WhiteFiber Strikes Gold: $865M Deal Proves AI is the New Bitcoin 🤑

Shares jumped 13% in after-hours trading, hitting $16.19, which is basically the financial equivalent of a standing ovation. 👏

Shares jumped 13% in after-hours trading, hitting $16.19, which is basically the financial equivalent of a standing ovation. 👏

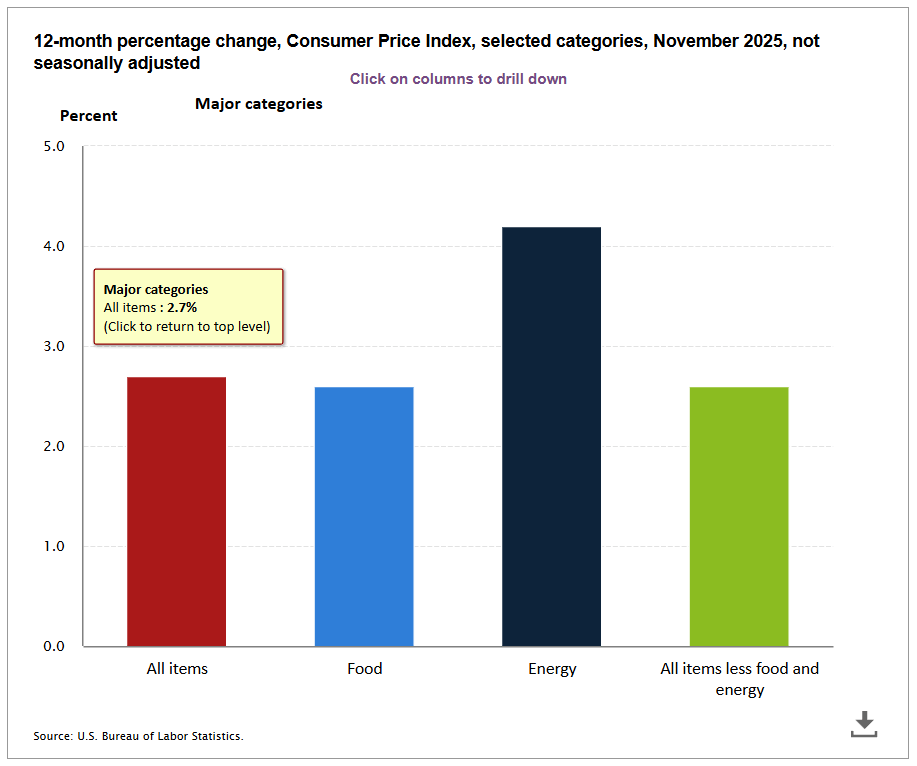

The Bureau of Labor Statistics (BLS) finally dropped its long-awaited Consumer Price Index report on Thursday, revealing that inflation is as cool as a cucumber, and stocks did their happy dance! 📈💃 But Bitcoin? It went up and down like a roller coaster at a carnival, peaking at $89K before plummeting back to $85K. It’s like watching a soap opera-full of drama and absolutely unpredictable! 🎢

Remember those old rules? Like the 2022 letter that made state member banks beg the Fed’s permission before touching crypto, or the 2023 letter that demanded approval for handling dollar tokens? Gone. Kaput. Vanished like a dwarf’s savings in a pub. These rules had smaller banks-especially the uninsured, crypto-loving ones-tied up tighter than a goblin’s purse. Now, they’re free to dance with the Fed accounts and payment systems once more. 💃🕺

Behold, comrades, the Bitcoin market is shedding its old skin, and the signs are as clear as a hangover on a Monday morning. 🍻🤕 The Bitcoin Spent Output Profit Ratio (SOPR) Trend Signal, that trusty old compass of the crypto seas, is pointing south. The rewards from shuffling coins across the network are dwindling, like a pensioner’s savings in a recession. Rapid price swings, once the playground of the nimble trader, now offer little more than a slap on the wrist. 🏃♂️💨

JPMorgan once claimed BTC and gold would ride the debasement train together, projecting $165k for BTC. Spoiler: That train just left the station, and BTC is now stuck in the parking lot. 🚂💨

Behold, the co-founders and co-CEOs of IREN Limited (IREN), a company that, like a phoenix from the ashes of bitcoin mining, has risen to claim its throne at the heart of the AI infrastructure boom. 🦅🔥 From the frigid landscapes of Canada, where it was born in 2018 as a humble renewable energy-powered bitcoin miner, IREN foresaw the true destiny of its endeavors-not in the ephemeral glow of cryptocurrency, but in the boundless expanse of artificial intelligence. Ah, the irony of it all! 😏

Ethereum’s getting scarce on exchanges faster than a pocketbook at a poker table. Per Arab Chain’s report (yes, that market sage with a name like a desert), the ETH supply is shrinking like a puddle in a drought. It’s now at its skinniest since 2016-when folks were still arguing whether “crypto” was a word or a typo. This ain’t just holding; it’s hoarding, folks! Long-term storage’s the new black, and selling? Well, that’s as popular as a flat tire at a car show. 🏦🚀

Earlier this week, while the world was busy with its usual chaos, Coinbase dipped its toes into the vibrant waters of India, receiving a nod from the Competition Commission of India for its audacious plan to acquire a minority stake in the local crypto trading platform CoinDCX. One must applaud such daring ventures-after all, what’s life without a little risk? 🍸

Solana [SOL] memecoins followed closely behind. Launches like Official Trump [TRUMP] and Melania Meme [MELANIA] reinforced Solana’s reputation as the “go-to” network for high-speed, speculative activity. 🇺🇸😂

//cdn.sanity.io/images/s3y3vcno/production/8120f19a9e4ab07a954184d8a19c7b3decd072de-1920×1080.png”/>