Oh, the week has been a whirlwind of wild rides in the precious metals gig, with silver doing dizzying dives and rises like a star acrobat on a tightrope. Spot silver on the Shanghai Gold Exchange ended its performance on December 24, 2025, at a premium to futures contracts. This particular juggling act, known as backwardation, whispers tales of the market being ‘snug as a bug in a rug’ for China’s physical silver supply.

China’s Silver Market Takes a Backward Leap: Demand Flexes More Muscle Than Supply in Shanghai

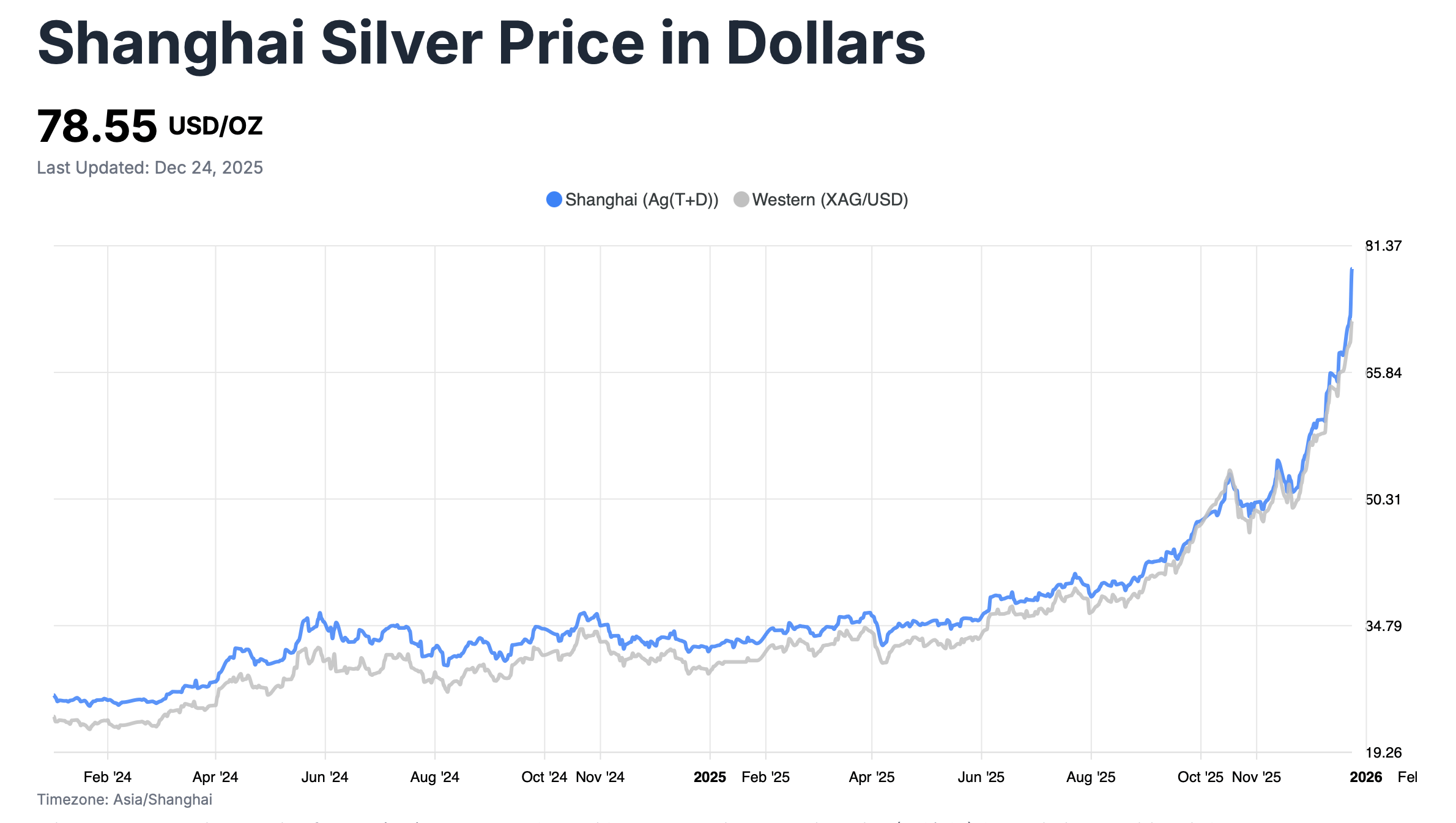

