Hot damn, folks! Gold and silver are having a moment-like, a seriously expensive moment. Gold’s flexing at $4,640 per ounce, and silver’s like, “Hold my beer,” hitting a lifetime high of $92. Why? Oh, just the usual: geopolitical drama, the Fed’s midlife crisis, and supply shortages that make toilet paper in 2020 look abundant. 🌍💸

Gold’s Glow-Up Continues as Silver Goes Ghost 👻

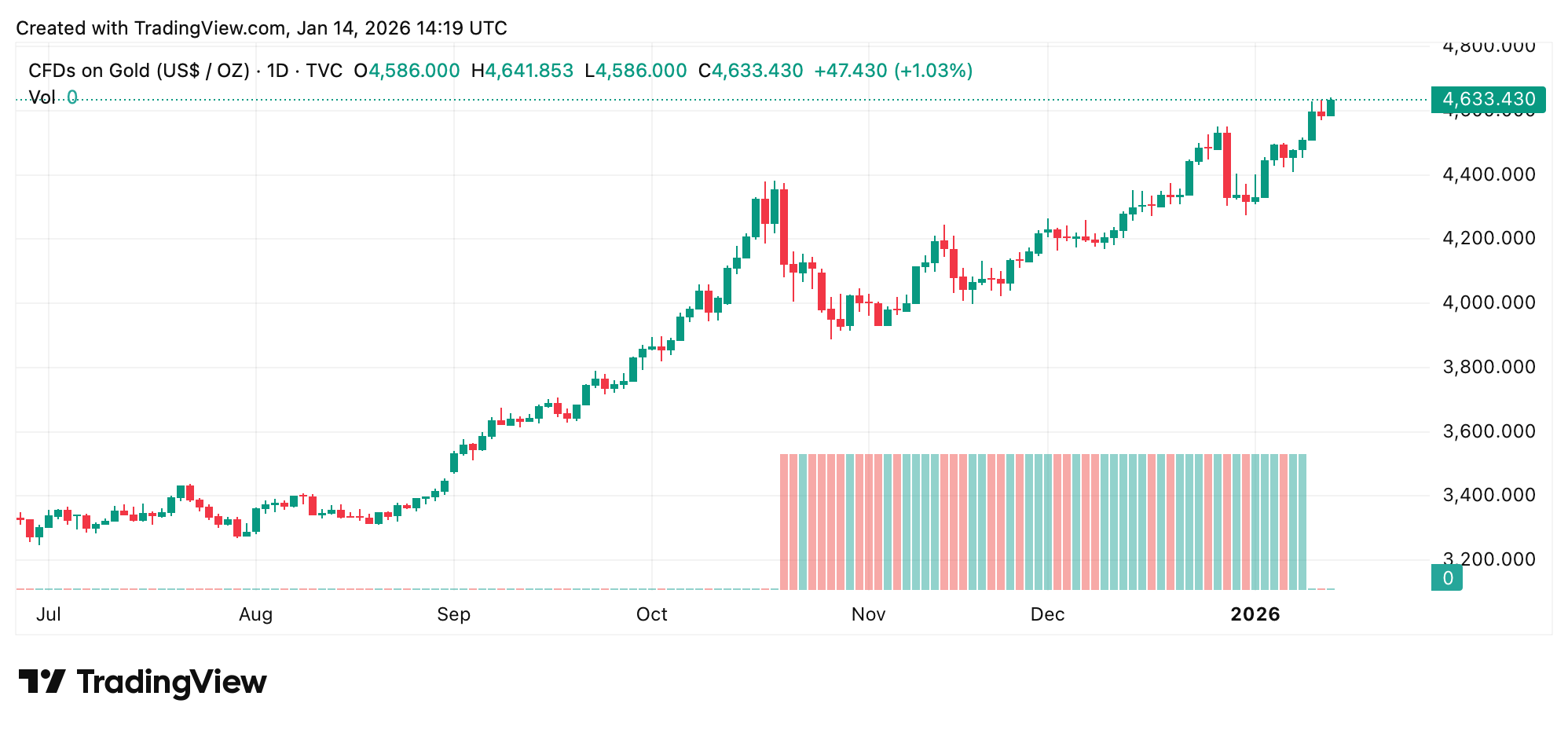

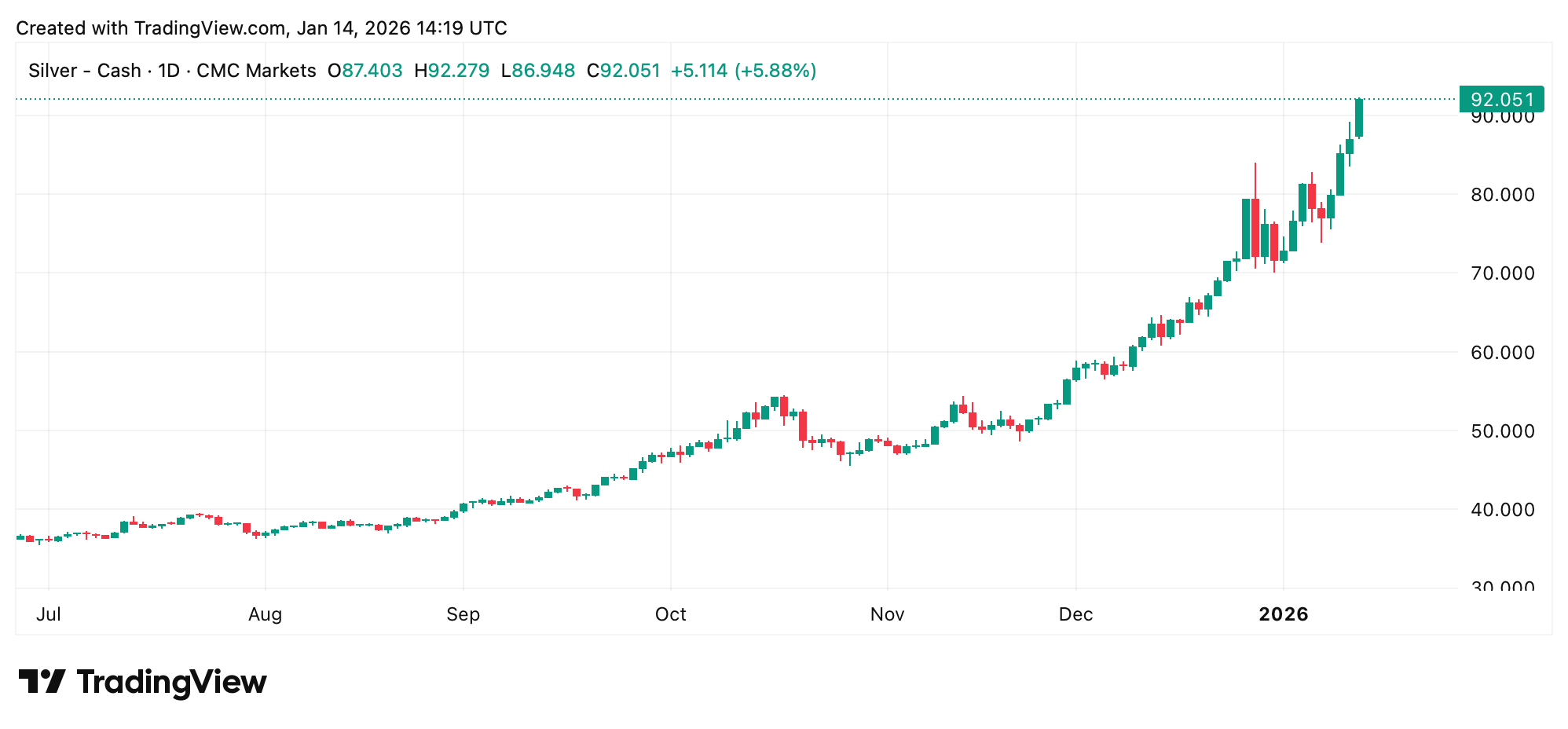

As of Wednesday, Jan. 14, 2025, gold’s chilling at $4,631, and silver’s at $91.45. Gold’s up 0.98% because it’s fancy like that, and silver’s like, “I’m not just a pretty face,” climbing 5.4%. 💃💰

