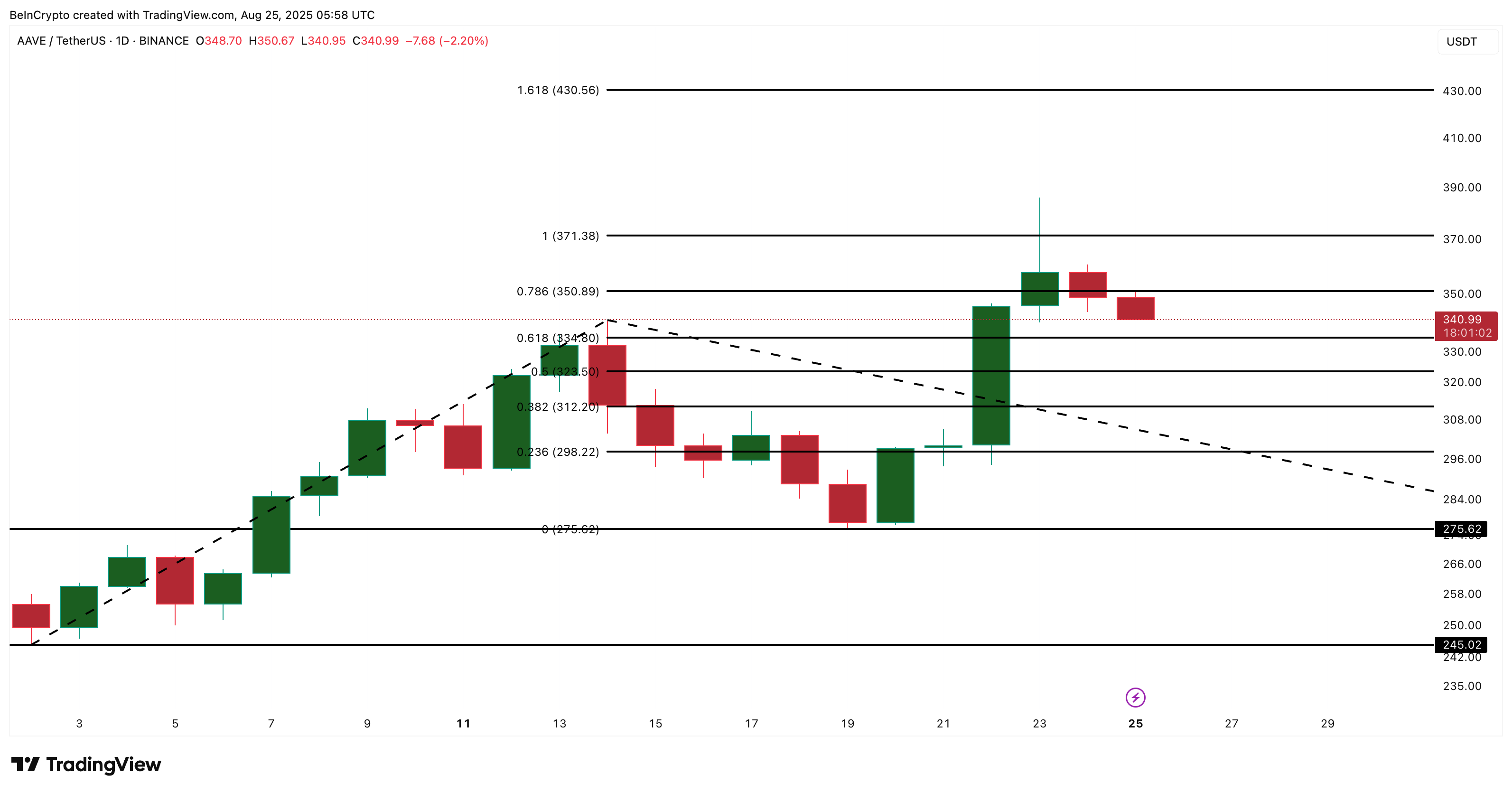

The AAVE price recently decided to throw a mini tantrum, thanks to some spicy rumors about World Liberty Financial (WLFI). Imagine a roller coaster, but instead of excitement, it’s just your portfolio sweating bullets. On August 23, our brave token took a nosedive from $385 to $339-more than 8%. But guess what? That $339 level acted like a stubborn stain-nothing could wipe it out. Who knew support could be so sassy? 😊

While the market was cha-cha-cha-ing with volatility, data hints that the move was more about feelings than facts. AAVE is still eyeing its shiny upper targets, undeterred by the drama. Because nothing screams confidence like whales hoarding more tokens while exchanges slim down – a real membership drive for the deep-pocketed crowd. 🐋

Whales Are Getting Richer and Exchanges Are Clearing Out

Over the last month, exchange reserves of AAVE shrank by 4.33%, leaving about 244,400 tokens feeling a little lonely on trading platforms. At roughly $341 each, that’s around $83.3 million leaving the building – but instead of a fire sale, it looks more like a confidence bath. The whales? Oh, they’re stacking up-up 13.49%, thank you very much. Now holding nearly 19,542 AAVE, worth a cool $790,000. Just a tiny little piggy bank for those guys. 🐷💰

When big wallets scoop up tokens while exchanges get emptier, it’s the market’s way of saying, “I believe in this thing!” Maybe WLFI’s brief stumble was just a hiccup, not the end of the world. Or at least, that’s what the whales seem to think. 🦄

For token TA and market updates: Want more insights that make you sound smarter at parties? Sign up for Harsh Notariya’s Daily Crypto Newsletter. (Your future self will thank you.)

Coins That Are Spending Time and Heatmaps That Know All

Then there’s the “spent coins” metric-think of it as coins’ confessional booth. On August 23, nearly 47,000 AAVE had confessed to being spent. Fast forward, and the number drops to around 15,230. Fancy word for “people holding onto their dinosaurs” – aka, long-term holders aren’t panicking. Probably just watching, waiting for a good excuse to buy more dip.

The heatmap of “who bought what where” shows a cozy cluster around $339. It’s like a neighborhood watch, but with traders. Another cozy spot is at about $272.90-heavy support so deep you’d think it’s hiding in a bunker. More reasons to believe that unless the ground shakes beyond that, AAVE’s structure stays pretty sturdy, like that IKEA bookshelf you probably never assembled right.

Looking Ahead: Targets, Resistances, and Doomsday Levels

August’s been quite the handsome month-started at $244, peaked at $385, for a glorious 58% gain. Despite the WLFI drama, it’s still floating around $340, making a firm “I got this” stance. The next shiny target? About $430, if the stars align and a daily close above $371. It’s like saying, “If only I can survive this weekend’s pizza party.”

But hold on, because if the price slips below $275, packs its bags, and heads south past $272.90-betting on a bearish timeout. Immediate support sits around $334, like a safety net woven by market traders who aren’t ready to give up just yet. Or maybe just tired of scrolling. Either way, AAVE’s attitude remains resilient-probably because it’s looking better than some of those old Christmas sweaters in the back of your closet.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Silver Rate Forecast

- Brent Oil Forecast

- ZK Price: A Comedy of Errors 📉💰

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

2025-08-25 11:51