- “He who watches the markets with patience, like a peasant nurturing a stubborn potato, may soon witness BTC attain fresh heights—a new all-time high, murmured the macro analyst, stroking his beard as if gripping destiny itself.”

- “True MVRV glimmers at 1.7—just shy of the ominous cusp, as if Bitcoin flirts with fortune, not unlike a reckless poet before his muse’s fickle gaze.”

For nearly four days, Bitcoin, like a resolute landowner gazing over his estate, has loitered near $105,000. All await—will Mother Market dispatch a new rally, or merely a withering correction? Even the crows on the telegraph wire seem to debate it.

Meanwhile, a throng of analysts, emboldened by destiny (and possibly strong coffee), are chanting incantations: “$135,000! Nay, $200,000! And all in but three to six months!” They mutter about macroeconomic breezes, the sort that, in Russia, would knock a samovar off the table.

On May 12th, BTC tumbled 4%, collapsing from $105K to $100.7K—an act viewed by many as no more unusual than a Dostoevskian antihero plunging into debt after poor trade decisions (in this case, following the apparent renewal of harmony between those notorious trading partners, the US and China).

Yet Bitcoin, obstinate as a hero in the third act, rallied anew the very next morning, like a lost dog finding its master, on news of less-penned inflation (0.2% month-on-month). This was seen as a subtle nod from the Fates—an inflation rate of 2.3%, lower than the soothsayer’s 2.4% prophecy, has the whole market speculating that perhaps the Federal Reserve, in a rare show of generosity, will finally lower rates in the autumn.

Subdued Inflation, Serene Markets—Shall Bitcoin Waltz Onwards? 💃

David Hernandez, a specialist in the enigmatic alchemy of 21Shares, composed a letter (one imagines by candlelight, perhaps in an unheated Moscow apartment), in which he declared for all to read:

“If this trajectory (easing inflation, nation-state adoption) continues, price targets of $200,000 by year-end now seem increasingly realistic.”

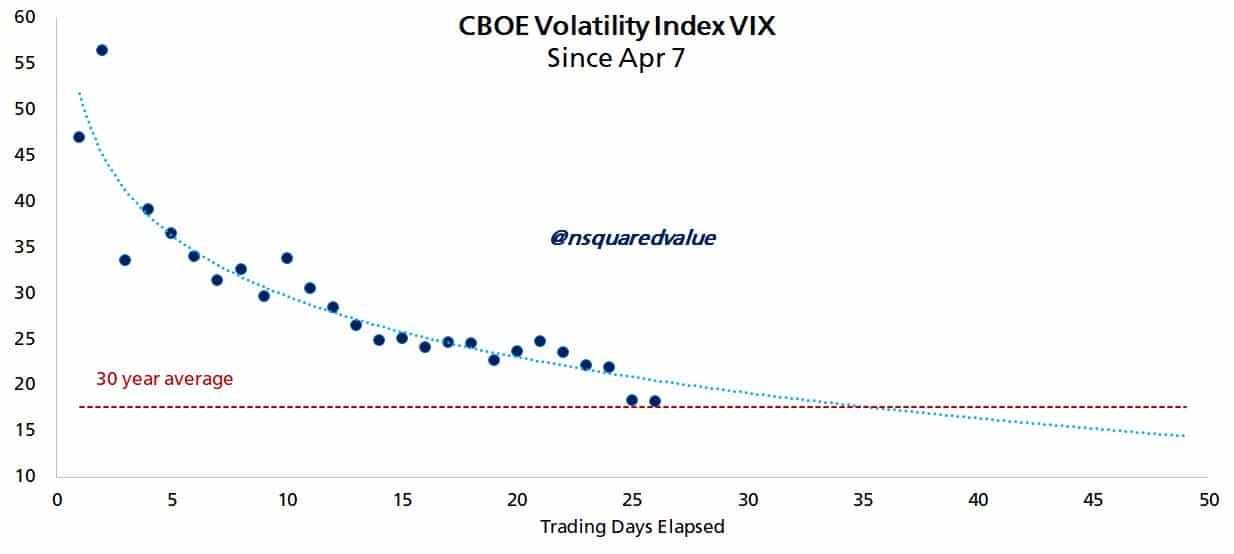

Timothy Peterson, self-appointed network whisperer, peered into the abyss and noted the VIX—a fearful American invention measuring volatility—has slunk quietly to a ‘normal’ 30-year average. This, he claims, coupled with waning inflation, has constructed the perfect ‘risk-on’ stage. Possibly, even Chekhov’s gun would fire at such a prospect.

“Inflation just came in lower than expected. This will be a ‘risk on’ environment for the foreseeable future.”

To the uninitiated, the VIX is as inscrutable as a Russian bureaucrat: it quantifies volatility, and therefore, fear itself. With Sino-American tariffs now a forgotten quarrel, fear has bowed out, and “risk-on” sentiment has swaggered in, umbrella spinning.

Peterson wrote, dreamily, on X: “A dip to VIX 18 may carry Bitcoin to $107K in three weeks, and $135K in a hundred days.” In Russia, of course, one might only predict the next snowfall, but such is the boldness of American financial forecasting.

“A continuation of this path, and VIX <= 18, implies Bitcoin at $107k in 2-3 weeks and $135,000+ in 100 days.”

