jpyxx

jpyxx

XRP’s Dramatic Descent: A Tragi-Comedy in Three Charts 🎭📉

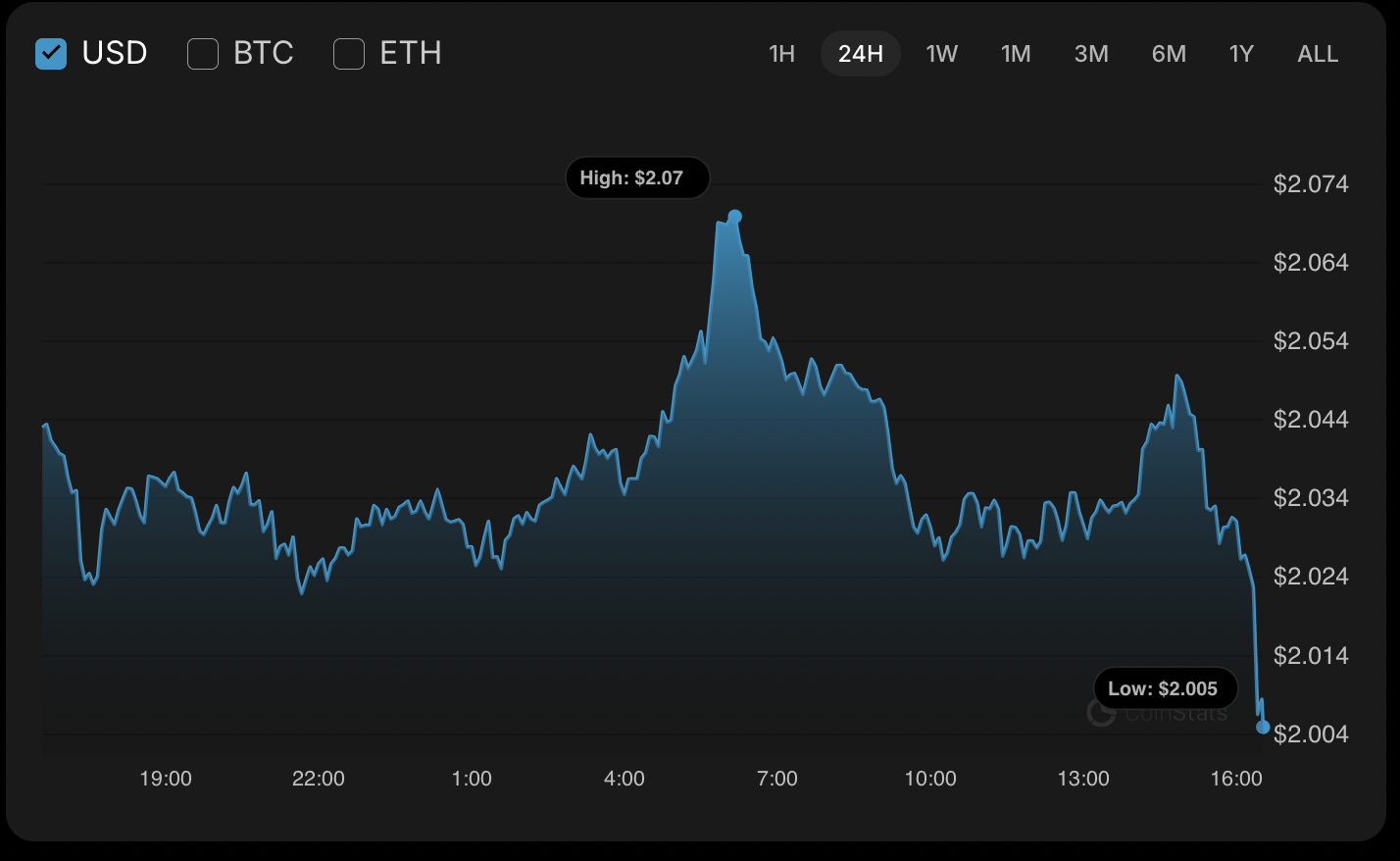

The XRP price, ever the drama queen, has slumped 0.17% in the past 24 hours-a tragedy of Shakespearean proportions 🎭📉.

