Bitcoin’s price dropped by 2.6% in the past 24 hours, reaching a low of around $90,600. Congrats, everyone! You’ve officially outdone yourself. Who knew that 2.6% could be the new 10%?

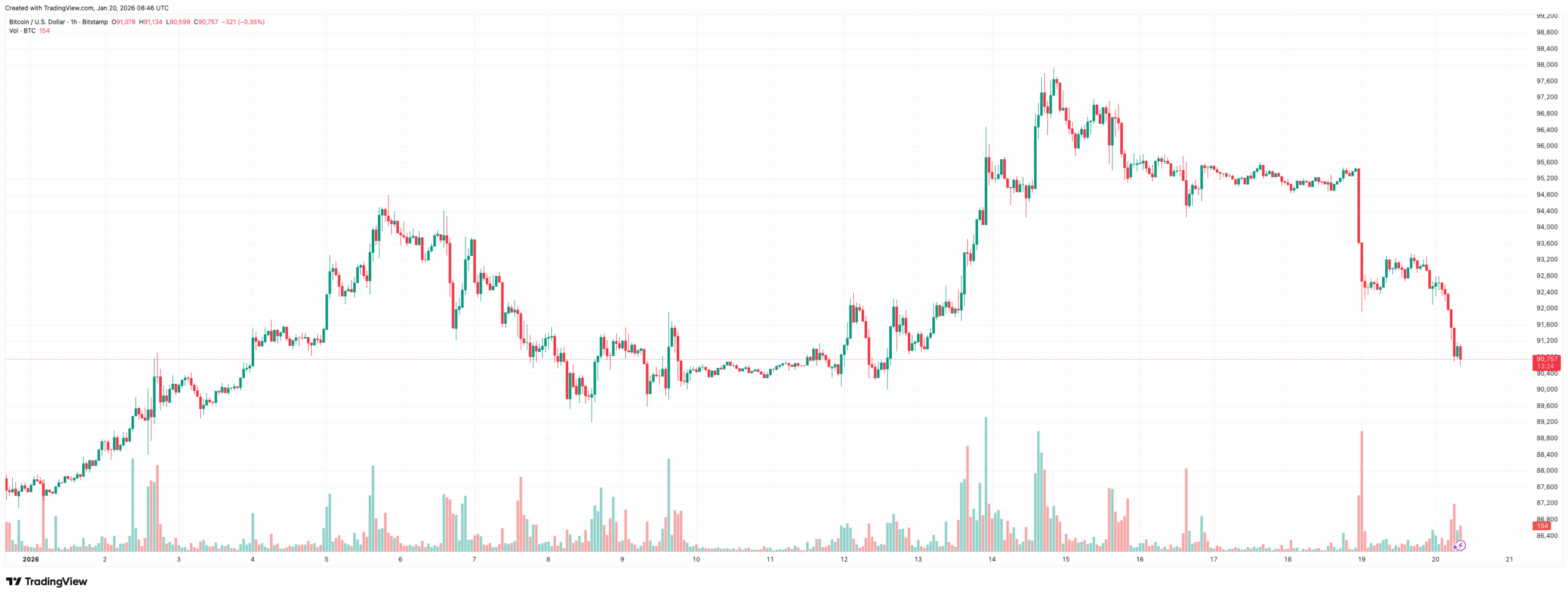

With this, the cryptocurrency has erased all its gains from January 14th and is once again trading at the levels we saw on the 12th, as shown in the chart below. Because nothing says “stability” like a time loop of panic.

The price instability stems mostly from expanding international trade uncertainty, as Donald Trump continues applying pressure regarding Greenland. Oh, right, because no one ever wanted to see a president obsessed with a frozen island that’s basically a giant ice cream cone.

