What to know:

- Bitcoin’s price has taken a nosedive… or perhaps it’s just confused about its life choices. Gold and silver? They’re thriving like a disco in the 2020s. 🐸

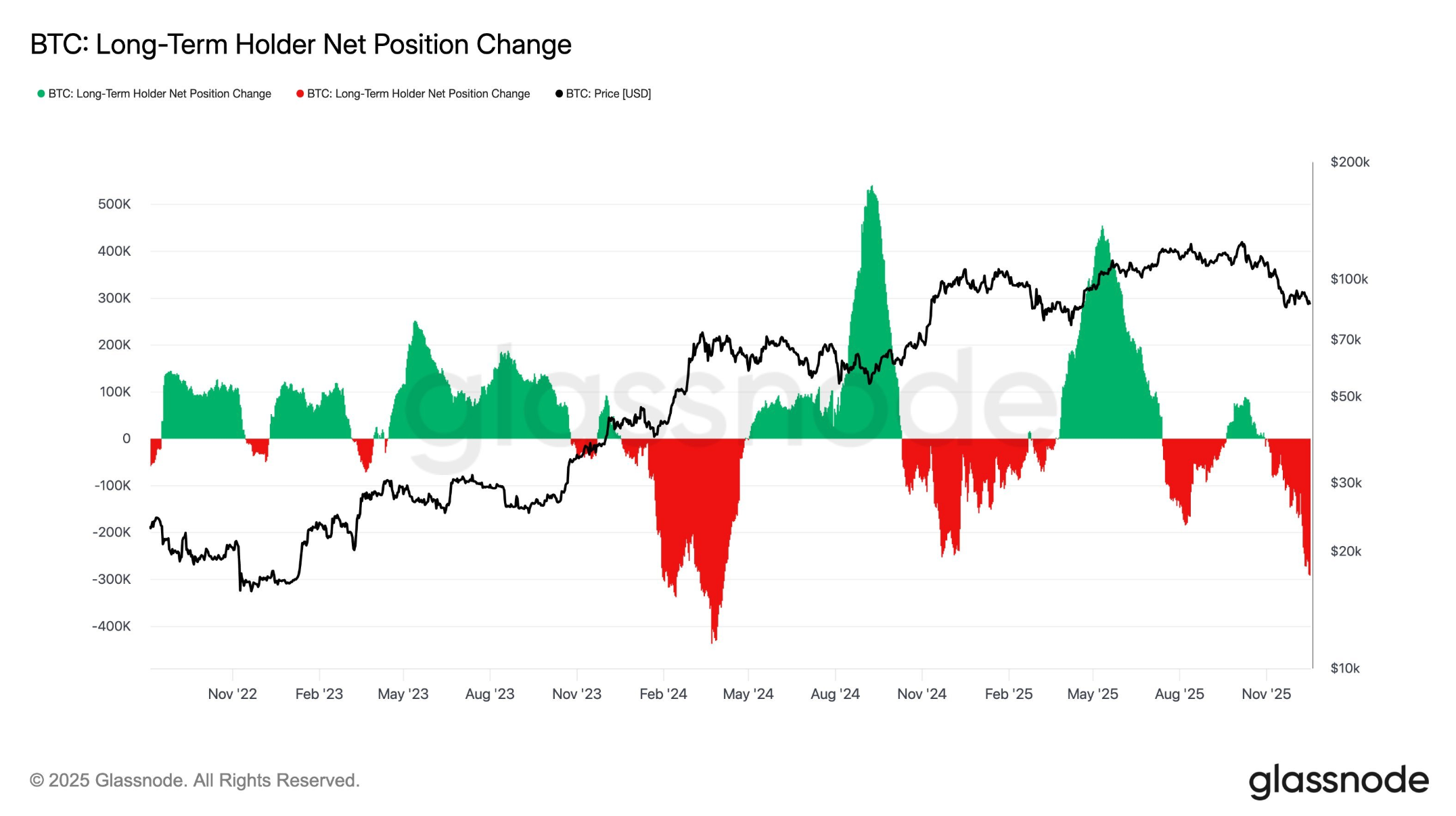

- Analysts whisper BTC’s weakness is due to its “risky asset” vibes and long-term holders cashing out like it’s 2018 all over again. 💸

- Historical trends hint BTC might rally post-gold’s peak. 2026? Sounds like a sci-fi movie plot. 🚀

Bitcoin’s recent rejection at $90,000 was a polite reminder that gold and silver are the real debasement-trade MVPs-not BTC, which is currently more “digital paperweight” than “digital gold.” 😅

JPMorgan once claimed BTC and gold would ride the debasement train together, projecting $165k for BTC. Spoiler: That train just left the station, and BTC is now stuck in the parking lot. 🚂💨

While BTC lingers near $88k (down 30% from October glory), gold and silver are flexing record highs. Silver’s even hitting $66-an all-time high that makes BTC weep into its cup of tea. ☕😭

“Bitcoiners can’t ignore the bull market in precious metals,” said Charlie Morris. Translation: “BTC’s not winning this round, but hey, at least it’s not a meme coin.” 🐆

Why is BTC lagging?

Bitcoin’s woes stem from its “risky asset” label-like a stock tip from your uncle who once bet on NFT penguins. Meanwhile, gold just sits there, serene and unbothered. 🐆

Technically, BTC’s gold ratio peaked in 2024 and is now in a bear market. It’s like watching your ex date someone richer and more confident. 🐾📉

In August, BTC-gold made a lower high (aka a “facepalm moment”) and has since hit a two-year low. It’s the financial equivalent of a midlife crisis. 🐍

Long-term holders are selling BTC like it’s expired yogurt. Research shows 1.6 million BTC reactivated since 2024. “Selling pressure” is just a fancy term for “BTC’s support network giving up.” 🐢

Quantum computing? A theoretical threat that’s already ruined a perfectly good cup of tea. Investors panic, but the quantum computers are probably just napping. 😴

Analyst: Silver Rally Could Set Stage for BTC

The silver lining (pun deliberately intended) is BTC might eventually take the baton from gold. Bitfinex claims gold peaks precede BTC rallies by 100-150 days. Sounds like a cosmic game of musical chairs. 🪑

“I remain bullish on silver, but it won’t go on forever,” said Morris. Translation: “BTC’s turn is coming… probably. Maybe. If it remembers where it parked.” 🚗

Read More

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Jito’s Spectacular Rise: The Token That Just Won’t Quit! 🚀

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- NFTs Soar to New Heights: Is the Bull Run Truly Back? 🚀💰

- Bitcoin’s Wild Ride: $2B Down the Drain and Counting! 🚀💸

2025-12-18 20:03