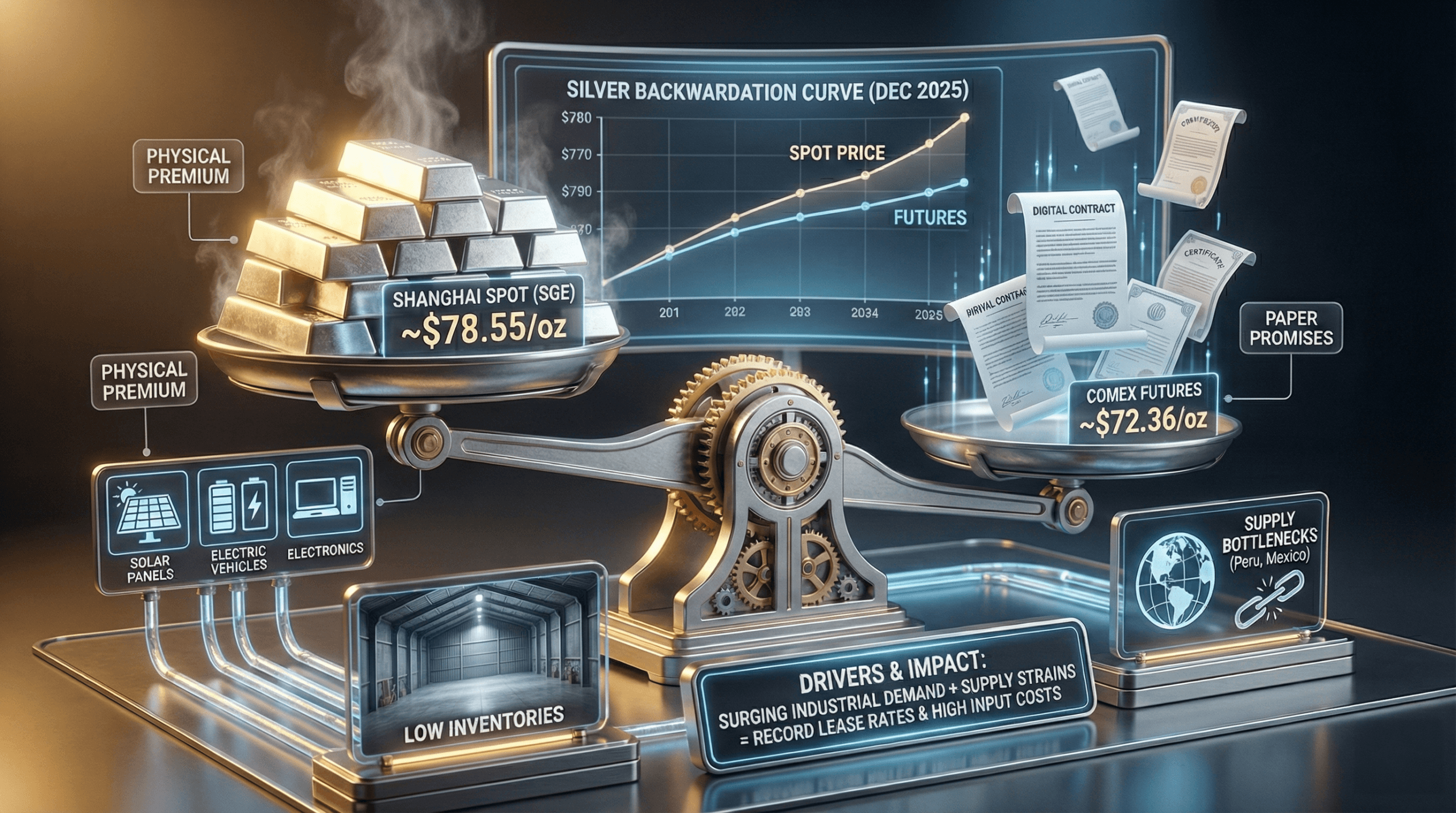

On December 24, 2025, the slippery little thing known as silver prices on the Shanghai Gold Exchange managed to climb to the high heavens, with the Ag(T+D) spot contract nestling close to 19,400 Chinese yuan per kilogram. That’s a rollicking ~$78.55 per ounce at the time, thanks to the USD/CNY rate dangling around 7.015. This means Shanghai silver played fancy dress and dove above global standards on Comex, where futures timidly concluded their performance at $72.36 per troy ounce.