Crypto Markets Suffer

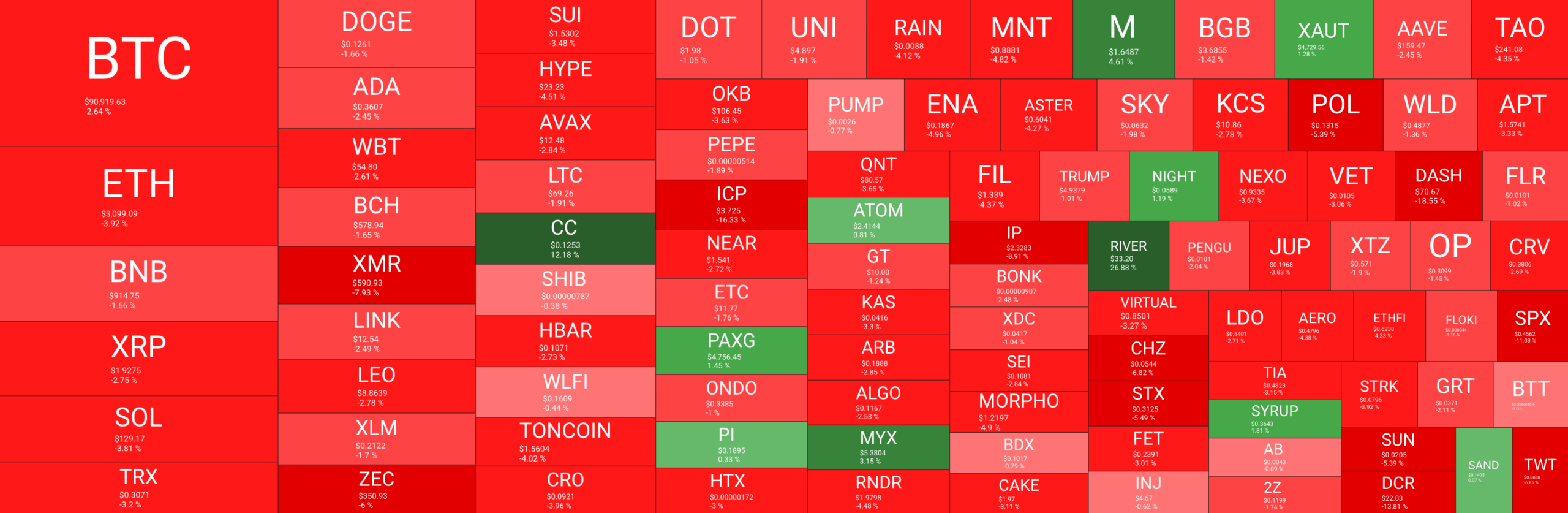

First things first, it’s important to note that Bitcoin is far from the only cryptocurrency in the red today. In fact, out of the top 100 coins by means of total market capitalization, only a handful are trading in the green. Because nothing says “I’m a winner” like being the only one who didn’t lose money in a 24-hour period.

In fact, out of the top 100 coins by means of total market capitalization, only a handful are trading in the green. Ethereum lost 3.5%, XRP is down by almost 3%, SOL declined by 3.7%, TRX by 3.2%, and so forth. It’s like a crypto version of a family reunion-nobody’s happy, and everyone’s arguing about who’s the worst.

The total capitalization is currently $3.16 trillion, with a $109 billion daily trading volume across the board, which is relatively average over the past 3 months. Because nothing says “normal” like a trillion-dollar market that’s basically a high-stakes game of chance.

The market sentiment has returned to “Fear (32),” indicative of the indecisiveness and uncertainty that have gripped the crypto industry over the past few months. Fear, 32? That’s not a number, that’s a warning label.

But Why?

Well, the past 24 hours have been eventful in geopolitics, which seems to be having a direct impact on crypto prices. Bitcoin is widely considered to be a risk-on asset, and investors don’t seem to be feeling too risky right now. This is further evidenced by the rising prices of gold. As we reported earlier, gold prices soared to a new all-time high above $4,700/oz. Because nothing says “I’m safe” like buying a shiny rock that’s basically a symbol of greed.

Just yesterday, the POTUS issued an official White House statement with a threatening tone, suggesting that the US will continue to attempt to establish control over Greenland, an autonomous territory within the Kingdom of Denmark. Because nothing says “diplomacy” like a man who thinks he can conquer a place by yelling at it.

“Denmark cannot protect the land [read: Greenland] from Russian or China, and why do they have a “right of ownership” anyway? There are no written documents, it’s only that a boat landed there hundreds of years ago, but we had boats landing there, also. […] The World is not secure unless we have Complete and Total Control of Greenland.”

