In the grand tradition of speculative manias, the cryptocurrency market has once again proven that it is a place where logic goes to die. The meme coin sector, that most absurd of financial subcultures, has taken center stage, with Shiba Inu (SHIB) leaping 15% in a week. One might ask, “Is this a rally or a farcical leap into the void?” The answer, as ever, is both.

Just hours ago, SHIB flirted with the lofty height of $0.00000935-a price so infinitesimal it could fit in a teacup and still have room for a biscuit. This minor triumph was achieved thanks to the meme coin renaissance, a phenomenon where $50 billion is spent on digital barks and wagging tails. The resurgence of the token-burning program-now dubbed “token incineration”-has also provided a spark, though one suspects the real magic lies in the sheer audacity of the numbers involved.

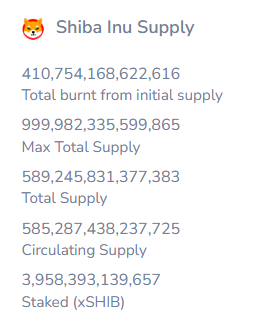

The burning program, a noble endeavor if ever there was one, saw 195 million tokens vaporized in a week-a 531% increase from the previous week. To put this into perspective, if you burned 195 million pounds of actual dog biscuits, you’d need a fire big enough to roast a small village. The circulating supply now stands at 585.28 trillion SHIBs, a figure so large it makes “a lot” seem quaint.

Analysts, those modern-day soothsayers, are already busy with their crystal balls and spreadsheets. X user JAVON MARKS, a self-styled crypto oracle, claims SHIB could “pump” 246% to $0.000032. Meanwhile, CryptoPulse, a firm that may or may not be run by a single person in a basement, predicts a rise to $0.0000100-$0.0000112. One wonders if they’ve considered the possibility of gravity-or perhaps the laws of arithmetic.

Alice Crypto, another X luminary, declared a “successful breakout” with “good volume,” a phrase that sounds impressive until you realize “volume” here means “not zero.” She forecasts a 70% gain, which, if true, would make her the first analyst to predict a rise in something that costs less than a cup of coffee.

The Bears Might Return

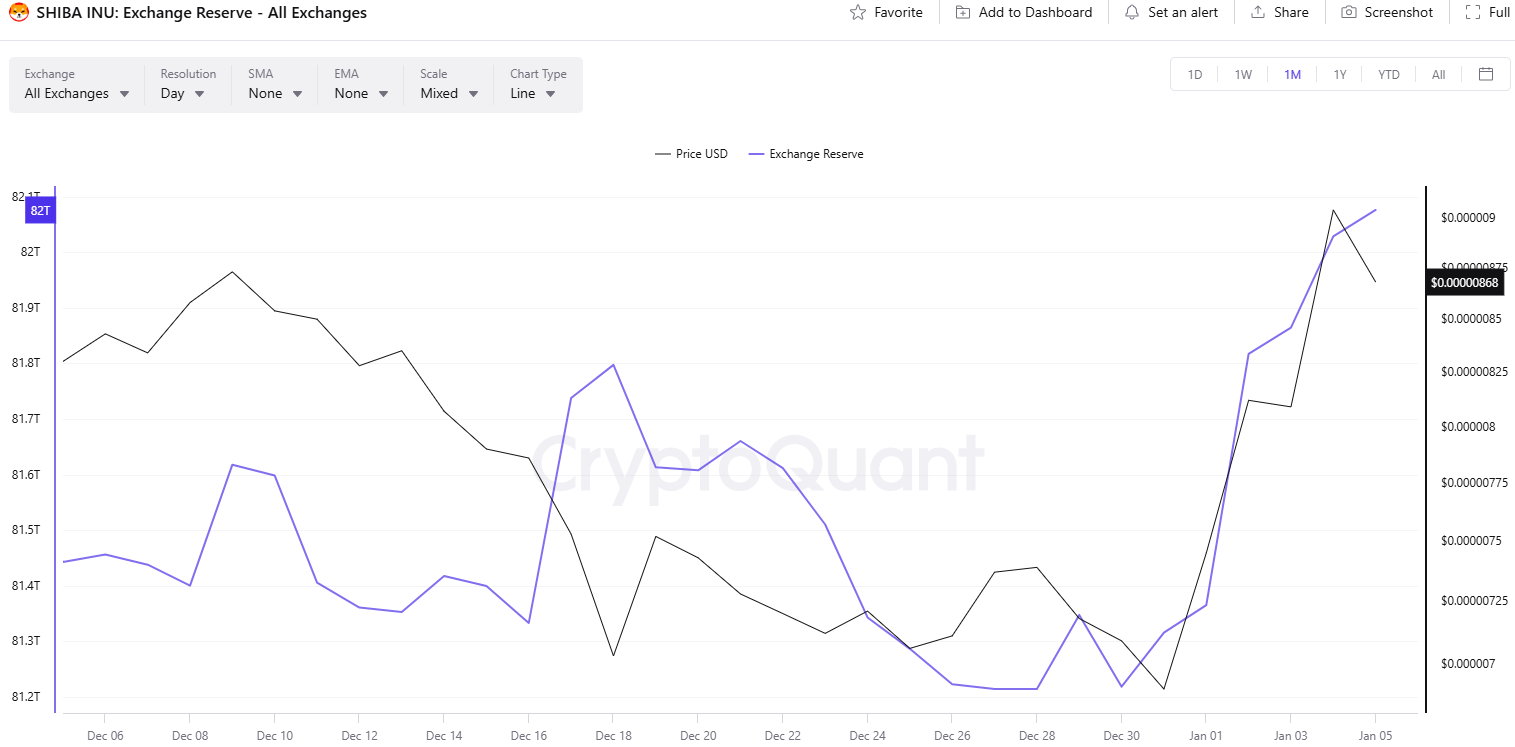

Yet, for all this bullish bravado, the bears are sharpening their claws. Exchange reserves for SHIB have been climbing, a sign that someone, somewhere, is quietly accumulating tokens to sell later. Perhaps they’re saving them for a rainy day-or a particularly aggressive bear market.

The RSI, that most misunderstood of technical indicators, hovers near the ominous 70 mark. This suggests SHIB may be “overbought,” a term that in crypto parlance means “likely to crash spectacularly.” Investors are advised to tread carefully, or risk becoming the next victim in this high-stakes game of digital hot potato.

In conclusion, Shiba Inu’s recent surge is a tale of optimism, hubris, and the eternal dance between hope and despair. Whether it will continue is anyone’s guess-but given the history of meme coins, it’s probably best to treat this with the same enthusiasm one might reserve for a dog wearing a tiny Bitcoin hoodie. 🐾💸

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- XRP: The Calm Before the Storm?

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- Brent Oil Forecast

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- Who Owns Bitcoin ETFs Now? Shocking Top Holders Revealed! 😂

- Silver Rate Forecast

2026-01-05 21:45