Crypto’s Quiet Before the Storm: Will BTC & ETH Break Free? 🌪️💰

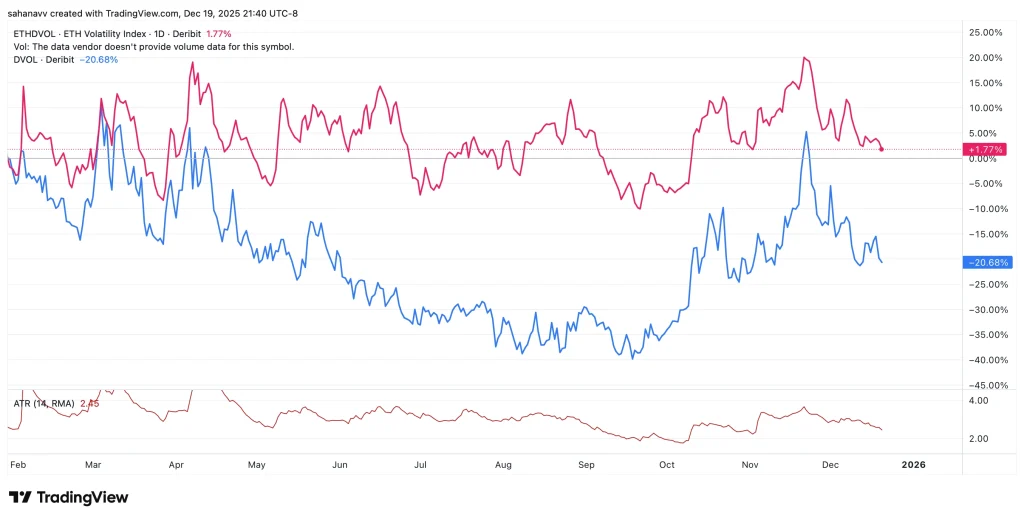

The charts, my dear reader, are as exciting as a sermon on a wet Sunday. Expected price movements for both Bitcoin and Ethereum are shrinking faster than a pair of trousers in a hot wash. Traders, once the daredevils of the financial world, are now expecting moves so small they’d make a snail blush. Daily candles? More like daily naps. The price is stuck in a range so tight, it’s like watching paint dry-but with fewer thrills. 🎨😴