If Bitcoin had a theme song today, it’d be “The Troika’s Lament” by a drunken balalaika band-because nothing says “momentum” like a horse-drawn cart careening toward a cliff while the driver naps. The asset, having decided $95K is its new favorite number, lounges there like a nobleman avoiding taxes, forming what chartists call a “bullish flag” (or maybe just a napkin doodle). The market’s pulse? Steady enough to host a tea party, but with firecrackers in the punch bowl.

Bitcoin Chart Outlook: A Tale of Three Timeframes

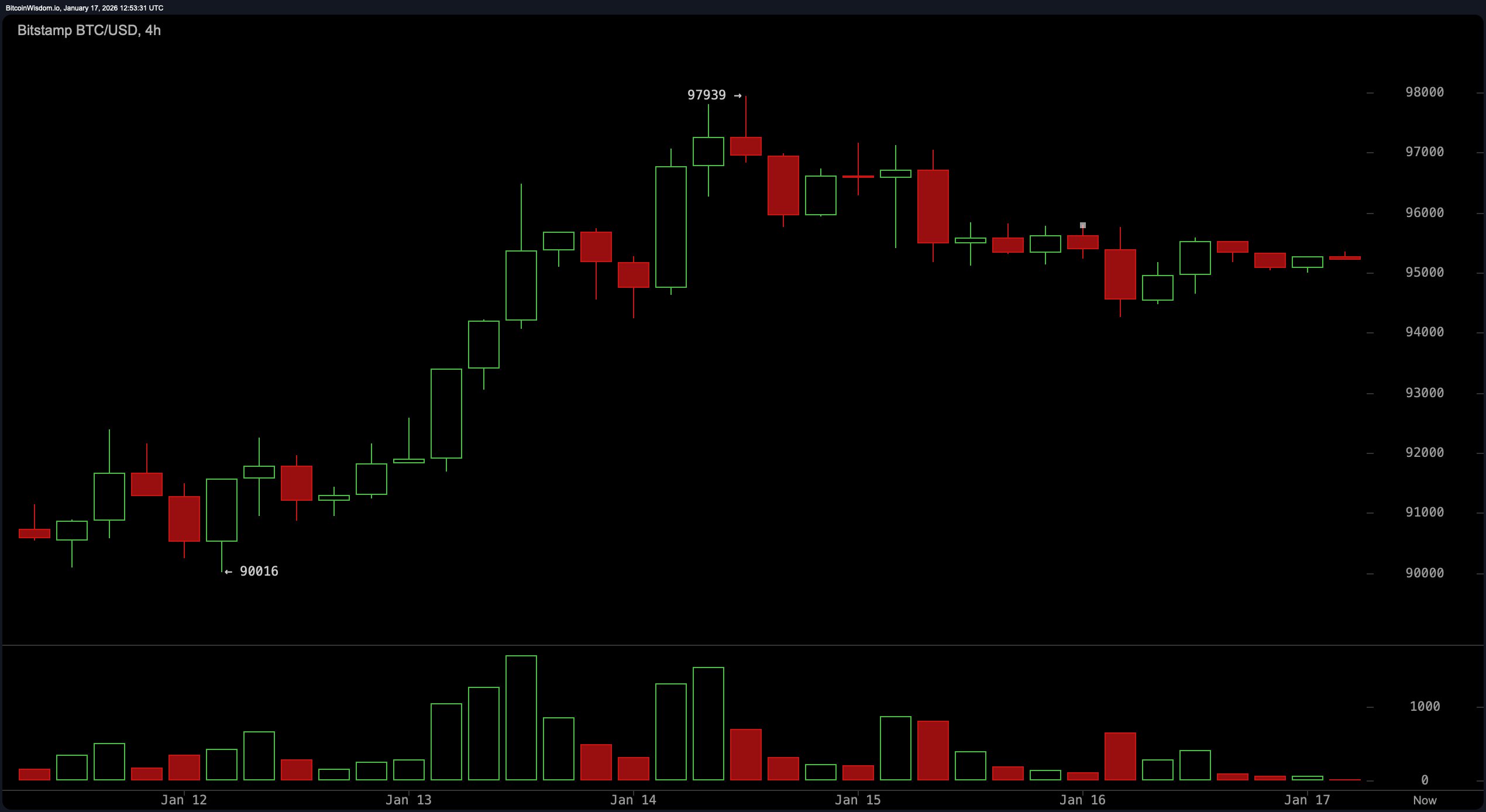

Behold the daily chart, where Bitcoin struts its stuff like a merchant hawking “authentic” Persian rugs at a flea market. It’s propped itself above $95K, building an uptrend since its “oh no, $84K!” panic-though a recent dip to $97,939 left it slightly winded. Volume? It spiked like a drunk uncle’s wedding toast, then fizzled into awkward silence. A classic “buy the rumor, sell the news” play, or just the market’s way of saying, “Hold my kvass”?

The technicals whisper: “Breakout ahead!” But first, Bitcoin must either bounce off $91K-$92K like a goat on a trampoline or bulldoze through $98K with the grace of a drunken bear. No pressure.

Zoom into the 4-hour chart, and Bitcoin’s a cat pacing in front of a closed door-$94K-$96.5K, the purr-fect trap. Lower highs? Sure. But buyers cling to $94K like a child to a candy wrapper. Volume? Declining, which either means “accumulation” (read: stealthy billionaires) or “distribution” (read: stealthy billionaires cashing out). Either way, 🎩🕵️♂️.

The 1-hour chart? Bitcoin’s power nap, stuck in a $94.5K-$95.5K purgatory. Volume’s lower than a peasant’s expectations at a tsar’s feast. Break above $95.5K with gusto, and it’s off to $96.5K! Drop below $94.25K, and we’re looking at a “healthy correction” (read: panic selling). 🧐

