Well, well, well, if it isn’t ARB stirring up some excitement again. After a long period of crawling along the ground like a tortoise with a broken shell, it’s finally returning to a support zone near $0.30. And believe it or not, despite all the pressure pushing it down, buyers have been quietly defending this area like a bunch of stubborn cows protecting their favorite patch of grass. Looks like a good old-fashioned accumulation is happening right under our noses!

ARB Back to Long-Term Support Region

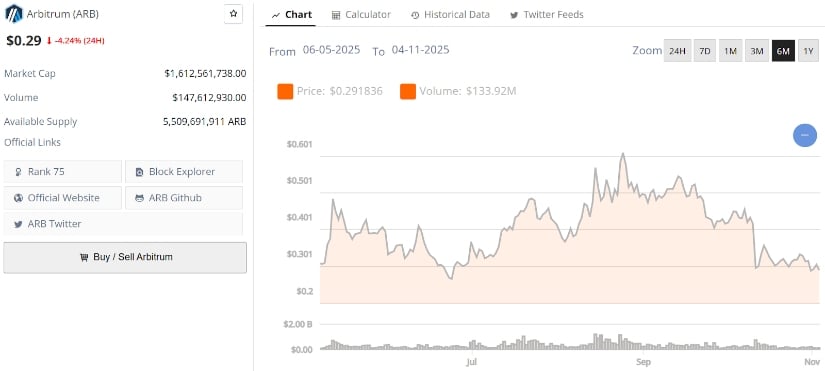

So, Arbitrum has wandered back to its familiar old haunt between $0.28 to $0.30. This spot’s been a loyal friend for rebounds in the past-kind of like that one reliable friend who always shows up to the party, even though they’re a bit rough around the edges. Looking at the last 6 months, ARB’s price action has been more like a slow squeeze, with lower highs that just won’t quit. Yet, every time ARB tests this support, it’s like a chorus of buyers stepping in to say, “Not today, my friend!”

What’s even juicier is the drop in volume, which tells us there’s not much panic selling going on. In fact, it’s more like a bunch of people sitting on the sidelines, quietly thinking, “Hmm, maybe it’s time to start loading up.” As long as this support range holds steady, it’s setting the stage for a comeback, especially if some sneaky accumulation is happening right now.

Fundamentals Underscore Arbitrum’s Undervaluation

Despite trading near its multi-month lows, some bright minds (like Hydraze) are whispering in the shadows that Arbitrum is still one of the strongest Layer-2 ecosystems. We’re talking about solid tech and adoption here, people. With a proven track record and integration across DeFi and gaming, it’s clear that ARB’s current price is not reflecting its true value. They’re basically telling us, “Hey, don’t let the price fool you. This is a bargain!”

That $0.30 mark? It’s not just a random number. It’s being seen as a long-term accumulation zone-especially when you consider how far ARB is from its all-time highs back in January 2024. If you ask analyst Hydraze, it’s all opportunity, no weakness. So, grab your popcorn-this could be one heck of a show.

4H Structure Signals Early Recovery Momentum

If you’ve got a penchant for the technical side of things, then you’ll love this: the 4-hour chart is starting to show signs of life. ARB’s been holding steady above $0.29 to $0.30, like a stubborn mule refusing to move. This is creating a higher-low structure, which could be the first step towards a broader recovery. Think of it like a toddler taking their first steps. Sure, it’s wobbly, but hey, it’s progress.

And here’s the kicker: volume is expanding during minor pullbacks. That’s a sure sign that people are starting to buy in. If ARB can break above $0.32 to $0.33, we could be looking at a short-term push to $0.36 to $0.38. But let’s not get too ahead of ourselves. For this recovery to really kick off, ARB needs to keep its footing above $0.29. No slipping on banana peels, folks!

ARB Price Prediction: Weekly Pattern Points to Reversal Potential

On the weekly chart, things are looking downright juicy. ARB’s been trapped between two descending trendlines since early 2024, forming a classic falling wedge pattern. You know, the kind that’s typically a big “HELLO, BUY ME!” sign for traders. The latest bounce from $0.28 suggests that the lower boundary is holding strong, like an old oak tree weathering the storm.

