In the grand theater of finance, where the curtain rises and falls with the whims of the market, Bitcoin, that enigmatic prima donna, clings to a trendline as if to a lifeline in a tempestuous sea. For four long years, this line has dictated its every move, a silent choreographer guiding its steps from resistance to support, from triumph to trial. Now, as the weekly candle closes above it, one cannot help but marvel at the absurdity of it all-a mere line, drawn by human hands, holding such power over the digital realm. 🌊✨

The Trendline Tango: A Four-Year Romance

Ash Crypto, that modern-day oracle, presents a chart as if it were a sacred text, revealing Bitcoin’s fidelity to a rising trendline since 2021. Three times it has been rebuffed, like a suitor denied at the altar, only to return with renewed vigor. Now, it stands above, transformed from foe to ally, a testament to the fickle nature of markets. “As long as BTC holds above this trendline, the long-term outlook stays bullish,” Ash proclaims, though one wonders if even the stars can predict such whims. 🕊️🔮

BITCOIN weekly candle closed above the 4-year Trend Key level

BTC is sitting right on the macro long-term trendline that’s held the market together for 4 years.

This level has acted as major resistance 3 times over the last 3 years, now flipping as strong support.

As long as…

– Ash Crypto (@AshCrypto) November 24, 2025

Yet, in the daily drama, resistance looms like a skeptical critic. Titan of Crypto, ever the pragmatist, points to the Tenkan-sen level on the Ichimoku chart, a barrier that has stifled Bitcoin’s recent ascent from the $82,000 abyss. “A clean close above it is needed to unlock higher levels,” Titan declares, though one cannot help but chuckle at the notion of “clean” in such a chaotic dance. Until then, Bitcoin remains confined, a caged bird dreaming of the Kijun-sen and the Ichimoku cloud. 🐦⛓️

The Ebbing Tide of Fear

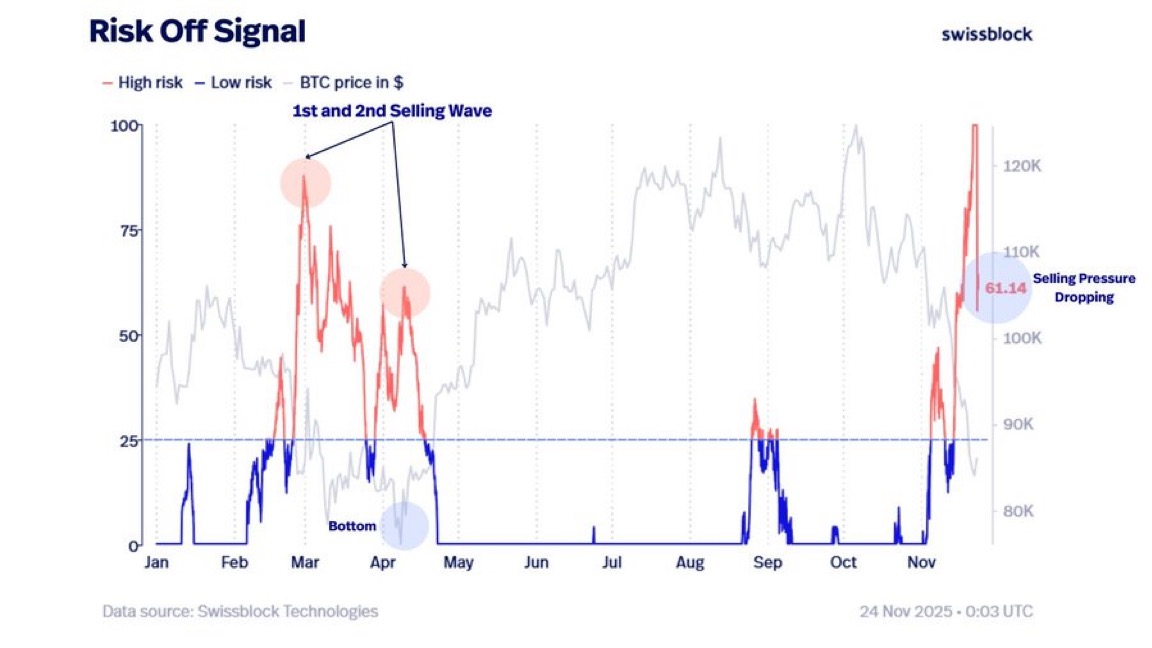

Swissblock Technologies offers a chart that speaks of fear and greed, a “Risk Off Signal” that peaked like a melodramatic soliloquy before falling from 90 to 61. The heavy selling, it seems, is waning, like a storm giving way to calm. Two earlier spikes in March and April were followed by tranquility, and now, the market whispers of a local bottom. That Martini Guy, ever the observer, remarks, “Bitcoin selling pressure is easing. BTC is starting to form a bottom, as fear starts to drop.” One can almost hear the collective sigh of relief, though the market’s humor is never without a twist. 🍸😓

Whales and Minnows: A Tale of Two Worlds

Santiment, that chronicler of wallets, reveals a curious dichotomy: the number of wallets holding at least 100 BTC has risen by 91 since November 11, while the small fry retreat. Retail investors, it seems, are exiting stage left, leaving the whales to their grand designs. Yet, even among the leviathans, there is discord, as older wallets stir, some reducing their positions in this volatile ballet. “Retail capitulation will generally play out well for crypto prices in the long run,” Santiment assures, though one cannot help but smirk at the irony of such certainty in an uncertain world. 🐳🐟

“Retail capitulation will generally play out well for crypto prices in the long run,” Santiment reported.

And so, the dance continues, a spectacle of bulls and bears, whales and minnows, all bound by the invisible threads of a trendline. In this grand theater, Bitcoin remains the star, its every move a source of both awe and amusement. For in the end, is not the market itself the greatest comedy of all? 🎭💹

Read More

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- TRX: The Bullish Saga of $0.30 – Will the Whales Save Us? 🐋💰

- Bitcoin’s Bold $112K Move – Is It A Breakout Or A Breakdown? Find Out! 💥💸

- Ride the Crypto Wave or Wipe Out – $250K Up for Grabs! 🌊💸

- Dogecoin’s $2B Volume Spree: Bearish Brouhaha or Bullish Blunder? 🐕💸

- Solana’s Meltdown: $111M Longs Liquidate Like It’s Going Out of Style! 💸🔥

- Trump’s Crypto Invasion: Blockchain Meets Bollywood Drama! 🎭💰

- Is XRP Really Trading at $1,000 on a Secret Ledger? The Truth Behind the Rumors Revealed

2025-11-25 18:27