Well, here we are again, folks! Bitcoin has decided to throw a little tantrum and has dropped below the oh-so-important $85,000 mark. 🙈 But wait! It’s made a tiny rebound above $87,700, which is like putting on a brave face after a bad hair day. This suggests our beloved BTC might just be cooling its jets for a bit. And by “cooling,” I mean it’s fluctuating like my mood during a Netflix binge. 📺🍿

Now, you might be wondering, will this current price action-where selling is met with solid demand (and no one is losing their heads, thankfully)-help Bitcoin reach that mystical unicorn level of $100K? 🦄✨

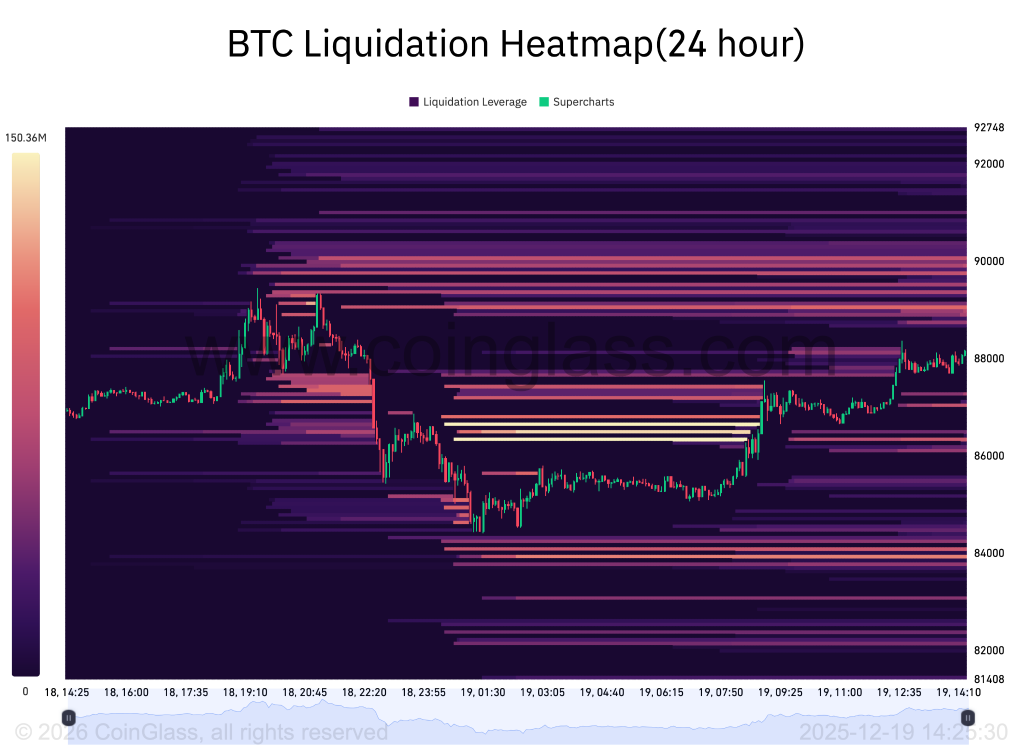

Liquidations Are Cooling-And That Matters, Darling!

Recent liquidation drama has shown a sharp decline in forced selling. Remember those chaotic moments when long positions were liquidated left and right? It was like watching a reality show where everyone was voted off the island! 🌴 But now? Liquidation intensity has eased up, even while Bitcoin continues to strut its stuff in the marketplace.

This shift is crucial, lovelies! When forced selling calms down, it means the weak hands have dropped out, leaving the big players to play nice with spot demand. Basically, sellers are still hanging around, but they’re no longer the life of the party. 🎉

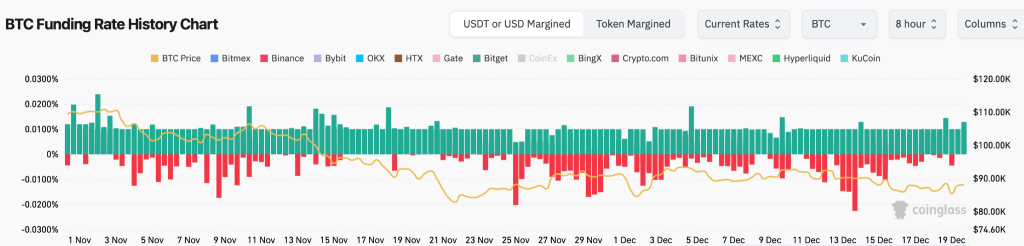

Funding Rates Point to a Reset, Not Panic-Phew!

Funding rates across major exchanges have decided to play nice after flipping negative for a hot minute. This indicates that leverage has cooled off and those latecomers trying to ride the wave have been flushed out. 🧼 Importantly, funding isn’t aggressively positive either. It’s like the market is taking a deep breath rather than diving headfirst into a pool of excitement.

Historically speaking, sustainable moves come after funding resets-not while everyone is in a frenzy. The vibe right now is all about hesitation and balance, which usually sets the stage for a grand expansion once the price decides which way to go.

BTC Price Analysis: Structure Holds the Final Clue (Spoiler Alert)

On the 4-hour chart, Bitcoin is still defending its well-defined demand zone and the ascending trend line like it’s guarding the last piece of chocolate cake at a party. 🍰 Each dip below support has been met with buying action, suggesting there’s some real interest here, not just desperate short covering.

For all you traders out there, here’s the scoop:

- If we stay above this demand zone, recovery scenarios are alive and kicking! 🎉

- If we fall below, well, hold onto your hats because we might see another liquidity sweep lower. 😱

Until then, Bitcoin is stuck in a range-bound phase, not quite confirming a dramatic downtrend, thank goodness!

Wrapping it Up: Can Bitcoin Price Reach $100K? 🤷♀️

So, what’s the final verdict? Bitcoin is likely to hang out in a tight range this weekend, stabilizing above key support as the market digests the recent craziness. As for that elusive $100K? Well, it’s feeling a bit out of reach for now. The current price action looks more like a calm cup of tea than the explosive breakthrough we’re all dreaming of. ☕️💭

Read More

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- NFTs Soar to New Heights: Is the Bull Run Truly Back? 🚀💰

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Jito’s Spectacular Rise: The Token That Just Won’t Quit! 🚀

- BitMine Hoards ETH Like There’s No Tomorrow-2.65M Tokens & Counting! 😂

2025-12-19 12:43