of buyers stepping in to say, “Not today, my friend!”

Let me start drafting each section, keeping paragraphs concise, using Steinbeck-like metaphors, adding humor and emojis where appropriate, and ensuring the technical details are translated into more narrative terms.End of Thought (14.66s)

But wait! Not all is as it seems in this land of digital fortunes. Enter the whale, wallet 0x9eec, who, rather than join the cheerleading squad, decided to double down on his bearish bet. While the world was busy digesting CZ’s announcement, this whale took the opportunity to aggressively pile on ASTER shorts-because nothing screams ‘confidence’ like betting against a market darling. It’s the crypto equivalent of cheering for the underdog… or perhaps just being a little too good at math.

Today’s announcement marks a decisive moment in Ripple’s quest for financial world domination-or at least, a solid presence in the U.S. market. The service allows U.S. institutional clients to execute over-the-counter (OTC) spot trades in major digital assets, including none other than XRP and RLUSD. Yes, the infamous XRP-still fighting for relevance in the crypto jungle.

According to SEC records (the paper trail of dreams and delays), Grayscale was the first in line on October 17. A parade of hopefuls followed-21Shares, Bitwise, Canary Capital, CoinShares, and WisdomTree-all waiting on the edge of their seats. Yet, the government’s prolonged nap (the shutdown) kept everyone twiddling thumbs till late October. Oh, the drama!