jpyxx

jpyxx

Massive UK Crime Network Using Crypto to Fund Russia’s War Effort – 128 Arrests, £25 Million Seized!

In the land of tea and scones, a massive criminal syndicate, spanning 28 UK towns and cities, was busy converting drug trafficking, arms sales, and organized crime profits into cryptocurrency. And guess where those profits were ultimately headed? You guessed it – Russia. Not for caviar or vodka, but to sidestep sanctions and, oh yes, fund a war effort. Who knew, right?

🤑 Fed’s December Dance: Will Crypto Waltz to a 71% Rate Cut Tune? 🎶

This sudden ardor follows the musings of New York Fed President John Williams, who, with a wave of his hand, assured us that a rate cut need not threaten the Fed’s inflationary vows. “Modestly restrictive,” he called the current policy, as if describing a mildly inconvenient rain on a picnic. 🌧️ Tariffs? Mere ripples in the pond of inflation, he says, with the confidence of a man who’s never paid retail. 🛍️

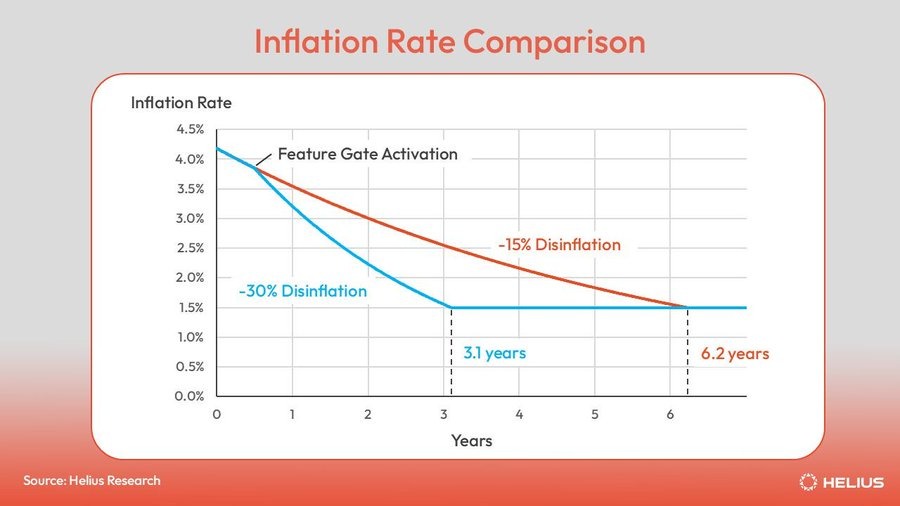

Solana: Soon Too Expensive For You? 😱

So, apparently, getting your hands on some Solana (SOL) might soon require taking out a second mortgage. A group of people who are very clever with computers – developers, they’re called – have put forth a proposal. It\’s a bit like deciding to eat fewer biscuits, but with potentially billions of dollars at stake. They want to drastically reduce how many new SOL tokens are ever made.

Kiyosaki Sells Bitcoin? 🤑 Surgery Centers Over Satoshi?

A modest $27,500 per month, tax-free, beginning in February. Enough to make a tsar blush, though Kiyosaki seems unfazed, his coffers already brimming with the spoils of real estate.

Bitcoin Faces a Bitter Winter: ETF Exodus Hits Crypto Hard

According to Bloomberg-yes, that same Bloomberg-the crypto world had its own version of a “Great Escape.” Investors snatched away nearly $1 billion from Bitcoin ETFs, marking the second-largest daily outflow ever. BlackRock’s IBIT took the lion’s share, with a swift $355 million pulled out, while Grayscale’s GBTC and Fidelity’s FBTC each saw nearly $200 million waltz out the door.

BTC ETFs: A Wild Ride of Wonders & Woes 🚀💸

This transpired amid the underlying asset’s tumultuous tango, which pirouetted between $80,000 and a five-grand rebound, as if the market itself were a fickle lover, alternating between despair and delirium.

Kiyosaki’s Crypto Caper: From Bitcoin to Billboards! 🎭💰

My dear, Kiyosaki insists this isn’t a flirtation with doubt but a strategic sashay toward recurring income. How marvelously pragmatic! 🕺

Oh Look, Crypto’s Next Big Risk-Free Thing…

Strengthening U.S. digital-asset policy seems to be shaping some sort of notion for a clearer crypto framework. At the SIFMA conference,-yeah, I’d rather be at a coffee shop-Jamie Selway from the SEC talked about rebuilding trust and how crypto is apparently getting trendy and fit into the ever-so-evolving market structure. 🙄