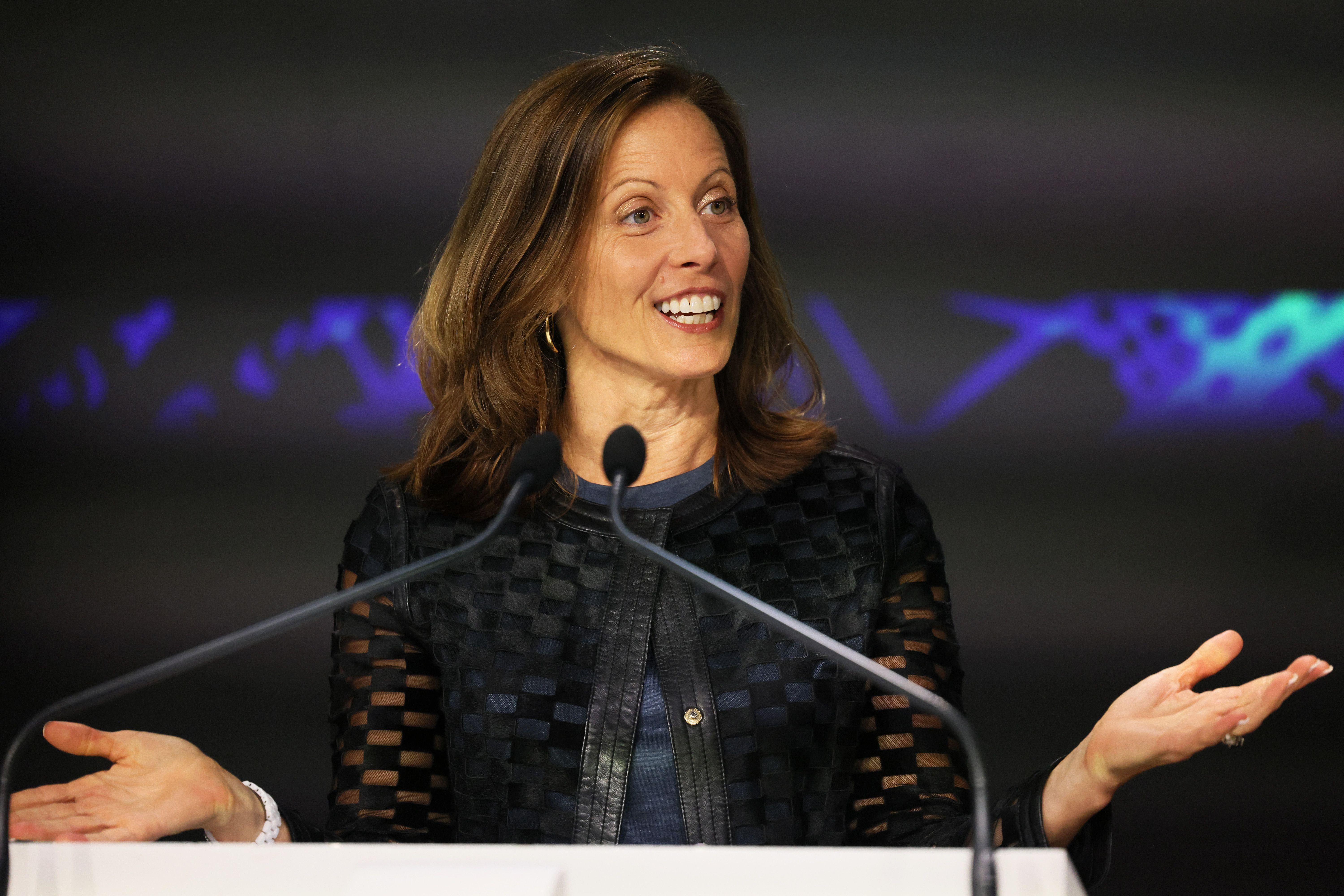

Nasdaq CEO Adena Friedman Reveals How Blockchain Can Fix Finance (Seriously!)

Alright, folks. Nasdaq CEO Adena Friedman, in her infinite wisdom, is telling us that blockchain is the future of finance-no big surprise there, right? But she’s really onto something here, making some bold claims about how blockchain could shake up the way finance has been working for decades. Who knew? Maybe it’s time we stop pretending the current system doesn’t feel like it was built with a typewriter and a fax machine.