ZK Price: A Comedy of Errors 📉💰

Apparently, a minor dip to $0.065, a hunt for liquidity, as they call it, might be followed by a rather predictable…bounce. A rebound! Oh, the suspense!

Apparently, a minor dip to $0.065, a hunt for liquidity, as they call it, might be followed by a rather predictable…bounce. A rebound! Oh, the suspense!

They’ve gone full doomsday.)

Bitcoin, ever the unreliable friend, faltered at $104,000, triggering a fresh plunge. It slipped below $103,500 and $102,400, entering a bearish purgatory where hope is a distant memory. 🕯️

Well now, the indicators are a curious case of mixed signals. Exchange reserves are guttering like a guttering candle, while the spot taker CVD has flipped from bearish to neutral-though it seems more like a temporary truce than a royal pardon. Still, neither has managed to halt LINK’s current slump, much to the delight of bears everywhere. 🪶✨

Say goodbye to those pesky high-cost dollar brokers, because OKX is here to save the day with a digital dollar wallet and card that’ll make your Reais do the samba! 🕺💳

Traders, gather ‘round! ZEC’s 1,218% surge since August smells fishier than a troll’s breakfast. Nothing’s fundamentally changed-it’s all narrative and no substance. So, instead of buying more, maybe pocket those profits before the bubble bursts. 🧙♂️💥

Now, ADA flutters around $0.53, its wings trembling as bulls wage a valiant (if slightly delusional) campaign to defend this fragile sanctuary. A descent below $0.52 would, of course, invite the bearish hordes to throw confetti and chant “I told you so” in unison, but let us not spoil the drama with spoilers.

Now, let’s talk turkey. Gold, that shiny rock we’ve been hoarding since the dawn of time, hit $4,377 per ounce and then took a tumble, dropping 10% faster than a politician’s approval rating. Meanwhile, Bitcoin’s recent 20% dip from its all-time high? Oh, that’s just “heavy deleveraging in futures” and a little $128 million crypto heist. Nothing to see here, move along. 🕵️♂️💰

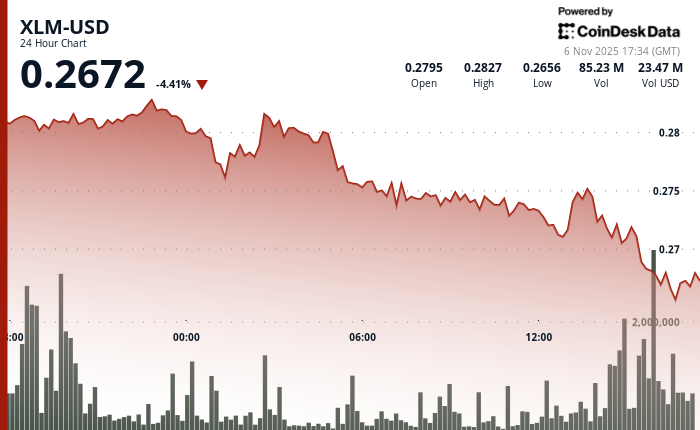

Stellar (XLM), that once-promising star, extended its melancholy slide on Tuesday, falling 2.2% from $0.2789 to $0.2727. Resistance at $0.2815, like a cold-hearted muse, once again capped its upside momentum. The token traded within a $0.0124 range, a mere shadow of its former self, reflecting 4.5% intraday volatility. A series of lower highs, like a chorus of doom, confirmed the prevailing bearish bias. Support, fragile as a whispered promise, remains near $0.2709, bolstered by repeated tests of the psychological $0.27 level. 🕳️

But wait! This might be the moment crypto bros start reciting affirmations in the mirror. Bearish saturation? Sounds like the point where you stop screaming “SELL!” and just start whispering. 🤫