Markets

What to know:

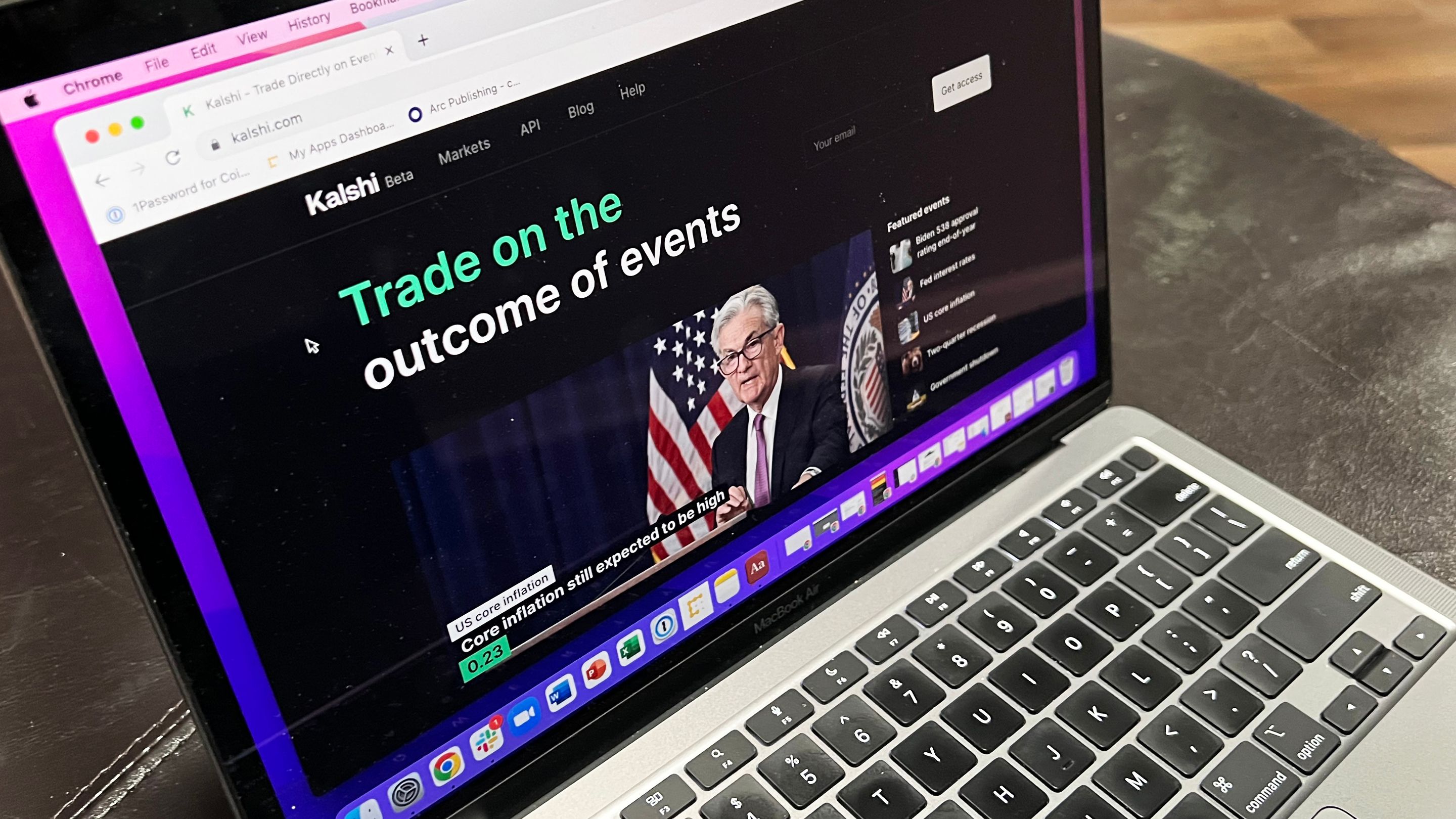

- Kalshi raised $1 billion in a new funding round at an $11 billion valuation, according to TechCrunch. (Because who doesn’t want to bet on the future?)

- The regulated platform is closing in on rival Polymarket’s reported $12 billion to $15 billion valuation target. (Because nothing says “trust me” like a $15B valuation.)

- Kalshi and Polymarket compete with opposing models – Kalshi as a CFTC-regulated exchange, Polymarket as a decentralized, crypto-native alternative. (Because nothing says “legal” like a blockchain and a 50% chance of losing your life savings.)

Kalshi, a regulated prediction market platform, has closed a $1 billion funding round that values the company at $11 billion, according to TechCrunch. The round was led by returning investors Sequoia Capital and CapitalG, with participation from Andreessen Horowitz, Paradigm, Anthos Capital, and Neo. (Because nothing says “investment” like a bunch of venture capitalists betting on the stock market’s next crash.)

The new valuation brings Kalshi closer to the $12 billion to $15 billion valuation target reportedly sought by its crypto-native rival Polymarket. The milestone also comes just a month after Kalshi announced a $300 million round at a $5 billion valuation, underscoring investor appetite for the growing prediction market space. (Because who needs stability when you can have chaos?)

Kalshi operates as a regulated exchange under the oversight of the Commodity Futures Trading Commission (CFTC), offering event contracts on topics ranging from inflation rates to political outcomes. It has positioned itself as a U.S.-compliant alternative to offshore or decentralized platforms, focusing on institutional and retail traders who want legal certainty and fiat onramps. (Because nothing says “safety” like a government-backed bet on the apocalypse.)

Polymarket, by contrast, is built on blockchain rails and operates as a decentralized information market. Users wager crypto on yes-or-no outcomes, often tied to political elections, market data or pop culture events. (Because nothing says “fun” like losing your crypto to a tweet.)

The two firms have emerged as frontrunners in a sector that blends financial speculation with news-driven engagement. While Kalshi touts regulatory compliance and a path toward mainstream adoption, Polymarket’s decentralized design appeals to crypto-native users seeking transparency and censorship resistance. (Because nothing says “freedom” like a system that’s 90% code and 10% hope.)

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- Crypto Chaos: Will the White House’s New Report Save the Day? 🤔💰

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- Traders Rush Back to XRP: The Silent Storm Brewing in the Crypto World! 😱🚀

- Doge Doomed?! 😱🐳

- When Will the Long Traders Finally Give Up? 🤔

- Brent Oil Forecast

2025-11-21 01:13