Dogecoin’s Descent into Madness 🐕📉: Will it Sink to New Depths or Ride a Shiba-Inu to Recovery?

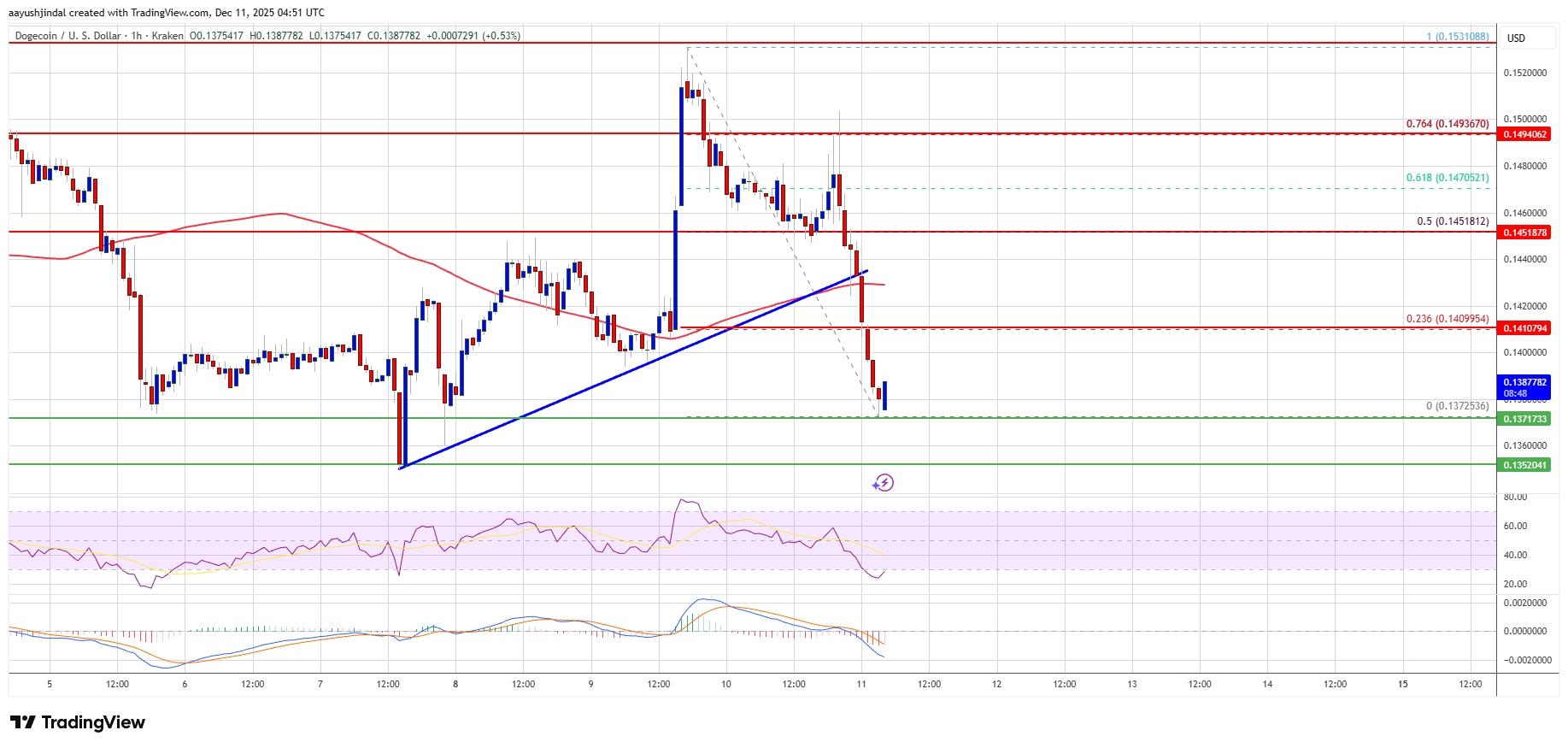

Dogecoin’s price, once a sprightly pup, has morphed into a limping stray. After closing below $0.150 (the crypto equivalent of a broken leash), it slithered past $0.1450 and $0.1420, as if Bitcoin and Ethereum had whispered, “Run, little DOGE, run!”