Wall Street Wizards Invest in Digital Chocolate Factory 🍫💸

Digital Asset, the wizard behind the curtain of Canton Network (CC), announced this week that four Wall Street titans have decided blockchain is the new black. Or perhaps the new gold? 🤔

Digital Asset, the wizard behind the curtain of Canton Network (CC), announced this week that four Wall Street titans have decided blockchain is the new black. Or perhaps the new gold? 🤔

Starting in 2026, CNBC will have real-time forecasts on “Squawk Box”-because nothing says “financial expertise” like predicting the future with a ticker that’s probably wrong. 🕒💸

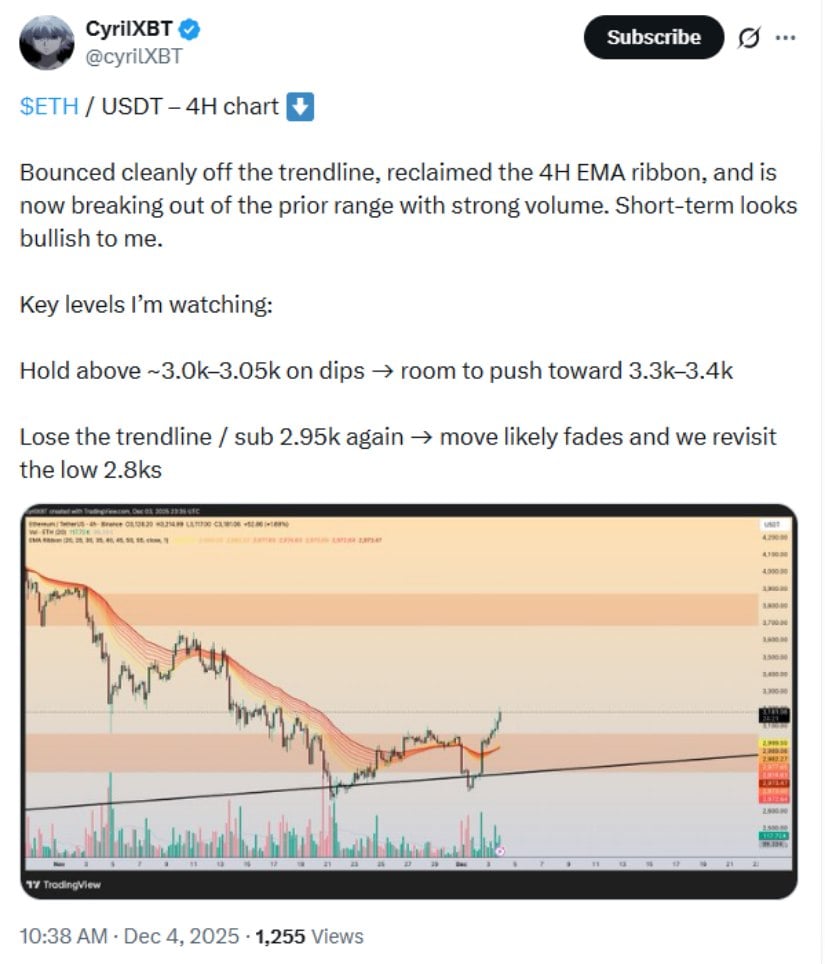

Ethereum (ETH/USD) has been gradually decreasing in value, as shown on its daily price chart. The price is now nearing a “supply zone” between $3,500 and $3,700 – an area where there’s typically more selling than buying, potentially leading to a price pause or drop. A key support level – a price point where the value is likely to bounce back – sits between $2,400 and $2,550, a level that previously helped fuel Ethereum’s price increase.

Under this new regulatory wonderland, companies with a DCM license or DCO designation can now legally offer spot crypto trading. Because why trust anyone without a fancy acronym, right? 🤷♂️

Acting CFTC Chair Caroline D. Pham just dropped a tweet that’s got the crypto community buzzing louder than a Bitcoin ATM at 3 AM. “We’re reclaiming our crypto throne,” she declared. Translation: “We’re about to add 10,000 pages of paperwork to your transactions.” 🧾

After a week of vibes, ETF rumors, and a rare alignment of astrology charts, DOGE’s now at that “ooh, is this a thing?” phase. Retail investors, aka the people who bought $10 of Doge during the Super Bowl, are suddenly financial geniuses. Meanwhile, analysts are squinting at screens like they’re trying to spot Bigfoot in a Walmart parking lot. 🛒👻

It was no triumphal march for bitcoin holders as their precious asset shed value like a molting goose. Yet, even in this financial frost, ancient coins emerged from the shadows, their silence broken after years of hibernation. And while a 50 BTC coinbase reward shuffled in December, not a single coin from 2009 or 2010 stirred-those old geezers must be saving their strength for the apocalypse. 🌋🤷♂️

Total net assets now sit at $906.46 million, which is just $94 million short of a billion. Because nothing says “financial stability” like betting on a asset that’s basically just a blockchain version of Monopoly money. 🎲

So, Bitcoin’s back above $90k? Big whoop. It’s like a yo-yo on steroids. The real drama is the “critical junction” everyone’s hyping up. Spoiler: it’s just a fancy way of saying “hope springs eternal.” But congrats, Darkfost! You’ve managed to make derivatives sound like the most exciting thing since sliced bread. 🤡

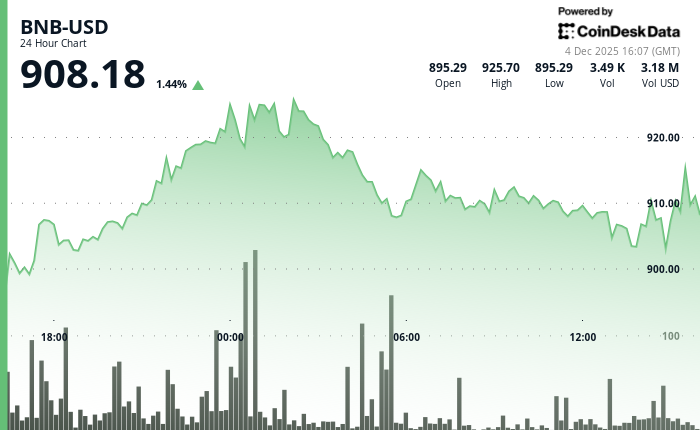

Trading activity for BNB surged 68% above normal, reaching a high of 86,436 transactions in one hour, as the price approached a significant resistance level between $920 and $928, according to analysis from CoinDesk Research.