Ethereum’s price started to recover in early December after a dip in November. It successfully bounced back after testing a downward trend and has now found support around $3,050. If it stays above this level, it could potentially rise to between $3,400 and $3,500. However, experts warn that these gains aren’t certain and depend on how actively people trade and how much money is available in the market.

Ethereum Price Today: Navigating a Corrective Phase

Ethereum (ETH/USD) has been gradually decreasing in value, as shown on its daily price chart. The price is now nearing a “supply zone” between $3,500 and $3,700 – an area where there’s typically more selling than buying, potentially leading to a price pause or drop. A key support level – a price point where the value is likely to bounce back – sits between $2,400 and $2,550, a level that previously helped fuel Ethereum’s price increase.

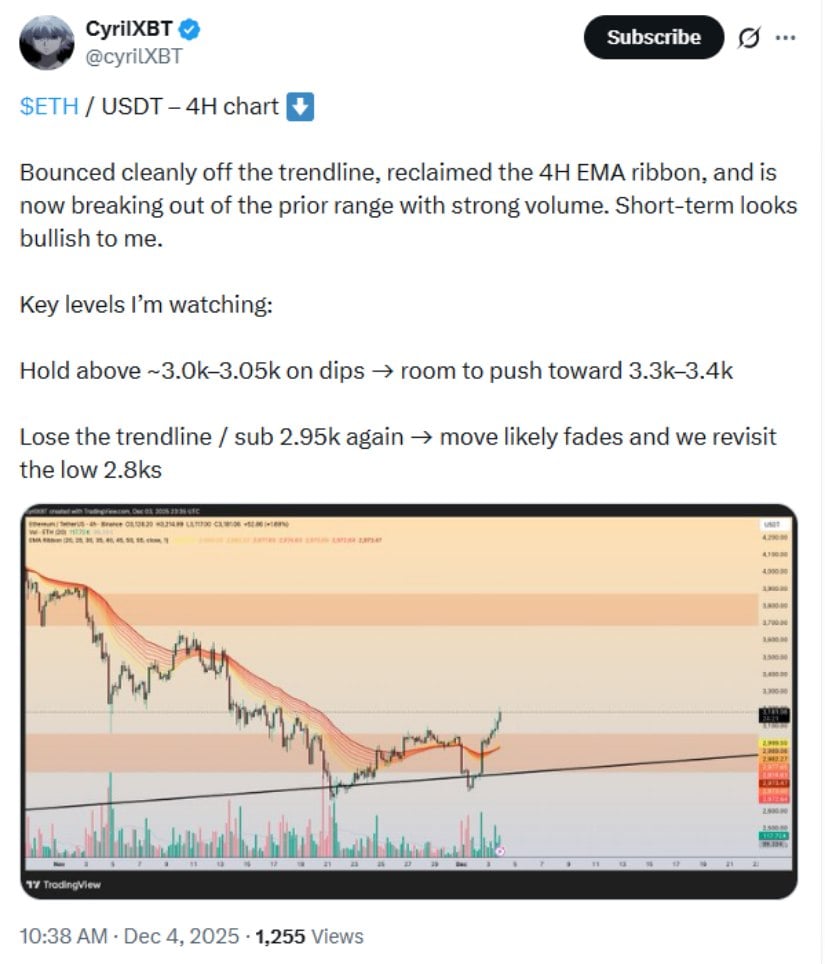

Cryptocurrency analyst CyrilXBT believes that if Ethereum (ETH) stays above the $3,000 to $3,050 level when the price dips, it could rise to between $3,300 and $3,400. He sees $3,050 as a key price point – if ETH can stay above it, the price is likely to go up. However, if the price falls below $3,050, it could test even lower price levels.

Short-Term Ethereum Technical Analysis: EMAs and Trendlines

Looking at the 4-hour chart, Ether (ETH) has moved back above a key group of moving averages, known as the EMA ribbon. This often indicates that buyers are starting to drive the price up again. However, if the price falls back below this ribbon, it could suggest a weakening trend. The recent price increase, along with higher trading volume, shows potential for further gains, but experts believe this rally is a temporary correction within a larger trend, rather than the start of a strong, sustained upward move.