This paved the way for a curious dichotomy-local woes where short-term hands-on physical demand overshadowed the available supply. Ever heard of backwardation, dear reader? It’s when the present is more appealing than the future, and with China’s silver contracts at the tail end of 2025, spot prices towered over futures, suggesting silver was in higher demand than promises of future delivery. More like a demand stress test of sorts.

In typical round-about fashion, the main culprit was as elusive as a unicorn in a china shop-slimming silver stockpiles within China’s borders, the world’s colossal consumer of refined silver. By November 2025, these reserves on Shanghai exchanges had dwindled to record-breaking lows, thanks to a spirited industrial appetite for the shiny stuff, surpassing both imports and local leafing. It didn’t help that China’s solar panel industry, a voracious eater, had expanded like an overfed cat in 2025, fertilizing expectations of a global silver deficit looming like a storm cloud for the fifth consecutive year.

Not to skimp on the drama, supply hiccups from regions like Peru and Mexico also preferred to join the party. Labor disputes and environmental regulations there, acting as the responsible element, clipped productive wings, causing a restriction on bullion flows into China, which aggravated local imbalances. Meanwhile, trade policy shifts and currency movements participated in this tango, as a stern yuan stared down an infantile USD, nudging holders to cling to their metal like a koala.

On the demand stage, China’s electronics and electric vehicle sectors exerted added pressure, since silver’s conductivity makes it as invaluable for batteries and wiring as a teapot on a Sunday morning. Amateur investors, sniffing for hedges against inflation and geopolitical pressures (sandwiched by the curious U.S.-Venezuela tiff that rattled international commodity routes), were also eager, sparking cyclical hunger where higher spot prices further fueled hoarding over hedging in futures.

This game of musical chairs called backwardation sent tremors throughout China’s silver market, inviting jittery day-to-day price fluctuations. Trading volumes on Shanghai exchanges viewed sprinters in their finest garb, with whispers of rapid movements as speculators positioned for potential short squeezes. Meanwhile, silver lease rates, the cost of borrowing physical metal, ventured into record territory, uttering coded distress calls about the dwindling lending pool.

Chinese producers hurriedly pried their vaults open, aiming to profit from these elevated spot prices, though risking future supply vacuums if mining investment growth stuttered to a halt. Industrial users, baring their teeth, gazed up at steeper input costs, which could translate into higher prices for silver-entrenched exports like solar panels and electronics, showcasing silver’s dual identity as both an industrial gear and financial trinket.