If ARB can break above that pesky wedge resistance around $0.40 to $0.42, then it could be the start of a mighty surge. Next stop: $0.97. But don’t hold your breath just yet. For now, it’s all about keeping momentum going and not losing steam in the process.

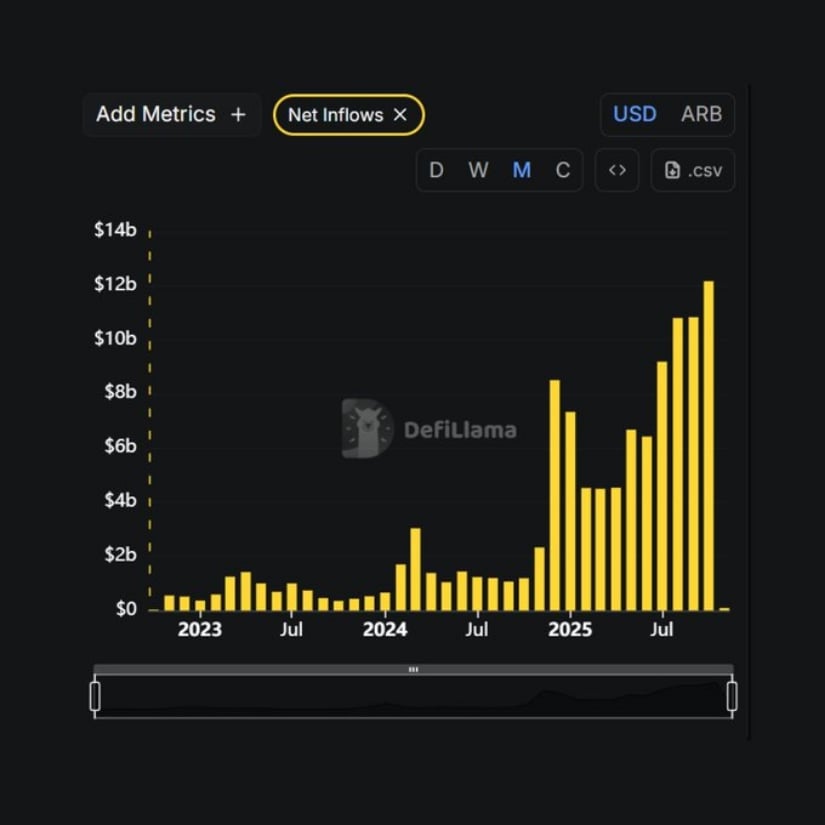

On-Chain Data Confirms ARB’s Renewed Network Strength

Now, let’s talk on-chain data. Marc Shawn Brown-yes, that Marc Shawn Brown-pointed out that Arbitrum’s net inflows hit an all-time high in October. That’s right, folks-strong investor confidence, even with the price feeling like it’s stuck in quicksand. DeFiLlama reports that inflows are surpassing $14 billion, which is one of the biggest surges since the protocol’s inception. It’s like the network is saying, “Don’t mind the price, we’re doing just fine.”

With on-chain trends improving and fundamentals looking solid, it’s clear that ARB’s network strength is in better shape than its price might suggest. If the price starts playing catch-up, we could see a beautiful convergence of the two.

Final Thoughts

So, what’s the deal with ARB? While the market sentiment is still a bit on edge, the technicals and fundamentals are pointing toward some serious resilience. The $0.28 to $0.30 support range continues to attract buyers, and on-chain inflows are strong enough to keep things moving. Several indicators are showing that a recovery is coming-whether you like it or not.

If ARB can reclaim $0.33 to $0.35 with some serious volume behind it, we might just be witnessing the start of a big reversal. Until then, the focus is on holding that support and keeping an eye on liquidity movements across exchanges. So grab your popcorn (again), because Arbitrum is ready to make some noise.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Brent Oil Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Bulls Refuse to Back Down: $107K Double Top? More Like $116K Next Stop!

- SEC Gives Galaxy Digital a Green Light—But Will They Survive Delaware?

- Tokens, Trinkets, and Trials: The Crypto Conundrum Unveiled!

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

2025-11-04 02:00