The Shadows Over 2026: A Chronicle of Hope and Despair

The year 2025… a fleeting moment of imagined prosperity. A brief, disquieting surge in the collective appetite for risk – a sickness, really – quickly succumbed to the familiar weight of fragility. Like a fever dream, it passed.

They say Bitcoin touched the heavens, reaching $126,210.50 on the 6th of October. A phantom peak. Since then? A descent into the expected: a gloom-ridden scuttle of doomscrolling, the hollow protests of denial, the omnipresent suspicion that clings to human dealings like dampness, the desperate flailing of liquidations, and the occasional, almost pitiable, burst of… optimism? A sentiment as foreign to this world as kindness.

After a parade of “crypto bloodbaths” – a theatrical term for the inevitable – traders approach 2026 with a caution so mild it amounts to indifference. One wonders if they’ve simply run out of tears, or perhaps, of hope. 🤔

Whether another illusion of a bull run will emerge in early 2026 depends, naturally, on forces beyond our control, on the whims of macroeconomics, on the fickle heart of the market. A pathetic reliance on external factors, isn’t it?

The S&P 500: A Distant Echo of Past Delusions

The question of the sinking S&P 500 and whether Bitcoin might offer salvation is a tiresome one, endlessly rehashed by those who believe in simplistic solutions. Comparing today’s situation to the dot-com bubble of 2000 is, at least, a gesture towards historical awareness. Though, let us not pretend that history repeats itself; it merely rhymes, and often poorly.

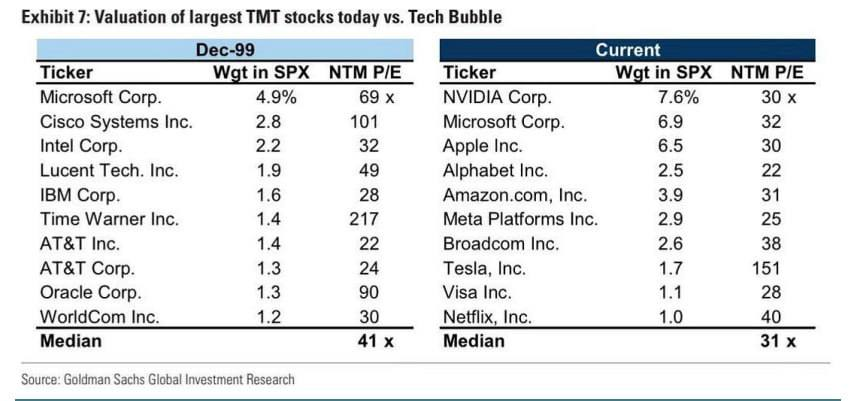

Goldman Sachs, with its endless charts and pronouncements, offers a comparison of Price/Earnings (P/E) ratios. A ritual, really, a modern-day divination. They point to concentration – the few holding the fortunes of many – much as it always has been. Then, three entities controlled 10% of the index; now, a staggering 20%. The concentration of power, naturally, remains unchanged.

But the numbers are… nuanced. Like a subtly rigged game. Valuations, on average, are a mere 30% lower than they were 25 years ago. Outliers, of course, exist – Cisco then, Tesla now. But the core truth remains: the facade of stability is maintained, precariously.

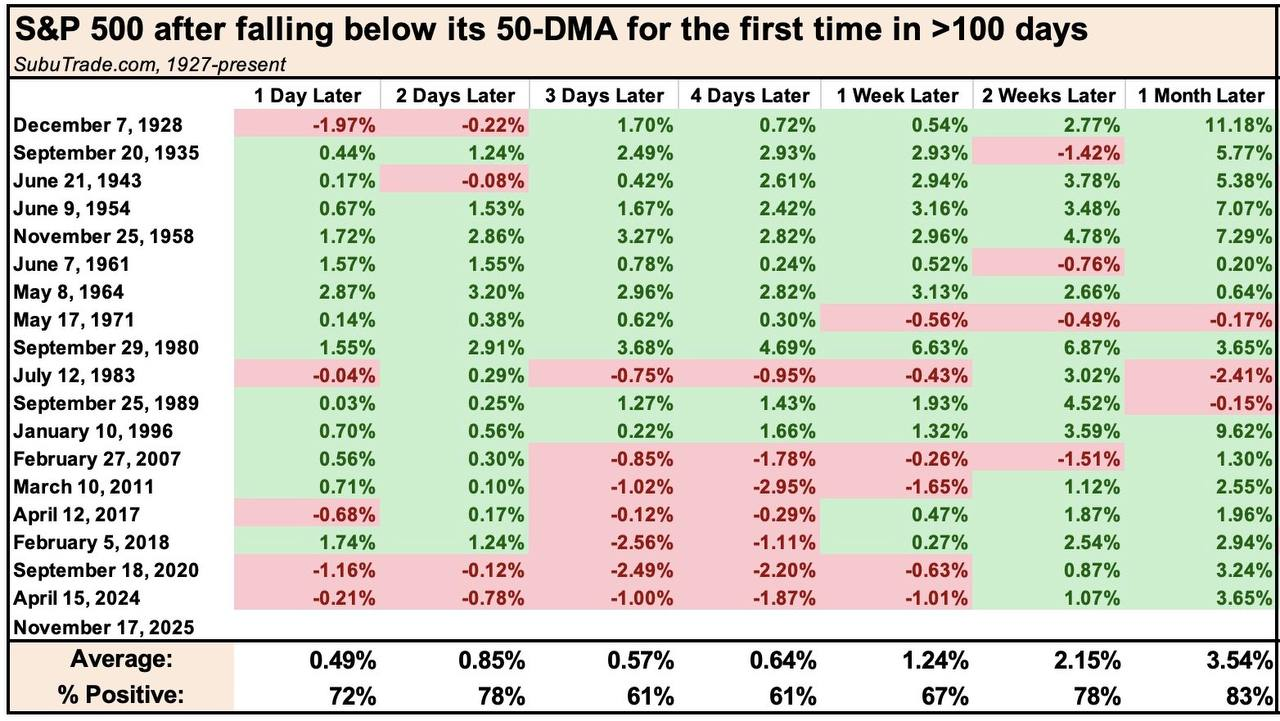

The S&P 500 recently enjoyed 138 days basking above its 50-day moving average. A prolonged period of… what? Complacency? Delusion? Let us consult the historical records for guidance. The results are, predictably, inconclusive. A coin toss, they say. On a weekly horizon. A monthly basis offers a glimmer of positivity, but who lives by months when years are already slipping through our fingers?