Oscillators? More confused than a tourist in a dacha. RSI at 62 (neutral), Stochastic at 72 (meh), CCI at 108 (overbought), but MACD struts in at 1,547 like a peacock in a chicken coop. Conclusion: Bitcoin’s a 🤹♀️ juggling plates labeled “Bull,” “Bear,” and “Meh.”

Moving averages? A family feud. Short-term EMAs cheer, “Go, go, go!” while the 100-day and 200-day SMAs mutter, “Back in my day…” like grumpy uncles. The trend’s bullish-if you squint and ignore the ghosts of volatility past.

Bull Verdict:

If Bitcoin holds $94K like a tsar clings to his crown and smashes $98K with the vigor of a vodka-fueled Cossack, the bulls throw a party. Momentum’s already there, humming “If You’re Happy and You Know It.” 🎉

Bear Verdict:

Drop below $94K, and the bears host a “controlled descent” (read: dumpster fire). Long-term MAs side-eye the rally, and overbought CCI giggles like a trickster. Cue the “I told you so” chorus. 🐻

FAQ ❓ (Because Even Speculators Need a Napkin Sketch)

- Bitcoin’s current price?

$95,222. Because 2026 called-it wants its drama back. - Key levels?

Support at $94K (the “don’t panic” line), resistance at $96.5K-$98K (the “get rich or die trying” zone). - Bull or Bear?

Bullish long-term, neutral short-term. Bitcoin’s mood today: neither here nor there, like a bureaucrat avoiding responsibility. - Indicators?

MACD’s hype, MAs argue. The market’s a 🤹♀️ juggling a bear, a bull, and a potato.

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Brent Oil Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- SEC’s Jenga Tower: Crenshaw Calls Out Crypto Chaos! 🎲💥

- Vitalik Buterin’s Modexp Meltdown: The ZK Drama You Didn’t See Coming 🚀

- Ukraine’s Bitcoin Myth: The 46,000 BTC Mirage! 🚀🤡

2026-01-17 18:15