jpyxx

jpyxx

XRP ETF Chaos: 21shares Waits for SEC’s Magical Stamp! 🧙♂️💼

The air is crackling with anticipation (and probably a bit of greed) as 21shares US, the crypto wizards, revealed on X (formerly known as Twitter, because why not rename everything?) on Dec. 2 that they’re still waiting for the SEC’s “declaration of effectiveness.” 🧙♂️✨ Sounds like something out of a fantasy novel, doesn’t it? Meanwhile, the internet is ablaze with speculation hotter than a dragon’s sneeze. 🔥

XRP\’s Wild Ride, Bitcoin\’s Brave New Game, and Shiba\’s Slim Hope! 🚀📉

That there’s a spike in XRP Ledger payment activity so wild, it’d make a squirrel jealous after a nut shortage! Up 1,100% – fancy on paper, sure, but when you line it up with the price chart, it’s like tryin’ to balance a chicken on a teacup. The network lit up like Fourth of July fireworks, payment volume and counts sprintin’ to heights last seen when folks were still convinced crypto’d buy us wheelchairs for the moon 🌕. But here’s the rub: activity alone don’t dance a bullish tune, and XRP’s chart’s chillin’ in a descending channel, gettin’ rebuffed by the 20-50 EMA crowd like a infographic at a poetry slam. RSI’s in the low 40s, volume on the green candles flatter than a possum on a flatbed truck – ain’t much to cheer about.

Bank of America Says: “Put 4% in Crypto-What Could Go Wrong? 🤷♀️”

Bank of America (NYSE: BAC), in a move that screams “Fine, we’ll do it, but we’re not happy about it,” has decided its wealth management clients can now sprinkle a delicate 1%-4% of their portfolios into crypto. Because nothing says “trustworthy investment” like an asset class that swings harder than a divorcée’s mood. 💃

XRP is Up 330% Since Trump’s Election, But What is it Really Good For?

After years of bickering with the SEC (the crypto equivalent of a really bad ex), Ripple is finally experiencing some sunshine in the regulatory department. Thanks to Trump being in office (don’t ask why, we’re just going with it), XRP, the altcoin launched by Ripple back in 2012, has been comfortably resting above a $2 price tag – a level we haven’t seen since the Great Blockchain Bull Run of 2017.

ETH’s Price Dance: Will it Waltz to $5,000 or Trip at $2,900? 🤡💸

This past week, Ethereum has dawdled near $3,018, fencing with resistance levels of $3,100-$3,200. Oh, noble analyst “CryptoTrendX,” whose name drips with faux gravitas, proclaims: “A decisive leap above $3,100 may unlock the vaults of $5,000!” One must ask-does this vault require a key, or merely a well-timed gas fee?

How to Make XRP Hit $22 Before the Next Pizza Day

Guy on Earth issued a warning so sharp it’s almost poetic-XRP is basically “hanging on for its dear life.” Talk about a mood. His very cautious forecast is that XRP needs Bitcoin to wake up, stretch, and decide to play nice for a change. Apparently, the entire altcoin neighborhood has been living in stress-induced chaos, waiting for BTC to lead the parade to recovery. Once Bitcoin flexes those digital muscles and the altcoins’ dominance shrinks, XRP might get the chance it desperately needs to make a move. Think of Bitcoin as the party host, and XRP as the guest of honor hoping for a dance-if Bitcoin doesn’t get motivated, XRP will still be stuck in the corner trying to figure out where everyone went. 💃

