Well, the crypto world sure got a slap in the face last month. Bitcoin, the so-called king of crypto, had its price drop below $86,000, sending traders scrambling like chickens in a storm. The whole market followed suit, like an out-of-tune orchestra. Ethereum felt the burn too, tumbling towards $2800. But it was poor Solana that really got roasted. The token fell below $130-again. At this point, it might as well get a permanent residence on the “danger zone” list. 😬

Solana’s crash wasn’t exactly a surprise, though. While Bitcoin’s collapse was all about liquidity gaps and chaos, Solana’s tumble had more to do with a slow, painful decline in on-chain activity. Its user base was basically taking a nap long before the storm hit. With fewer people using the network and less buzz around it, the token became a sitting duck for any macro pressures that came its way. Not great, right?

Active Users and Transactions Began to Cool Off

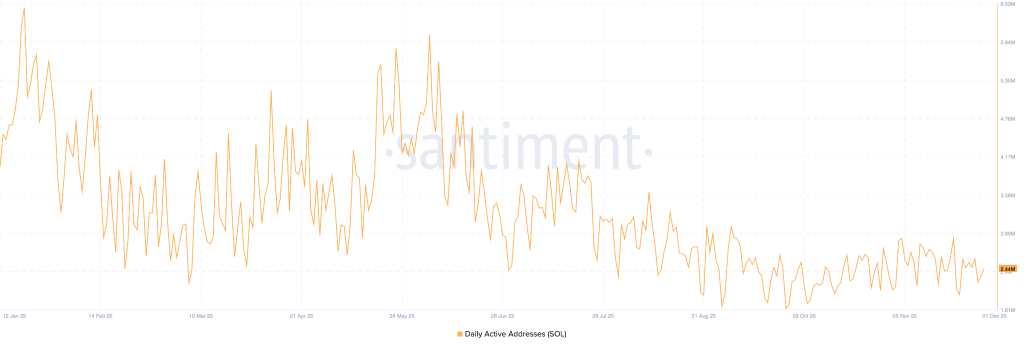

The number of active users is a key indicator of a platform’s health, and right now, Solana looks like it’s about to check into a hospital. You see, fewer active users means less trading, less demand, and-drumroll, please-less utility. Solana’s active addresses have been stuck below 3 million since July 2025. That’s a far cry from its heyday, when it was dancing between 7 and 9 million. Things started to go downhill fast. 🚶♂️

By mid-2025, the daily active addresses dipped to 3 to 4 million and have been lingering there ever since. That’s a slump, no doubt. For a network that was once all about high-speed, high-frequency transactions, that decline is a real kick in the pants. Without momentum, it’s hard to keep up the hype, and it looks like the Solana train is running out of steam. 🚂💨

Consistent Drop in DEX Volume & TVL

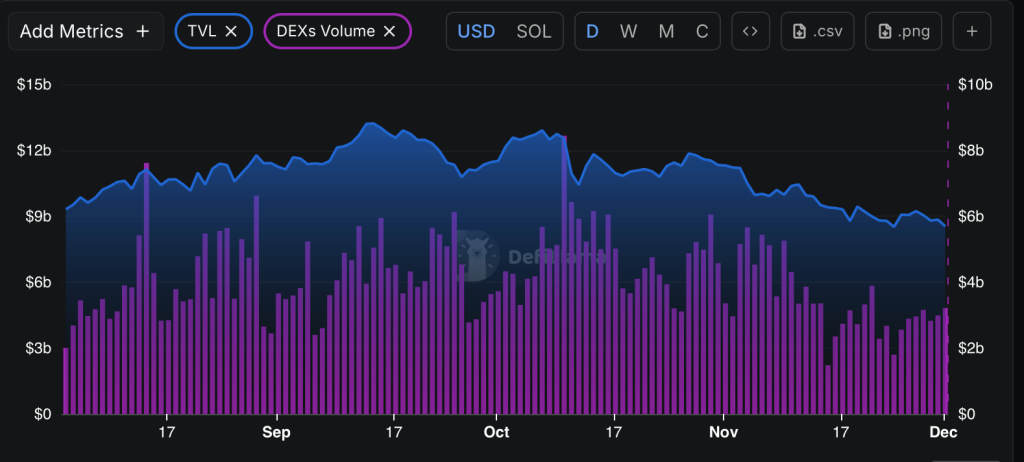

You know how every bull run has a meme coin phase? Well, Solana had its time in the spotlight, thanks to the rise of memecoins. They were all the rage-until they weren’t. As these coins fizzled out, so did Solana’s decentralized exchange (DEX) volume. A big chunk of Solana’s recent action was driven by these speculative trades, and once the volatility settled down, so did the volumes. Bye-bye, hype. 👋

According to data from Defilama, the decline has been steady since the fourth quarter. The once-lively Solana ecosystem is now struggling with low liquidity, fewer inflows, and no one really burning up the fee charts. As if that weren’t enough, capital is flowing out faster than a leaky faucet, and the total value locked (TVL) on Solana is dropping. All these little signals are like red flags at a bullfight. 🏳️🌈

Will Solana (SOL) Price Recover?

So here we are, staring down the barrel of a Solana price that seems to be in a perpetual downward spiral. It’s been forming lower highs and lower lows, which is basically the crypto version of a bad trendline. Not looking good, right? But hold your horses, folks. The token is trying to hold onto a support zone between $121 and $128. It’s like a fighter trying to stay on its feet in a boxing match. Can the bulls defend this zone? Maybe. But the fight’s far from over. 🥊

Right now, the bulls are working overtime, trying to keep that $121-$128 support intact. But with the volume draining out, it’s like trying to fill a bucket with a hole in it. And then there’s the RSI, which is basically giving a thumbs-down to the whole idea of a rally. If Solana can’t turn things around soon, it could end up crashing all the way to $100 or even below. 🤷♂️

But let’s not count Solana out just yet. If the on-chain activity picks up again, or if meme coin trading comes back to life (no one said it was dead, right?), Solana might just surprise us. For now, though, it’s a waiting game. Hold tight and watch the numbers. 🧐

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Brent Oil Forecast

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- How I Lost $1.25M Talking to Myself (And Thought It Was MrBeast) 😂💸

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

2025-12-01 12:23