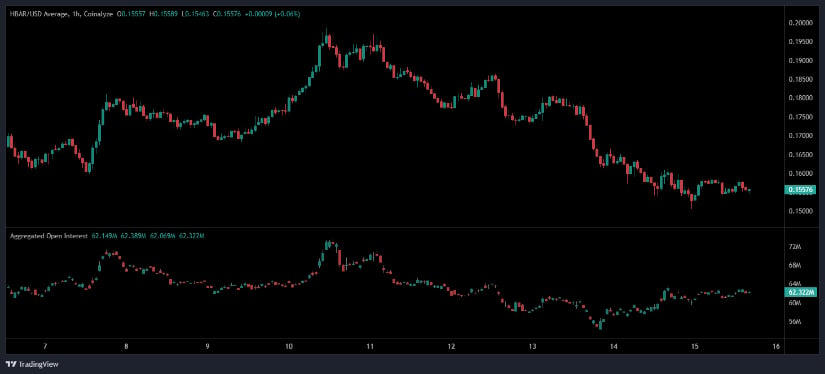

HBAR’s Descent: A Bear Market Ballad 🐻📉

The HBAR/USD 1-hour chart from Coinalyze reveals a price of 0.15631, after a rather dramatic slump from its lofty peak of 0.20000. Recent action has painted a picture of lower highs and lower lows, a bear market ballet if ever there was one. Stabilization near 0.15500-0.16000 is merely a pause for breath, not a grand encore. The price clings to local lows like a toddler to a security blanket. 🧸