Perhaps, driven by their own inertia, investors and managers will chase after lost gains, fearing to be left behind. FOMO, they call it. A base instinct, dressed up in the language of finance. A small downward correction, followed by a rebound? Entirely possible. Another new high? Do not dismiss it. But do not bet your life savings on it either. 😂

To speak of a “bubble” is premature. Bubbles, true bubbles, swell with euphoria, with the childish belief that “this time is different.” A lack of self-awareness, magnified by collective delusion. Such is not the mood today. The CNN Money fear-greed index, just weeks ago, wallowed in “extreme fear.” Now, it has merely achieved… neutrality. A tepid comfort, at best. After a short breath, it may incline upwards in Q1-Q2 2026. Such is the way of things.

Strategy (MSTR): The New Masters of the Game

This Bitcoin, this digital phantom, is no longer the domain of rebels and outlaws. It is now embraced by the very institutions it once sought to circumvent. A tragic irony. Public companies, regulated products… the scent of control hangs heavy in the air.

Strategy alone holds 641,692 BTC. Marathon, 53,250 BTC. Coinbase, 14,548 BTC. Even Tesla, burdened by its own ambitions, possesses 11,509 BTC. And, of course, the ETFs of BlackRock and others. The supply, increasingly, is in the hands of those who answer to shareholders, to boards of directors, to internal policies. Market instinct? A quaint relic of the past.

Brandt observes a reversal of fortunes: prices falling while traditional indexes remain stubbornly stable. A curious imbalance. The problem, he says, is that many assets are already priced for a rapid decline in interest rates. Crypto, predictably, followed suit, ignoring the possibility that those cuts may be… delayed. It is always thus.

Brandt’s thesis: Bitcoin’s explosive growth is fading. Not dying, certainly. But maturing. Each “bull cycle” grows weaker, more tepid. A slow decline into irrelevance? Perhaps. But even so, he predicts a potential surge to $200,000 to $250,000. Provided, of course, that it first falls to $50,000. A delightful paradox.

The history of Bitcoin bull market cycles has been a history of exponential decay. Agree with it or not, you will have to deal with it. Should the current decline carry to $50k, the next bull market cycle should carry to $200k to $250K

– Peter Brandt (@PeterLBrandt) December 1, 2025

Meanwhile, Bloomberg’s Mike McGlone proffers a far darker vision. He foresees a catastrophic downturn, arguing that $50,000 will not hold. A mere illusion of support. He believes 2025 marked the definitive peak and expects 2026 to deliver a “reversion to the mean.” His target? A dismal $10,000. A chilling premonition.

Bitcoin $50,000 in 2026 On the Way to $10,000?

2025 may have marked peak Bitcoin/cryptos. Gold has only three major precious-metal competitors: silver, platinum and palladium. By contrast, Bitcoin was the first crypto in 2009, but now has millions of digital-asset competitors.…– Mike McGlone (@mikemcglone11) December 28, 2025

He also contends that the entire crypto class is inherently inflationary, a boundless proliferation of digital tokens diluting value. A strange truth, if one cares to admit it.

BTC/USD: A Forecast Rendered in Uncertainty

They say the “whales” – those large holders of Bitcoin – have been selling off their holdings since the peak. A classic sign of distribution, of the insiders making their exit. More supply than buyers… a familiar formula for decline. 😔

Since the high of $126,025 in October, the price has corrected by 20-30%. The natural order of things. A consequence of the whale’s maneuvers.

Young Ju initially predicted further decline, shaken by the selling. But then, inflows from Strategy and the ETFs intervened. A temporary reprieve, perhaps. A stay of execution.

Some whisper of a potential bull run in Q1 2026. Always there are those who cling to hope against all reason. 😇

Mike Novogratz, CEO of Galaxy, claims 2026 could be a great year. “Stalled” is the word he uses. He demands a return to $100,000 before any momentum can be regained. A reasonable demand, in an unreasonable world.

Novogratz believes apathy is a bullish sign. The absence of hype indicates a bottom. A curious assertion. He views the lack of frenzy as a setup for 2026, since the market is not overheated.

Coinbase, ever optimistic, points to a boost in liquidity, expecting growth to continue through April 2026. The Federal Reserve’s shift in policy, from balance sheet runoff to injections, could offer further support. A delicate dance, dependent on the whims of central bankers.

Bitwise CEO Hunter Horsley dismisses the four-year cycle theory as obsolete. He proclaims 2026 will be “massive.” All the pieces, he says, are aligning. A bold statement.

Standard Chartered echoes this sentiment, suggesting the halving cycles are no longer reliable guides. A break above $126,000 – anticipated in early 2026 – would confirm this shift. A faint glimmer of possibility in a landscape of uncertainty.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Silver Rate Forecast

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Bitcoin’s Wild Ride: Is It a Rally or Just a Bunch of Greedy Investors? 🤔💰

- Crypto Riches or Fool’s Gold? 🤑

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

2026-01-01 06:45