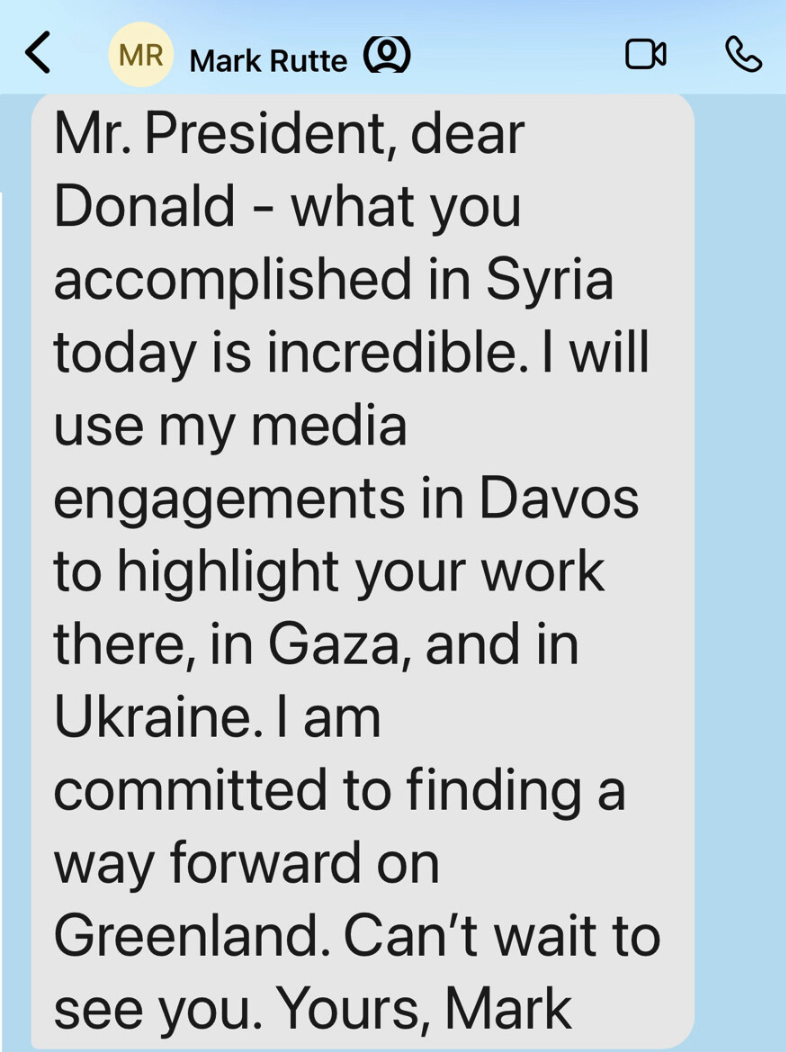

China has responded, urging Trump to stop using them as a “pretext to pursue selfish interest,” while the POTUS himself confirmed that NATO Secretary General Mark Rutte will be meeting with him in Davos. Because nothing says “international cooperation” like a meeting where everyone’s just waiting for the next drama.

So, why the uncertainty? Well, Greenland is part of an official member of the European Union and NATO. The US is downright threatening to take control of the country, and investors are worried of the potential implications this might have on international relationships. The US is also part of NATO, but Trump himself has said that he intends to put US interests “first,” saying:

“I have done more for NATO than any other person since its founding, and now, NATO should do something for the United States.”

He literally posted a picture of himself planting the US flag in Greenland: Because nothing says “I’m a leader” like a man who thinks he can claim a place by sticking a flag in it.

The French president, Emmanuel Macron, has also reached out to Trump, and the uncertainty is more than evident:

“My friend, we are totally in line on Syria. We can do great things on Iran. I do not understand what you are doing on Greenland…” Macron texted.

Because nothing says “friendship” like a leader who’s confused about why another leader is acting like a toddler.

What’s Next?

The Kobeissi Letter has done a step-by-step breakdown of what they think will go down, and so far, it seems to be playing out. According to the analysts, President Trump should soon start posting that they are working toward a solution with the leaders of the countries that were recently targeted by the tariffs. They believe that there will be expedited discussions regarding a trade deal for Greenland, and once announced, markets will hit a new record high. Because nothing says “I’m a genius” like a 2-3 week lead time before tariffs hit.

They believe that the current tariffs are yet to take effect from February 1st, which indicates that:

President Trump’s entire negotiation strategy is centered around timing and pressure. He provides 2-3 weeks of lead time before his tariffs go into effect to allow for a deal to be reached. Trump’s goal is for these tariffs to NEVER actually go live, he wants a deal.

Whether or not this comes to fruition remains to be seen, but if one thing is certain is that turbulent times are ahead of us, so plan accordingly. Because nothing says “prepare” like a president who’s basically a walking drama queen.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Brent Oil Forecast

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- Why Switzerland’s Bank Said “No Thanks” to Bitcoin (And Probably Enjoys Paper Money More)

- EUR MXN PREDICTION

- Bitcoin’s Wild Ride: Is It a Bull or Just a Bump? 🐂💰

- Is FLOKI About to Break the Internet? You Won’t Believe What Happens Next! 🚀

- EUR PHP PREDICTION

2026-01-20 12:44