It is a truth universally acknowledged, that a cryptocurrency in possession of a good fortune, must be in want of breaking a four-year trendline. And so it is with Chainlink, whose recent flirtations with a pivotal resistance level have captured the hearts and minds of analysts and investors alike. Should this charming Coin succeed in conquering this formidable barrier, it may well find itself in the enviable position of aiming for the £30 mark, a sum most delightful and significant in the medium term.

Interaction with Long-Term Resistance Level

The current state of Chainlink finds it hovering near a descending trendline, a relic of its past glories. This line, much like the walls of a grand estate, has repeatedly thwarted the aspirations of our dear Coin, serving as a constant reminder of the challenges it faces. Each attempt to breach this barrier has met with a stern rebuke, sending our hero back into a period of consolidation or decline, much to the dismay of its admirers.

However, recent developments suggest that Chainlink may be gathering the courage to challenge this long-standing adversary once more. If successful, this valiant effort could mark a turning point, transforming a bearish narrative into one of renewed optimism. The market, ever the fickle suitor, may then reassess its stance, offering strategic buying opportunities for those with a keen eye and a steady hand. 🌟

Price Movement Supported by Volume and Market Activity

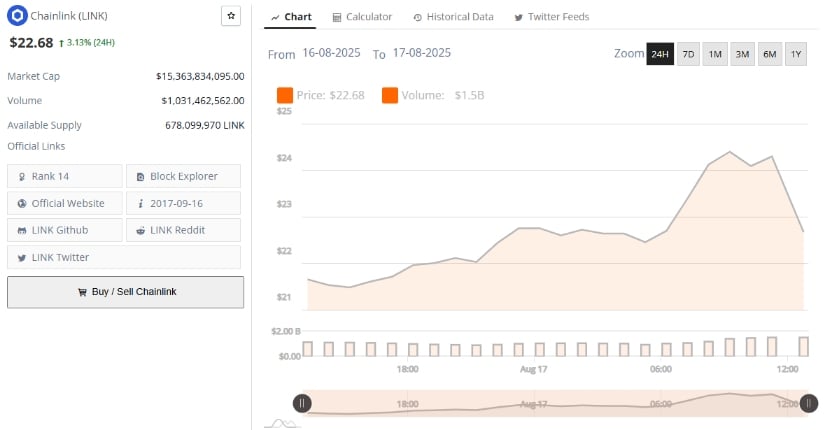

At present, Chainlink trades at the modest sum of £22.68, having experienced a modest but noteworthy 3.13% increase over the last 24 hours. This rise, though not as dramatic as a ballroom dance, is accompanied by a surge in trading volume, a clear indication of heightened market interest and participation.

Volume, in the world of finance, is akin to the applause at a concert; it validates the performance. The increased volume during this uptick suggests that the market is indeed convinced of Chainlink’s potential, lending credence to the idea that this Coin may yet achieve its lofty goals.

The token’s resilience is evident as it holds firm at support levels, gradually building the momentum needed to challenge the £24 resistance. Should it overcome this obstacle, the path to the £30 mark, a psychological milestone of great import, may well be within reach. The steady rise in both price and volume reflects a subtle but significant shift in market sentiment, drawing more traders and investors into the fold.

Technical Momentum Indicators Highlight Bullish Potential

To further understand the current state of affairs, one must turn to the technical momentum indicators, those trusted advisors of the financial realm. The Moving Average Convergence Divergence (MACD), a tool of great repute, has recently displayed a bullish crossover, a sign that the forces of upward momentum are gathering strength. The positive readings on the MACD histogram only serve to reinforce this optimistic outlook, suggesting that the buyers are in the ascendant.

Additionally, the Chaikin Money Flow (CMF) indicator, which measures the flow of capital into or out of an asset, stands at a respectable 0.17. This figure, much like a well-stocked dowry, indicates that more funds are flowing into the token than out, a clear sign of accumulation and investor confidence. A CMF value above 0.10 is generally considered a bullish omen, further supporting the notion that the buying pressure will continue to propel prices higher.

In conclusion, these indicators, when taken together, paint a picture of a cryptocurrency well-positioned to extend its rally. Market participants, wise and discerning, may view any pullbacks to established support levels as opportunities to either build or enter positions, in anticipation of the next chapter in Chainlink’s story. 📈✨

Read More

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- 🚀 Ants Gone Wild: $1.24B Korean Crypto Frenzy During Chuseok! 🤑

- Deutsche Telekom: Now Validating Crypto, Still Not Fixing My Wi-Fi 🤷♂️

- TRX: The Bullish Saga of $0.30 – Will the Whales Save Us? 🐋💰

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- BTC AUD PREDICTION. BTC cryptocurrency

- TRX PREDICTION. TRX cryptocurrency

- Trump’s Crypto Invasion: Blockchain Meets Bollywood Drama! 🎭💰

2025-08-17 23:20