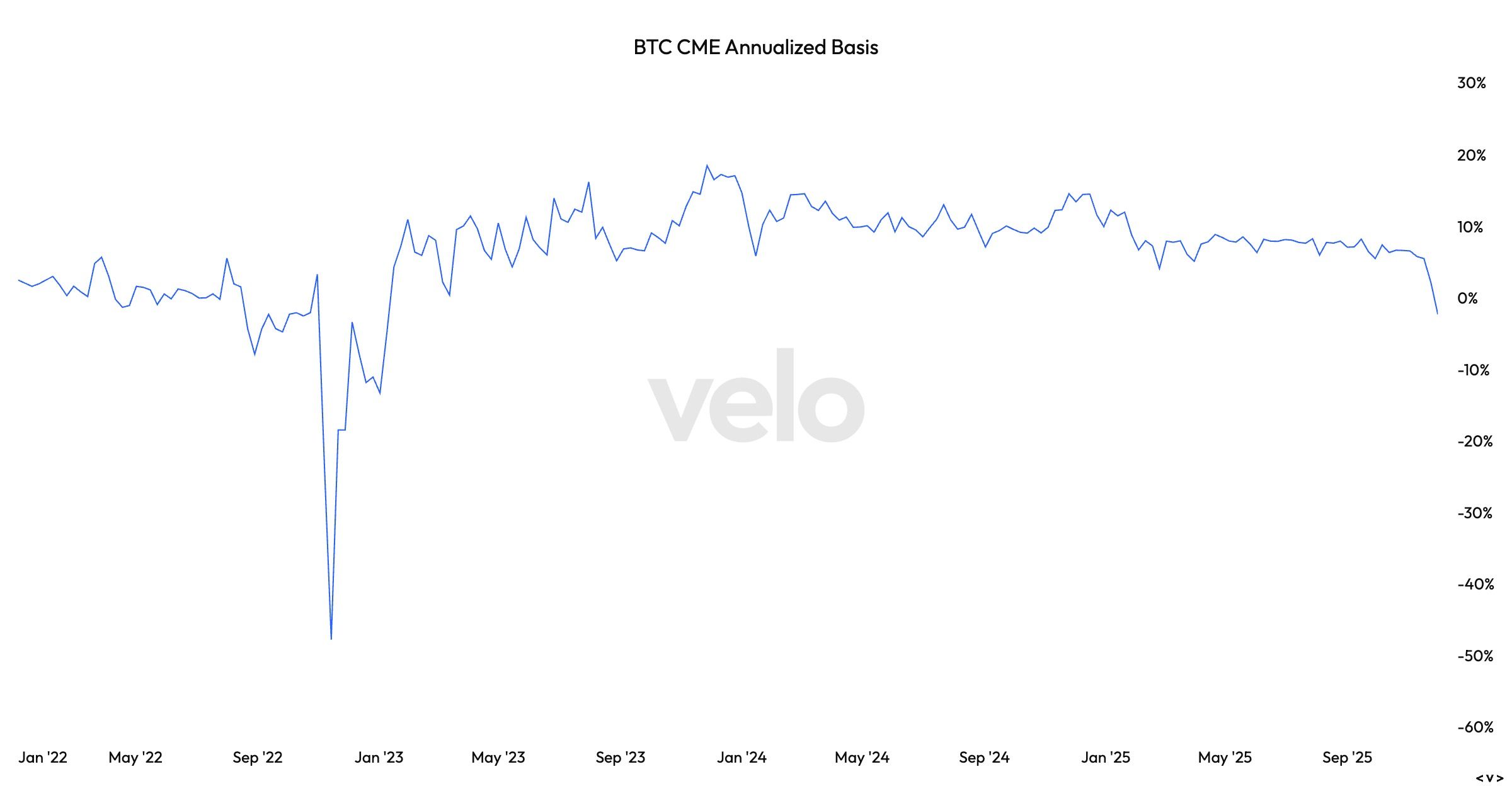

Bitcoin Futures Sink Into a Despair So Deep Even Dostoevsky Would Wink

The CME bitcoin annualised basis has slipped to -2.35%-a quiet but chilling descent,

its deepest backwardation since the chaotic days of the FTX collapse in November 2022,

when the basis flirted with a nightmarish -50%. One might almost hear it whisper,

as if confessing its sins in a dimly lit room. 😐📉

Backwardation, in its cruel simplicity, reveals a futures curve where nearer contracts,

like impatient Dostoevskian protagonists, insist upon higher prices than their distant,

brooding counterparts. The market thus speaks: tomorrow shall be poorer than today.

A sentiment we all relate to at some point, don’t we? 😅

And yet this is a curious condition for bitcoin, a creature that normally walks proudly

in contango-its futures elevated by leverage and the eternal optimism of traders who

believe tomorrow will be brighter… or at least funded.

