Bitcoin’s Wild Ride: Coinbase Premium Hits the Dirt, But Is the Bottom Near? 🚀💸

Bitcoin tumbled below $100,000 like a drunk man off a barstool, and might revisit its yearly open at $93,500-momentum’s as weak as a politician’s promise. 🥴

Bitcoin tumbled below $100,000 like a drunk man off a barstool, and might revisit its yearly open at $93,500-momentum’s as weak as a politician’s promise. 🥴

So, Mike Novogratz, the CEO of Galaxy (not the chocolate bar, sadly), has some thoughts on the crypto market. Apparently, it’s as sluggish as a Monday morning without coffee. ☕😴 Long-term holders are reallocating assets like they’re Marie Kondo-ing their portfolios. After a wild bull run, everyone’s diversifying because, you know, balance. 🧘♂️ But here’s the kicker: this is actually a good thing in the long run. Short term? It’s like throwing a wet blanket on a party. 🎉💦

SHIB’s been feeling a little adventurous. Despite everyone else plummeting into despair, it’s managed to creep up by a measly 1.77% over the past 24 hours. Oh, the excitement! 🤑

According to a survey by the Alternative Investment Management Association (AIMA) – a group of people who probably wear very expensive glasses and say words like “synergy” a lot – this is an 8% jump from last year. Progress, folks! Or is it just a fancy way of saying they’re chasing the next shiny thing? 🕶️💡

Whale Alert, that trusty watchdog of the blockchain, spotted a transfer of 126,791,448 XRP-enough to make a banker blush. At first glance, it looked like a whale just changed swimming lanes between unknown wallets. But dig a little deeper, and you’ll find both wallets belong to Evernorth Holdings, Ripple’s trusty XRP vault-keeper. 🕵️♂️

As the bears devour everything in their path, even the most optimistic prophets of the crypto world are forced to eat their words. Among them, Merlijn The Trader-oh, that name reeks of expertise and self-assurance-has become a voice of despair, a beacon of resignation. It seems he has thrown in the towel, waving it like a flag of surrender, muttering what we all secretly knew but dared not speak:

In a plot twist that’s more Larry David than Breaking Bad, Keonne Rodriguez, co-founder of the privacy-obsessed Samourai Wallet, is trading his laptop for a prison jumpsuit. Why? Because apparently, helping people keep their Bitcoin transactions private is a no-no when it involves drug lords and scammers. Who knew? 🤔

In a move that makes about as much sense as a plumber recommending you fix your pipes with duct tape, US Federal Reserve Governor Stephen Miran is pushing for a rate cut come December. If that happens, don’t be shocked when investors start eyeing crypto like they’re suddenly allergic to fiat money.

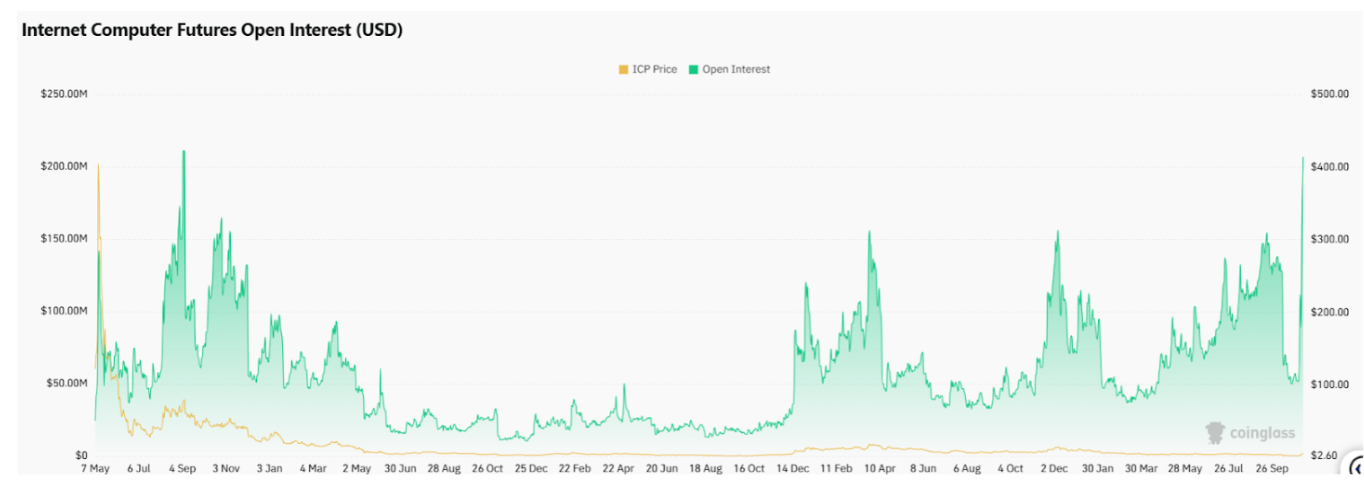

This circus act has flipped Bittensor from the top AI blockchain throne. ICP now struts at $8.56 with a $4.57 billion market cap, climbing into crypto’s top 30 like it’s dodging a swarm of bees. Meanwhile, TAO, the dethroned king, sips tea and mutters about “0.2% volatility.” How quaint. 🤷♂️