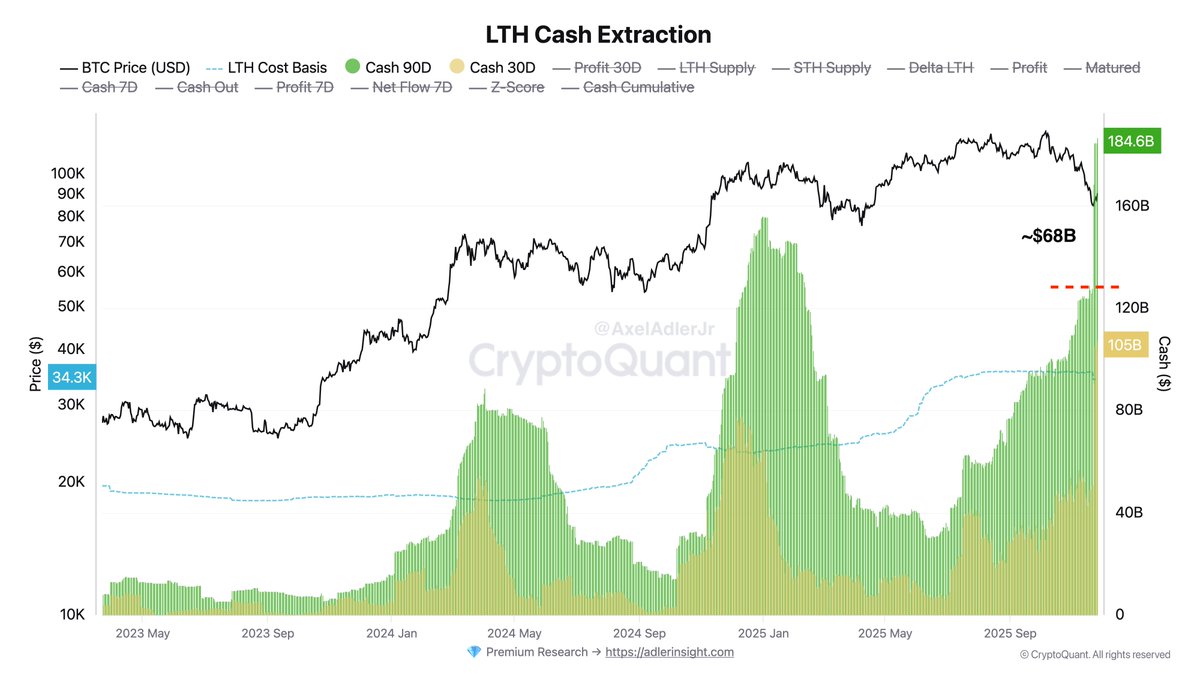

It is a truth universally acknowledged that when one encounters a wave of misinterpretation within the crypto market, it often proves more perplexing than a misstep at an ill-attended ball. The event in question, initiated on November 22, 2025, concerns none other than Coinbase’s extensive wallet rebalancing, audaciously distorting significant on-chain indicators. Many a gleaming dashboard now misleadingly boasts a $68 billion Long-Term Holder “sell” spike, which, upon closer examination by astute analysts, appears to be nothing more than an artifice born from Coinbase’s internal reorganization.

To consider this current confusion noteworthy, one must appreciate the cunning at play. Several illustrious analysts and commentators, whose insights are as sharp as a rapier in the dimmest candlelight, have pointed to egregious outflows and anomalous movements of wallets, yet they overlooked the very cause: Coinbase’s internal reshuffling. This oversight has led many to believe that long-term holders are in a frenzy of panic-selling, thus emboldening fear in an already fragile market. Such a conclusion, my dear reader, would be as absurd as suspecting Miss Bennet of disingenuous romancing of Mr. Bingley.

These rebalancing ceremonials are scarcely new, but given the king’s ransom of Coinbase’s holdings, even the most pedestrian operations can yield astonishing spikes in on-chain metrics. To be or not to be misled – that is the query for the shrewd observer analyzing such tumult.

The Bizarre Case of Coinbase’s Internal Coin Transfers and On-Chain Metrics

Our dear Axel Adler, ever the seeker of elusive truths, unearthed that Coinbase’s internal migration involved a staggering 800,000 BTC. This caused an upheaval in on-chain data without the slightest coin having exchanged hands. Imagine, if you will, 286 transactions totaling 798,636 BTC, discreetly moved from old P2PKH addresses to the more modern P2WPKH counterparts. The outcome? A dazzling $68 billion in “realized profit” – a beguiling illusion of distribution, indeed.

As a result, the illusion was laid upon LTH and STH Supply metrics, momentarily convincing many a zealous observer of an overflow of coins into the hands of eager sellers. Alas, this was merely a masquerade; Coinbase was not selling, merely rearranging its well-stocked attics. Even the LTH Realized Profit/Loss models witnessed the spectre of phantom gains, proving once again that appearances can indeed deceive.

This particular fusillade of activities reminds us all the importance of interpreting on-chain metrics with care equal to that of a debutante’s introduction at a grand ball. Without due caution, the observer risks gleaning much the same misinformation about a young lady as was gathered about the market, both borne from occasional ill-conceived impressions.

The Larger Cryptomarket: A Dance of Rebound and Uncertainty

The grand total of the crypto market cap has been charted with the precision of a seasoned governess. After hitting a lowly dip near the $2.88T zone, closely aligning with the importance of the 100-week moving average like a crucial veil lies upon the young debutante, we observe a valiant rebound above the $3 trillion mark!

However, do not panic into believing this to be an immediate delivery of stability, for the broad trend remains as capricious as Lady Catherine’s moods. The escapade from the $3.6 trillion-$3.8 trillion zone descended swiftly, their movements reminiscent of corrections past when the specters of 2021 and mid-2022 haunted the markets’ sensibilities.

The market’s recent recovery bears the mark of a gentler volume, indicative perhaps that the bearish participants have reached the very end of their wiles – much like a young lady’s ribbon after too many corset adjustments. Yet, to truly flourish, the market must capture and hold that elusive $3.25 trillion to $3.3 trillion domain above – a challenge not unlike winning a dance amongst the most accomplished partners of the season.

Should the market folly fall short, it risks further uncertain consolidation or perhaps a fateful revisit to the realms of $2.8 trillion support. For the present, one can catch a glimpse of market stabilization; however, the broader vindication, akin to that of a fine reputation, will rest upon Bitcoin’s ability to maintain its ascendancy and inspire confidence across the altcoin cadre.

Read More

- Gold Rate Forecast

- El Salvador’s AI Revolution: Nvidia Chips Power National Lab

- Unlocking the Secrets of Token Launches: A Hilarious Journey into Crypto Madness!

- Silver Rate Forecast

- Brent Oil Forecast

- Is Bitcoin Just Playing Hide-and-Seek with $100K? Spoiler: It’s Winning at Hide

- JPY KRW PREDICTION

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- Elon Musk’s Dogecoin Shenanigans: Billionaire’s Meme or Market Mayhem?

- Can Bitcoin Buck the Bear or Is It Just Playing Dress-Up at $87.5K? 🐻🤡

2025-11-28 05:14