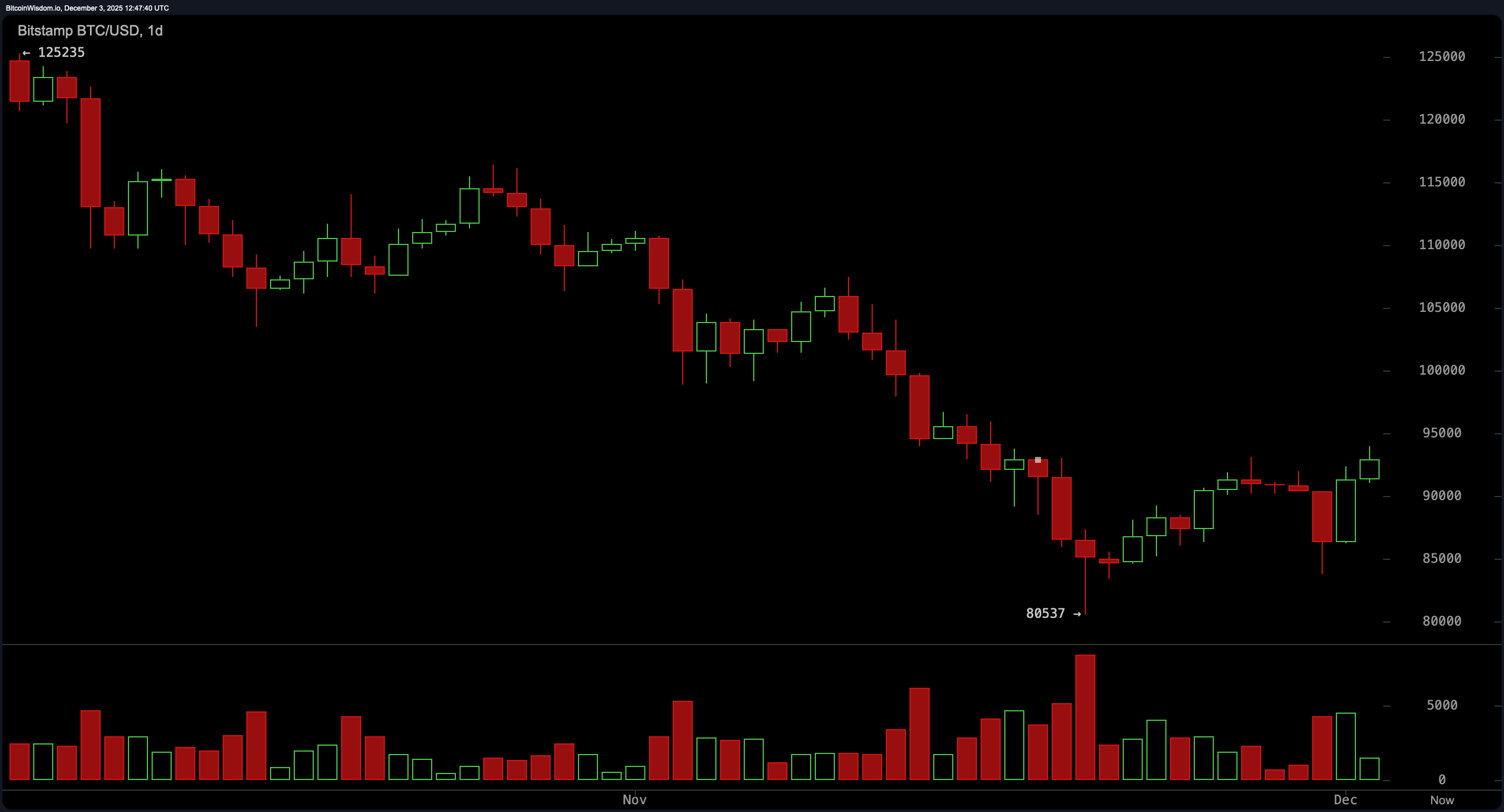

Bitcoin’s Desperate Dance: Can It Escape the Shadow of $95K?

Behold the daily chart: Bitcoin, having clawed back from the $80,537 abyss, now tests the $95,000 threshold-a wall of bricks erected by skeptics. Its V-shaped recovery, though valiant, reeks of desperation. The volume? A surge, yes, but one wonders if it’s the roar of lions or the whimper of mice in wolf suits. 🦊

Is ONDO About to Explode? 120% December Surge Could Be on the Horizon!

So, what’s going on here? Well, ONDO’s price is reacting with all the grace of a dancer who’s just figured out the rhythm of a falling wedge pattern. For the uninitiated, that’s the kind of structure that signals a bullish reversal, which is just fancy talk for “something good is probably coming.” And where does this sweet little support line come from? A spot that’s already fuelled a surge to $2.14 back in March 2024. That’s some sturdy history right there, like a comfy chair you never want to leave. And the best part? This support zone is so on point, it’s almost like it has its own fan club.