Oh, what a curious twist! Ethereum, that cheeky little digital gremlin, has leapt over the $3,350 wall like a frog in a welly boot race. The market, still clutching its tea and muttering about bears in the woods, now stares at this new adventure with one eye squinted and the other blinking like a drowsy owl. Analysts, those wise old gnomes of the charts, whisper of bear traps and crumbling cookies. But hush! Traders are now tiptoeing on a tightrope between “phew, it’s alive!” and “oh no, it’s just gasping!”

A new CryptoQuant report, written in the scribbles of a mad mathematician, claims Ethereum’s funding rates are behaving like a well-mannered porcupine-spiky but not snorting champagne. Earlier rallies were like a dragon belching fire, with funding rates soaring into the stratosphere. Now? A timid mouse tiptoeing through a cheese shop. The last two surges were all glitter and sparkles until the glitter clogged the drain. This time, though, the sparkles are… well, dampened. No grand spectacle, just a quiet, “Oh, I suppose I’ll buy a slice of this cake.”

Why? Because Ethereum isn’t being dragged by the ears of overzealous gamblers with leveraged lollipops. Instead, it’s ambling forward like a sleepy tortoise, nudged by spot buyers who think, “Might as well,” while sipping lukewarm coffee. Is this healthy accumulation or a yawn of indifference? The market’s greatest riddle, wrapped in a conundrum, tied with a bow of confusion. 🤯

Muted Funding Rates: A Whisper, Not a Scream

CryptoQuant’s report, penned in the margins of a forgotten ledger, reveals Ethereum’s funding rates are as lively as a deflated balloon. Even after a sharp climb from $2.8K (a rebound that made the market do a double-take), the derivatives market isn’t throwing a party. Buyers are present, but they’re more “meh” than “hallelujah.” Leverage? Minimal. It’s like trying to build a sandcastle with a teaspoon-possible, but not exactly thrilling.

This lack of chaos isn’t a red flag-it’s more of a “mildly suspicious” flag. Imagine a bear market in a tutu, tiptoeing around a garden of tulips. Ethereum isn’t overcooked, just simmering. But here’s the rub: without a surge of speculative madness, Ethereum might struggle to rocket into the stratosphere like it did before. History says, “Funding rates must froth like a witch’s cauldron to fuel a proper bull run.” And yet, here we are, with a cauldron that’s barely bubbling. 🫧

Resistance: The Final Frontier (Or Just a Sticky Note?)

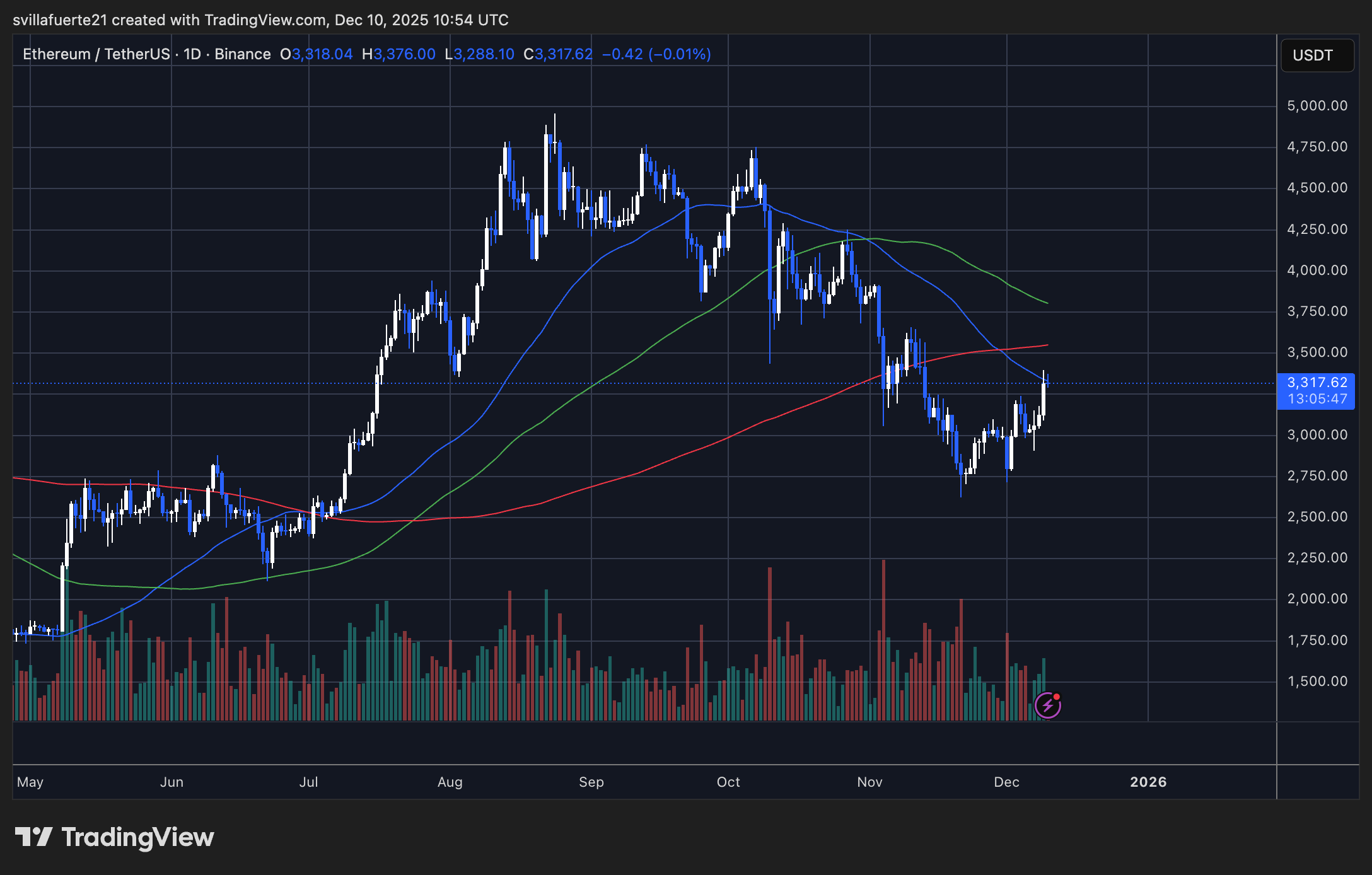

Ethereum’s daily chart looks like a toddler learning to walk-stumble, wobble, then a determined lurch toward $3,320. The 200-day moving average, that grumpy old gatekeeper, is now within reach. Last time someone tried to pass it, they tripped on a banana peel. Will Ethereum slide through or crash into it like a train derailing? Only time will tell.

The buyers are here, but their confidence is about as strong as a spaghetti bridge. Volume is low, like a whisper in a thunderstorm. To truly flip the script, Ethereum needs a horde of new buyers, not just the same old crowd playing with matchsticks. And if it falters? Well, the market might throw a tantrum and send it tumbling back to the abyss. But if it breaks through $3,350-$3,400, it might finally start dancing with the stars. Or at least, the ones that aren’t currently in a bear market ballet. 🌌

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- EUR UAH PREDICTION

- USD RUB PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD IDR PREDICTION

- GBP JPY PREDICTION

- Nigeria’s Crypto Crackdown: ₦2 Billion or Bust?

- Privacy Alert: Ireland’s Encryption Law Sparks Outrage 🔐💔

2025-12-11 01:19