🤑 Burry Bites Back: ‘You Think Shorts Are Retirement Plans?’ 😏

Back in the halcyon days of 2021, Burry spotted what he called a “textbook parabolic structure” in Bitcoin-a bubble so obvious it could’ve been drawn by a child with a crayon. And sure enough, the thing popped like a soap bubble in a hurricane, first in mid-2021, then with a vengeance in 2022, when it plummeted over 70% from its peak. “See?” Burry might’ve chuckled, “I didn’t need a crystal ball, just a pair of eyes.” 👀

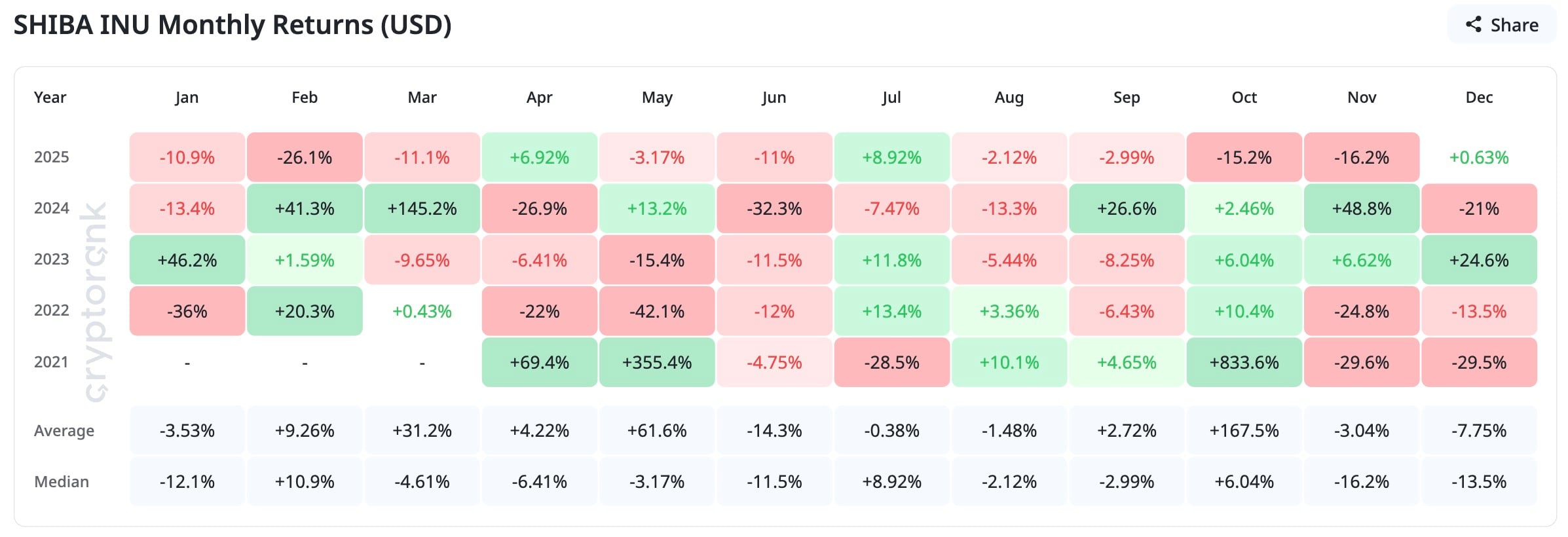

Crypto Circus: SHIB’s Woes, XRP’s Drama & Bitcoin’s Santa Tease 🎪

Expectations gallop ahead like a runaway troika while reality plods behind like a tired postal horse. Sentiment changes more often than a provincial governor’s moods, leaving every bounce as reliable as a promise from a tax collector.

🚨 Solana vs. Base: The Crypto Drama You Didn’t Know You Needed 🚨

In a move that screams “I’m not mad, I’m just disappointed,” Yakovenko threw shade at Base lead Jesse Pollak, claiming cross-chain bridges are less neutral than a Swiss referee in a soccer match. 🏆 According to him, these bridges are just fancy toll booths 🚦 deciding who gets the fees and who’s left holding the bag. 💰

Bitcoin Hits 171 Red Days – A Calm Before the Storm of 2026?

This year seems stuck in neutral, with volatility creeping up like an unexpected guest at the party, while sentiment remains trapped in a deep state of fear. But don’t let that fool you-institutions now hold over a million BTC, forming a sturdy safety net that might just keep things from crashing. Talk about an awkward plot twist.

XRP: Is Everyone Losing Their Minds? 🧐

Indeed, certain members of the XRP community – ever hopeful – view these pronouncements as a signal that the world of sensible finance is at last taking notice. One wonders if they shall be disappointed. Mr. Gayed, you see, is one who concerns himself with risk signals, macro observations, and crafting ideas for investing – activities typically reserved for those beyond the realm of mere speculation.