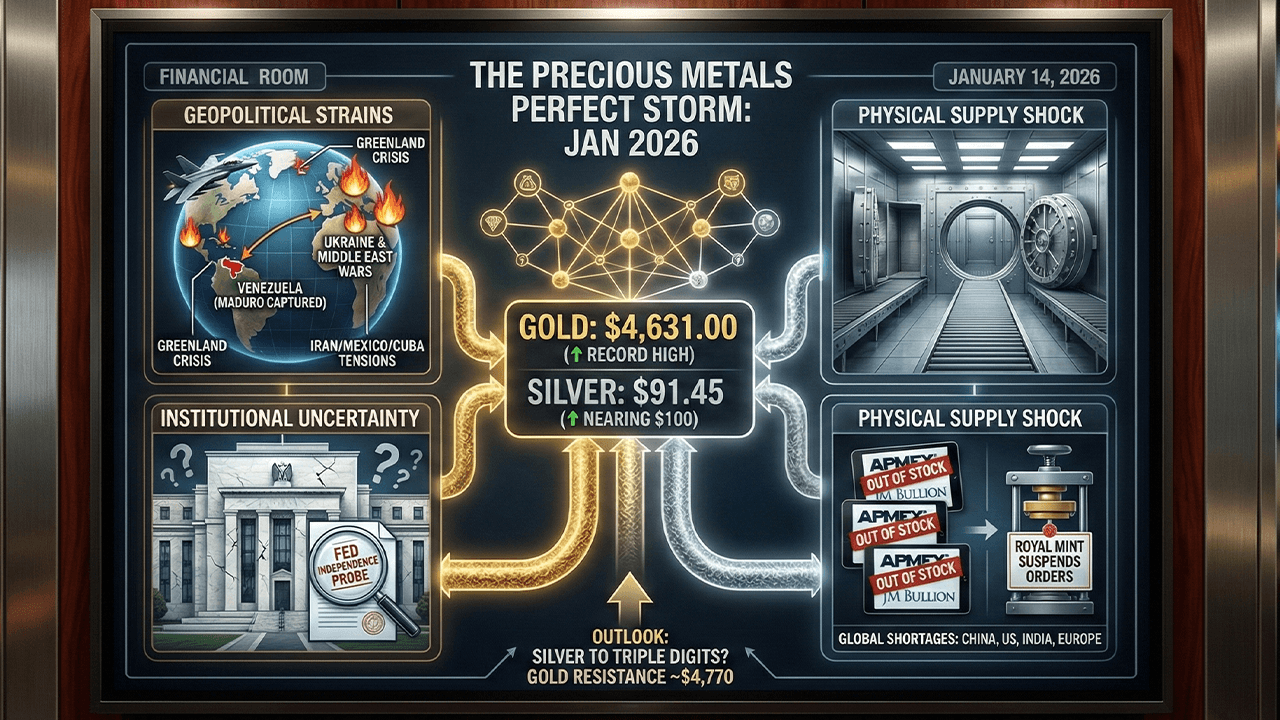

So, what’s behind this shiny spectacle? Analysts are blaming-I mean, crediting-geopolitical tremors (thanks, 2026, for being wild 🌋), the Fed’s renovation budget drama (seriously, who spends $2.5 billion on curtains?), and supply shortages that make silver look like a unicorn. 🦄

The World Gold Council (WGC) dropped a report saying gold’s riding these shockwaves like a boss. “Geopolitical spikes? More like geopolitical spikes,” they quipped. And when these spikes become frequent, gold’s like, “Risk premia? I’ll take it.” 🛡️

“And when usually short-lived geopolitical spikes become frequent, they start to embed higher risk premia, benefiting gold.”

Meanwhile, the Fed’s independence is under the microscope, and silver’s like, “I’m here for the chaos.” Central bank turmoil? Check. Diplomatic flashpoints? Double check. Safe-haven demand? Off the charts. 🚀

Oh, and let’s not forget the U.S. military’s Venezuela intervention (Maduro’s out, polymarket bets are in), threats to Mexico and Cuba (classic 2026 energy), and the Greenland crisis (because why not?). 🌎🔥

Silver’s not just a side piece-it’s the main event. With shortages in China, the U.S., India, Japan, the Middle East, and Europe, it’s like silver’s playing hard to get. The U.S. Mint’s delayed releases? Cute. The U.K.’s Royal Mint suspending orders? Iconic. Major dealers like APMEX and JM Bullion? Sold out faster than concert tickets. 🎟️

Forecasters are like, “Silver, you’re so close to triple digits, I can taste it.” But gold’s like, “Hold up, I’ve got resistance at $4,770.” Drama queens, both of them. 👑

So, what’s the takeaway? Precious metals are having a moment, and it’s not just about price tags. It’s political risk, institutional uncertainty, and supply chains that make 2020 look like a walk in the park. Gold’s the hedge, silver’s the wildcard, and 2026? It’s a wild ride. Buckle up. 🎢

FAQ ❓

- Why’s gold so extra in 2026? Geopolitical drama, Fed shenanigans, and supply issues. Basically, the world’s a mess, and gold’s like, “I’m here for it.” 🌍💅

- Why’s silver almost at $100? Shortages, demand, and sellouts. Silver’s the hot ticket everyone wants but can’t find. 🦄

- Where’s silver gone missing? Everywhere. China, the U.S., India, Japan, the Middle East, Europe. It’s like a global game of hide-and-seek. 🌏

- What’s next for gold and silver? Gold’s got resistance at $4,770, and silver’s eyeing triple digits. Stay tuned, folks-this is better than a soap opera. 🎬

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Silver Rate Forecast

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- BTC Plummets: ETFs & Risk Aversion Send Crypto into Crisis 🚨

2026-01-14 18:38