Ah, Bitcoin, that most elusive of digital darlings, seems to have adopted the philosophy of “stay calm and carry on-preferably below key resistance levels.” While the crypto rollercoaster remains firmly on its tracks-mostly because nobody has the faintest idea where it’s headed-market methinks we’re approaching a juncture as decisive as Aunt Agatha’s opinion on pineapple in sausages.

Technical Analysis, or How to Read Tea Leaves and Trendlines

The Daily Chart

On the daily dance floor, BTC recently threw a bit of a tantrum at its favourite descending trendline-gently rejecting all attempts to make a break for the (digital) skies. One might say the resistance is as stubborn as Uncle Tom at a family reunion. Meanwhile, the cryptocurrency has taken refuge above the hallowed ground of $82,000-$84,000-think of it as a resilient duck on a pond, steady and unflapped, despite the ripple of bearish waves.

If only it could close a day above that pesky trendline, the bulls might puff out their chests and strut about, but alas, a breakdown below the $82K mark could turn the whole affair into a bearish barn dance. Well, if only cryptocurrencies had tailcoats and wine-oh wait, they do, just metaphorically speaking.

The 4-Hour Chart

Now, shifting our gaze to the shorter, more fretful 4-hour spiel, Bitcoin seems to be wavering more than a dodgy juggler. Attempts to rally have fizzled out like a soufflé in a heatwave, hitting a brick wall around $89K-$90K-proving once again that all that glitters isn’t necessarily a breakout.

The recent rejection confirms that Bitcoin’s bullish ambitions are as grounded as a zeppelin with a leak. As it continues its game of lower highs, anyone with a pulse and a keen eye might say the short-term outlook is as bearish as a Monday morning in the office.

Hang on, though-if it manages a miraculous reclaim above $90K, the door to recovery swings wide open. Until then, it’s just another tale of “almost there” that makes a fellow want to reach for the whiskey.

The On-chain Nonsense and Other Tales

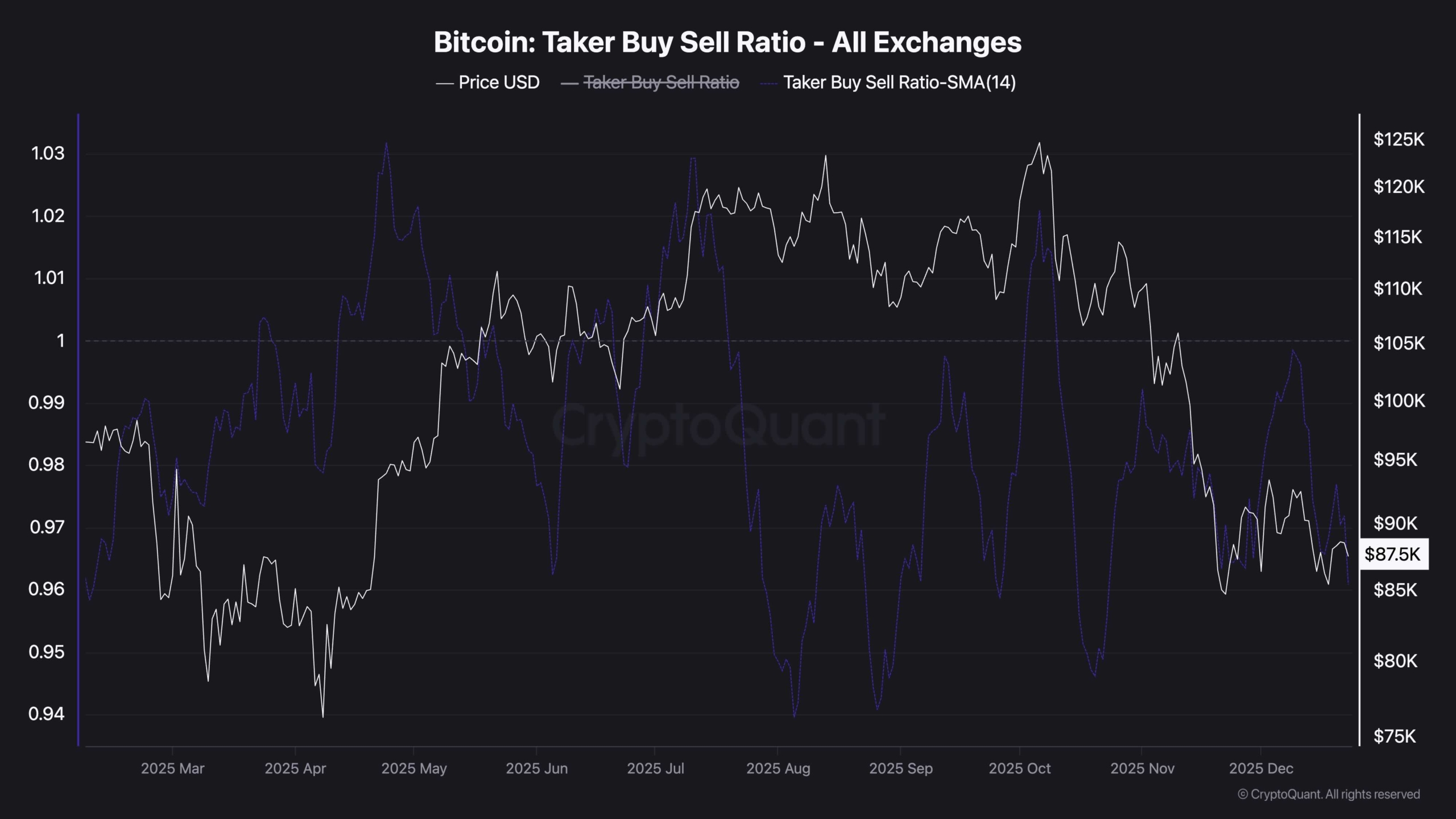

And now, a quick word from the on-chain analysts, who like to say things that sound impressive but mostly mean “buyers are feeling less like heroes and more like hedge fund fodder.” The taker buy-sell ratio reveals that sellers seem to be having all the fun, while buyers are lurking around like shy debutantes at a dance. The market’s mood? As lively as a funeral, with sell orders leading the conga.

Brief rallies tend to sputter out quicker than a New Year’s resolution, making it clear that the crowd is wary, waiting for a sign that this merry-go-round might actually stop spinning. Until then, Bitcoin’s position is about as convincing as a politician’s promise.

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Polygon’s Rise: A Most Curious Affair! 🧐

- Bitcoin to Moon? Tom Lee’s Wild Predictions and a Universe of Imbalance 🚀

- Bitcoin’s Droll Dance: Profits Plummet While Prices Prance! 💃🕺

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- SEC’s Crypto Crusade: Will America Lead or Get Left Behind? 🚀

2025-12-23 20:16