Bitcoin’s Midlife Crisis: $76K Support or Sell Everything Panic?

Total crypto market capitalization has dropped to $2.58 trillion-down 2% today, because nothing says “confidence” like watching your portfolio evaporate before lunch.

Total crypto market capitalization has dropped to $2.58 trillion-down 2% today, because nothing says “confidence” like watching your portfolio evaporate before lunch.

At the helm of this critical chorus stands Attorney General Letitia James, flanked by a quartet of district attorneys, including the ever-punctilious Alvin Bragg. They have penned a letter to Congress, deeming the GENIUS Act-ostensibly a paragon of stablecoin regulation-a woeful failure in its duty to shield the innocent from financial mischief. With the gravity of a society matron critiquing a poorly arranged ballroom, they argue the law bestows an “imprimatur of legitimacy” upon stablecoins while allowing their issuers to evade the very obligations that might curb the nefarious activities of terrorism financiers, drug traffickers, and the most odious of all, cryptocurrency scoundrels.

//media.crypto.news/2026/02/Image-04-02-2026-at-09.02.webp”/>

There’s always a bull market somewhere-or perhaps a bear market, depending on which side of the ledger you’ve been scribbling.

Oh, the nerve of Flare, daring to teach XRP-the token once stuck in Ripple’s never-ending courtroom drama-to play nice with DeFi. Modular lending, they call it. Fancy words for letting FXRP holders borrow assets, loop strategies, and pretend they’re Wall Street wolves without a care for the XRP Ledger’s curfew.

Vitalik Buterin, the Ethereum equivalent of a guy who just realized he’s been using the wrong app for his entire life, has decided that L2s aren’t “shards” anymore. Who knew?

Meanwhile, Hyperliquid’s HYPE token ascends with the audacity of a nouveau riche, its surge a testament to the merciless efficiency of market cycles. While ADA wallows in the quagmire of governance and ideology, HYPE thrives on the raw, unbridled energy of product innovation and trader demand. The contrast is as stark as it is ironic: one mired in the lofty ideals of decentralization, the other reveling in the pragmatic pursuit of profit.

While the ONDO token was busy playing hide-and-seek with its 37% monthly drop, the team threw a party for MetaMask. Because nothing says “I care” like integrating tokenized stocks into a wallet that’s basically a digital wallet for your digital wallet.

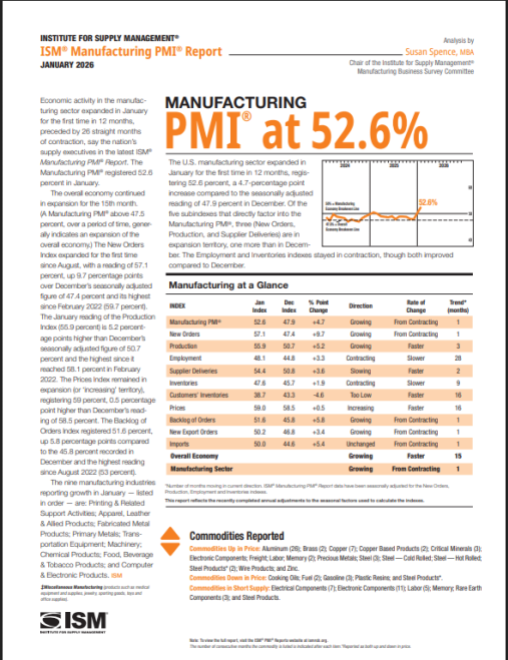

The PMI, a number so arbitrary it might as well have been plucked from a hat, has leapt into “expansion territory” at 52.6. The Institute for Supply Management, with its air of gravitas, declares this a triumph of growth over contraction. And lo, the strategists and analysts, those high priests of speculation, have emerged from their temples to pronounce their verdicts.

Behold! Over 167,000 traders were flash-opped like they were on a rollercoaster at a funeral. $730 million liquidated in 24 hours? That’s enough to buy a small island… if you could still find one not owned by Elon. And let’s not forget the $528 million in long positions-because nothing says “confidence” like betting on a bull market while wearing a bear costume.