According to market analyst Jainam Mehta, the price charts are showing a positive trend with increasingly higher lows on both 4-hour and daily timescales. This suggests buyers are stepping in when the price drops, which could help push the price higher. Currently, ETH is trading above its 20-day and 50-day moving averages, around $2,964 and $2,957 respectively, and these levels may provide some support if the price falls.

Ethereum Price Outlook: Key Levels to Monitor

Key resistance levels can be found at the 100-day and 200-day Exponential Moving Averages, currently around $3,013 and $3,206. These levels have often acted as price ceilings in the past when the price has been rising. If the price breaks above both of these levels and holds, it could then move towards $3,360 and $3,477, with a major turning point potentially around $3,566.

If the price falls below $3,050 or fails to break through the 200-day EMA, we could see a larger price drop. Initial support levels to watch are $2,900 (a key psychological level) and the 50-day EMA at $2,957. If selling continues, the price could fall further, potentially reaching $2,800–$2,720, especially with increased leveraged trading.

Experts point out that these price levels can serve as important benchmarks, but caution that quick market fluctuations might cause misleading indicators, like sudden reversals or temporary price drops driven by large trades.

Ethereum 2025 Price Prediction: Balancing Fundamentals and Risks

The recent Fusaka upgrade, launched on December 3rd, makes Layer 2 transactions more efficient and reduces the expenses for running Ethereum nodes, providing essential improvements to the network. Data from Glassnode shows Ethereum’s value has bounced back about 45% since its low point in November. There’s also growing confidence from investors, as seen by $58.10 million flowing into the ETH market on December 3rd – the biggest single-day increase in over a month.

Data from derivatives markets reveals a significant increase in open interest, reaching $38.34 billion. This suggests large traders and institutions are preparing for potential price swings. However, this activity can be interpreted in two ways: it shows increasing investment, but also indicates a higher chance of forced selling if the price unexpectedly drops.

Predicting the price of Ethereum in 2025 is difficult. Several things could influence it, including the overall economy, how quickly Ethereum improves its technology, and how it stacks up against competing platforms. While technical analysis and the basics of Ethereum look promising, the final price will likely depend on how widely it’s used, any new regulations, and the general feeling towards crypto as a whole.

Ethereum Price Target and Risk Considerations

If Ethereum can stay above $3,050, it could potentially rise to between $3,400 and $3,500 in the near term. Whether it continues to climb will depend on if it can break through resistance levels between $3,500 and $3,700. Traders should also pay attention to trading volume, moving averages, and overall market trends to confirm the strength of any upward movement.

However, if the price fails to break through current resistance levels or falls below $3,050, a more significant price drop could occur. Because trading is increasingly automated and many traders are using borrowed funds, price movements could be exaggerated, so managing risk is essential. Experts suggest watching for both long-term patterns like moving averages and key price levels, as well as short-term fluctuations, to identify genuine trends.

Looking Ahead: Ethereum Outlook

Ethereum’s price is showing some early signs of settling down, with support around $3,050 holding steady and technical signals looking a bit better. It could still go either way – up or down – and the final direction will depend on how many people are buying and selling, where it hits resistance, and broader economic conditions.

Investors should pay attention to prices consistently closing above important moving averages, identify areas where selling pressure might emerge, and track how easily the market can absorb buying or selling. Although some early buying is happening, the overall market is still uncertain, so it’s crucial to manage risk carefully and be prepared for potential price swings.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Brent Oil Forecast

- Why Switzerland’s Bank Said “No Thanks” to Bitcoin (And Probably Enjoys Paper Money More)

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- SHIB PREDICTION. SHIB cryptocurrency

- ProShares Dives into XRP Futures ETF: The Countdown Begins! 🚀

- Crypto Dreams Shattered: PI’s $100M Fund Debuts, Token Sinks Below $1 Anyway 😬

- Pakistan’s Hilarious Bitcoin Mining Adventure: Can It Save the Day?

2025-12-04 23:58