Could a Night at the Casino Be Smoother? The Road Ahead 🃏

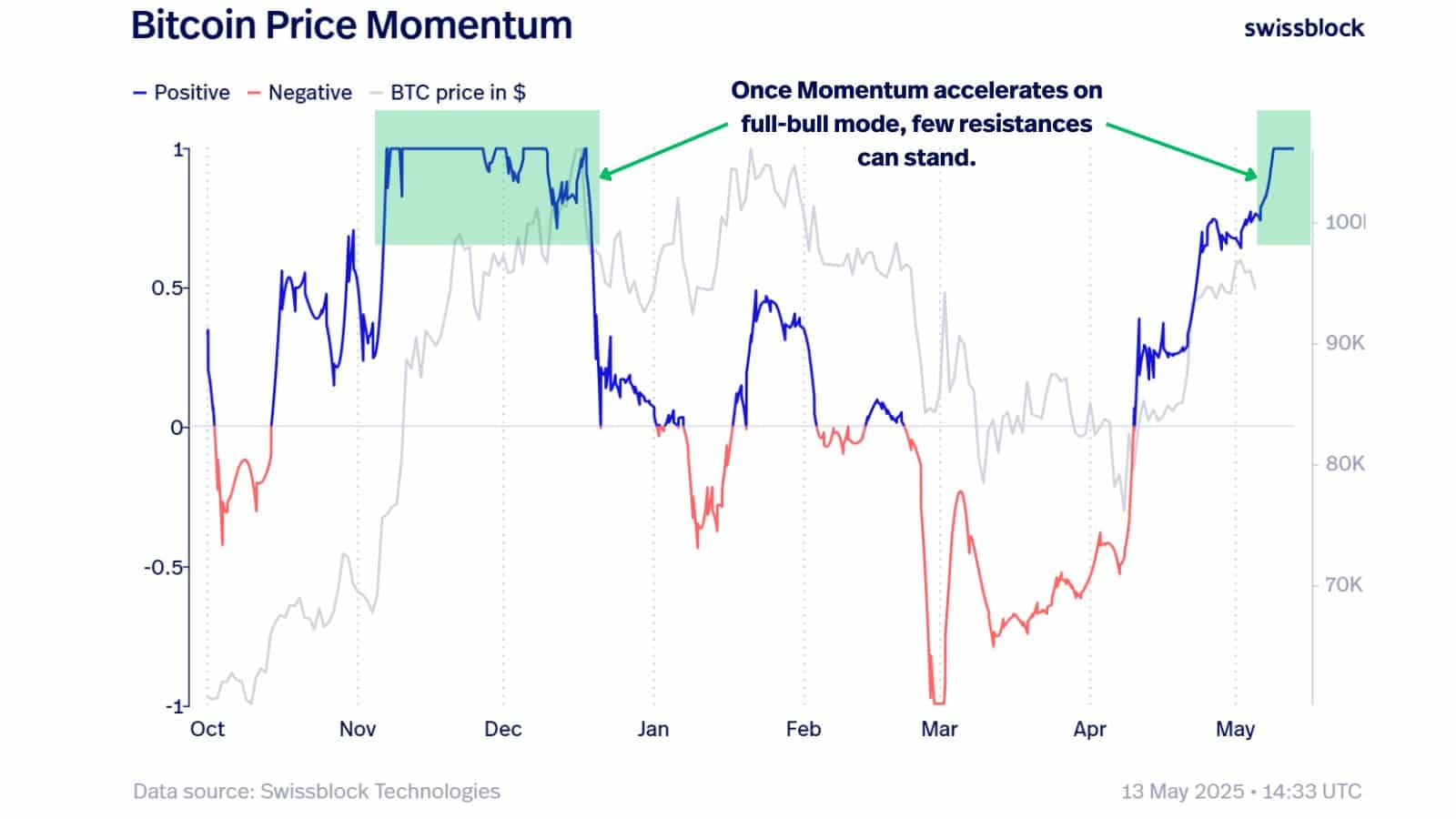

Swissblock, a research contingent more cautious than a chaperone at a Moscow ball, warns us not to clutch our hats just yet. They argue the journey to a fresh all-time high will be more like trudging through February slush, not gliding down a country hill on a troika.

This house of analysis predicts a stumble, a correction between $104K and $106K, before any champagne can be uncorked in earnest.

“Can $BTC push to uncharted territory? A reset could fuel the next leg.”

A chart (complex enough to make Tolstoy weep) testifies: bullish momentum abounds, yet the landscape bears scars from last winter’s rally. Still, not all oracles agree; the True MVRV metric—an arranger of digital fate—suggests the summit is not yet reached.

At 1.7, the MVRV remains tantalizingly shy of the dreaded “2”—implying that, like a restless Russian intellectual, Bitcoin paces the halls, not yet content to rest atop a peak.

Meanwhile, in the options market—where traders plot, scheme, and occasionally duel—positions are taken for both triumph and disaster. Bearish bets cluster around $95,000 (perhaps a wager on misfortune or too much vodka), while optimistic calls crowd around $105K and $115K. In essence: the mob expects a springtime bloom to $115K, but has their umbrella at the ready for a sudden downpour to $95K.

Summing up: the macro-market winds appear fair, risk-on sentiment prevails, and the potential for a new Bitcoin record glimmers on the horizon. Yet, beneath the moonlit optimism, the threat of a dip below $100K lingers—like an uninvited uncle at a country wedding, impossible to entirely dismiss.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- USD THB PREDICTION

- PLUME: 60% Down?! 😱

- When Will the Long Traders Finally Give Up? 🤔

- Silver Rate Forecast

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

2025-05-15 01:25