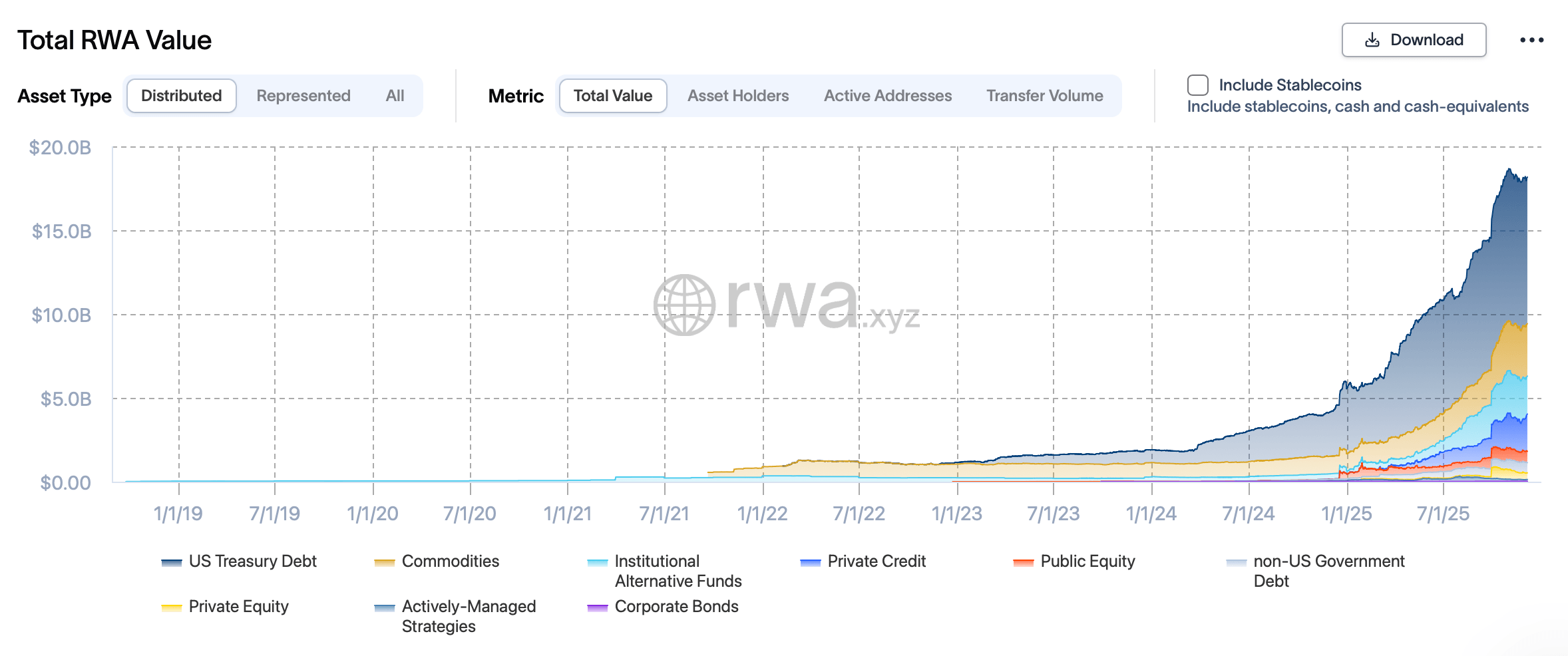

RWAs Take a Nap, But the Party’s Still On! 🎉

These onchain doppelgängers of traditional financial instruments-treasuries, commodities, private credit, and more-have expanded their repertoire, even as their total value took a brief curtsy. But fear not, for the show must go on! From tokenized T-bills to digitized oil, the RWA orchestra is still tuning its instruments, even if the conductor has momentarily lowered his baton.

XRP Suffers Despite Listing: It’s Like Being on a Diet-Exciting at First! 😱

OSL claims you can now do all this fun stuff: make deposits, withdrawals, and trade XRP/HKD, XRP/USD, or XRP/USDT. But only if you’re some kind of finance wizard, not the average Joe. You’ll want to dive deep into their trading rules, because without them, you might as well be searching for where the remote is when it’s actually in your hand the whole time. 🤷♂️

XRP: The Rich Are Secretly Stockpiling!

This news arrives, rather conveniently, just as a glimmer of… hope… flickers around XRP, fueled by those peculiar modern contraptions called ETFs. It seems even the staunchest foes of digital frivolity are now tilting a skeptical eyebrow at the blockchain. A paradigm shift, you say? Pah! More like a desperate scramble for anything that isn’t crumbling government bonds.