Bitcoin Community Divided as MicroStrategy’s Latest 10,000 BTC Buy Fails to Move Price – OTC Liquidity and Market Structure Under Scrutiny

Andrew Tate’s post questioning why MicroStrategy’s ~10,000 BTC purchase did not move Bitcoin’s price has triggered widespread debate across the crypto community. The exchange highlights a persistent point of confusion among retail traders: how can a buy of this scale take place without producing a visible market reaction? 🤷♂️

Community Debate Exposes Misunderstanding of Bitcoin OTC Market Depth

Andrew Tate’s discussion comes days after MicroStrategy added more than 10,600 BTC – a purchase worth nearly one billion dollars – taking its total holdings above 660,000 coins. 🧙♂️

Despite the size of the acquisition, Bitcoin barely moved at the time, remaining locked between 88,000 and 92,000 dollars before breaking out only today. 🕰️

I’m huge on BTC but micro strat buy 10k btc ina single day and the price doesn’t move.

Explain that to me.

– Andrew Tate (@Cobratate) December 8, 2025

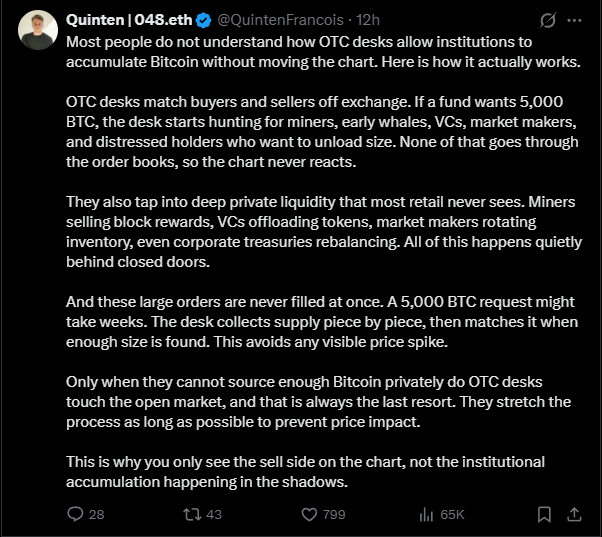

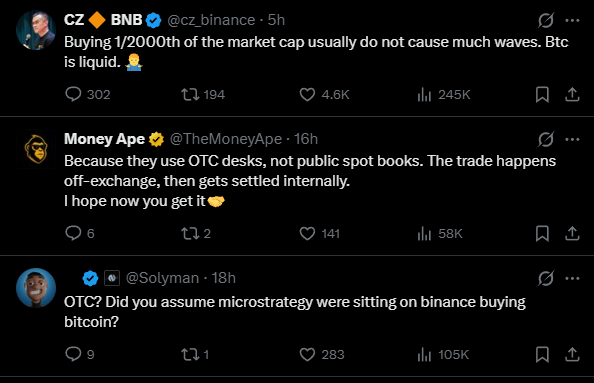

Multiple industry participants responded by pointing out that large institutional purchases rarely execute through spot order books. Instead, they are routed via Over-The-Counter (OTC) desks, which match buyers and sellers off-exchange. 🕵️♂️

Because these trades do not pass through public liquidity pools, they avoid slippage and leave no immediate footprint on candles, charts, or price indices. 🧙♀️

This means a billion-dollar purchase can settle quietly across miners, early wallets, market makers, and distressed sellers without triggering upward movement. 🧨

Only when OTC inventory cannot meet demand do buyers spill into spot exchanges – and that is when prices react. MicroStrategy’s ability to absorb coins privately reflects Bitcoin’s liquidity depth at current supply levels. 📊

Bitcoin Price Movement Depends Less on Size, More on Execution Route

Several analysts highlight that MicroStrategy’s buys may look huge but represent a small fraction of active supply. 🧮

Buying 10,000 BTC is still only ~0.05% of circulating supply, and when sourced through negotiated block trades rather than public spot books, the effect becomes nearly invisible. 🕳️

This illustrates how corporate accumulation can continue even during sideways markets, without retail noticing until after settlement. 🧩

Critics, however, argue that MicroStrategy’s strategy relies on perception more than impact. Some suggest the company’s promotional announcements are designed to create bullish sentiment rather than directly shift price. 🎭

The lack of immediate reaction fuels speculation that headline buys are less influential than investors assume. 🤔

This discussion lands at a moment of heightened sensitivity. The market only broke out today after a week of stagnation – a move driven not by MicroStrategy but by a mix of whale accumulation, short liquidations, and regulatory developments. 🚀

The contrast reinforces a key takeaway: visible price movement often reflects late-stage order flow, not the originating buy itself. 🧠

Read More

- Gold Rate Forecast

- TRX: The Bullish Saga of $0.30 – Will the Whales Save Us? 🐋💰

- Silver Rate Forecast

- TRX PREDICTION. TRX cryptocurrency

- Shiba Inu’s 2024 Rally: A Tale of Resilience and Market Whims 🐶💸

- Bitcoin’s Bold $112K Move – Is It A Breakout Or A Breakdown? Find Out! 💥💸

- ETH PREDICTION. ETH cryptocurrency

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- Is Mellow Finance’s $4.48M Bet on ENA a Genius Move or a Gamble? 🤔💰

- Brent Oil Forecast

2025-12-09 22:02