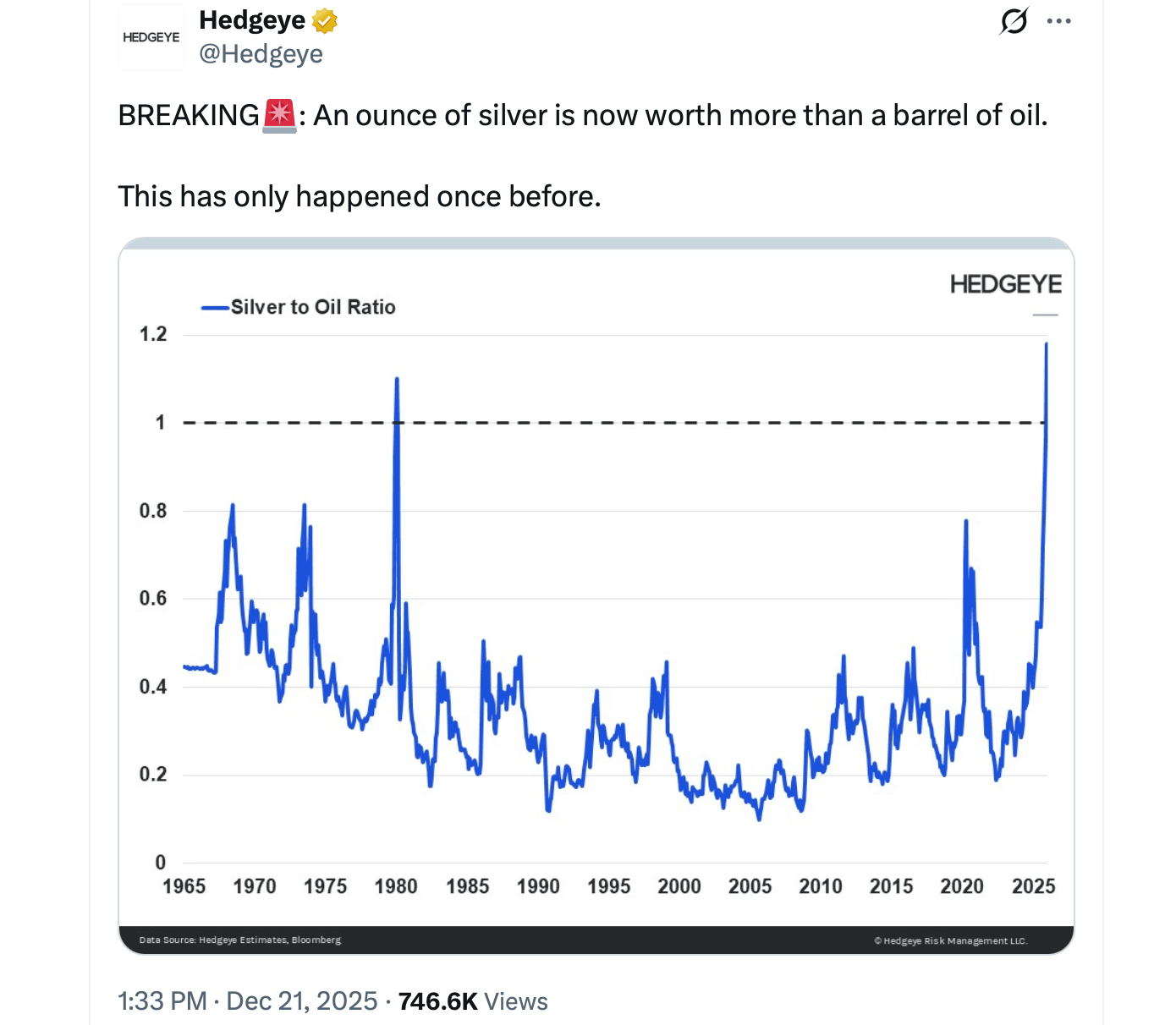

While echoes of this backwardation reverberated globally, Comex futures nodded sympathetically even if the inversion denouncer remained mild in the Western markets. Visionaries have sighed ominously that ongoing deficits, should supply not rally in 2026, could inflate silver towards triple-digit majesty. Alas, decisions by the Federal Reserve and economic vigor in realms like the U.S. and Europe might inject some patience into these projections.

Market spectators glared intently at inventory data, venerating Shanghai warehouse levels as prophetic beacons to gauge market snugness. By the last days of December 2025, despite earnest calls for more recycling and alternative sourcing, withdrawals from these stocks kept ticking, affirming the backwardated curve.

As the year draws its curtains, Shanghai’s reluctant premium over Comex hangs firm, a harbinger that physical disruptions might waltz into the new year. Unless policy shifts or production boons arrive to save the day, China’s silver backwardation in 2025 signifies deep-rooted contours in the global market where demand, especially from these pesky green technologies, has outpacing mine supply growth.

Frequently Asked Questions 🤔

- Why did silver sell at a premium in Shanghai on Dec. 24, 2025?

Silver on the Shanghai Gold Exchange played leapfrog over futures due to the squeeze of “snugger-than-your-grandma’s-jacket” physical supply backing spot demand. - What does silver backwardation whisper to China’s market?

Backwardation whispers that buyers coughed up more for the here-and-now, hinting at a shadowy near-term scarcity. - How did Shanghai prices tango with Comex silver?

Shanghai’s silver cut an enviable figure above Comex, a testament to unique neighborhood antics absent in Western stages. - Which sectors turn silver heads in China?

China’s gregarious solar, electronics, and electric vehicle industries devour silver faster than a family feast, tightening the metal’s availability across the local market.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- XRP Boss Bails… But Wait, He’s Back? 😏

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- SEC Gives Galaxy Digital a Green Light—But Will They Survive Delaware?

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Pantera Denies Akio’s $5M Scam! 🚨

2025-12-25 06:00