Well, well, well. It seems Bitcoin and ether ETFs decided to show up for work on Wednesday, posting a juicy $282 million in inflows. Solana and XRP, apparently feeling left out, joined the party, making it a full-blown green fest in the crypto ETF world. 🌿💰

Bitcoin and Ether ETFs Keep the Good Times Rolling, Like a Drunk Guy on a Parade Float

Wednesday, Dec. 10, didn’t just tiptoe into the crypto market-it strutted in like a guy with a winning lottery ticket. Fresh capital flooded in for the second consecutive day, lifting spirits and fueling rumors that institutional investors might just be warming up to the idea of crypto again. It wasn’t exactly a “get rich quick” scenario, but it was a steady little shuffle in the right direction.

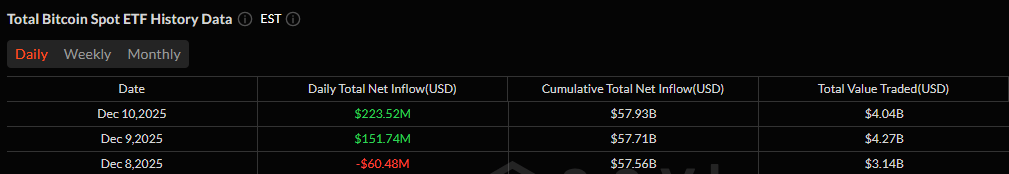

Bitcoin ETFs took the crown with a neat $223.52 million in inflows. And who carried this mighty sack of cash? Why, none other than Blackrock’s IBIT, which devoured a hefty $192.95 million. A complete 180 from earlier this week when it was saying “bye-bye” to funds. Fidelity’s FBTC also chipped in a respectable $30.58 million. With $4.04 billion traded, and net assets holding steady at $122.43 billion, it’s safe to say the ship isn’t sinking just yet. 🚢💸

Ether ETFs were not about to let Bitcoin have all the fun. They also closed their third consecutive green day, raking in $57.58 million. Blackrock’s ETHA once again took center stage, with $56.45 million, while Grayscale’s Ether Mini Trust added a little sprinkle of $7.91 million. Even Fidelity’s FETH couldn’t derail the good times, despite a tiny $6.78 million outflow. With $2.24 billion traded, and net assets steady at $21.43 billion, it’s clear-ether’s not going anywhere. 🌱📈

Solana ETFs made their contribution, with a modest $4.85 million in inflows, mostly thanks to Bitwise’s BSOL, which picked up a cool $3.68 million. Add in some smaller chunks from Vaneck, Fidelity, and Grayscale, and voilà-a steady, if unspectacular, performance. $26.46 million traded, and assets remained static at $949.18 million. Not exactly breaking the bank, but hey, it’s something.

XRP ETFs also tagged along, adding a respectable $10.20 million in inflows. Bitwise’s fund brought in $7 million, while Grayscale’s GXRP pocketed $3.20 million. With $24.53 million traded and assets holding steady at $939.46 million, XRP ETFs are riding the coattails of the crypto surge with quiet dignity. 🏅

Across all sectors, Wednesday’s session was a breath of fresh air, bringing in another round of steady inflows and reaffirming that crypto’s not dead yet. The momentum’s holding strong, and capital’s moving. Looks like the ETF market is on a roll-and who doesn’t love a good roll? 🌀💸

FAQ📈

- What drove Wednesday’s ETF momentum?

Bitcoin and ether ETFs received steady institutional inflows for the second straight day. Seems like folks are warming up to crypto again. - Which ETFs led the inflows?

Blackrock’s IBIT led the charge for Bitcoin ETFs, while ETHA stole the show for ether. - Did Solana and XRP join the trend?

Why, yes! Both SOL and XRP ETFs posted positive inflows as well. - What does this mean for market sentiment?

Well, these consistent inflows are quietly rebuilding investor confidence. It’s not a boom, but it’s something.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- USD IDR PREDICTION

- Brent Oil Forecast

- Cardano’s ADA: $60M Whale Shopping Spree! Is $1 in Sight? 🐋💰

- USD THB PREDICTION

- ETH’s Grand Gesture: A Love Letter to Bulls or a Joke on Bears?

2025-12-11 19:24